Get the free Quick Response Small Business Credit Application

Show details

This document is a credit application for small businesses seeking loans between $10,000.00 and $100,000.00. It outlines the application process, requirements, and necessary information regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quick response small business

Edit your quick response small business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quick response small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quick response small business online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit quick response small business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quick response small business

How to fill out Quick Response Small Business Credit Application

01

Gather necessary business information including your legal business name, address, and contact details.

02

Provide your business structure (e.g., LLC, Corporation, Sole Proprietorship).

03

Enter your Employer Identification Number (EIN) or Social Security Number if applicable.

04

List the owners or principals of the business along with their ownership percentages.

05

Detail your business financial information including annual revenue and expenses.

06

Fill out any credit references that may be required by the application.

07

Read and agree to the terms and conditions provided in the application.

08

Submit the completed application along with any required supporting documents.

Who needs Quick Response Small Business Credit Application?

01

Small business owners seeking financing or credit.

02

Entrepreneurs looking to expand their operations or manage cash flow.

03

Businesses that need to purchase inventory or equipment on credit.

04

Startups needing initial funding to launch their business.

Fill

form

: Try Risk Free

People Also Ask about

What is the quickest way to build business credit?

How to build business credit fast Register your business. Open a business bank account. Register for a Dun & Bradstreet number. Apply for a business credit card. Keep your credit utilization low. Register for relevant net 30 accounts. Pay all bills on time. Minimize risk by avoiding judgments and liens.

How to get a 700 credit score in 30 days?

Improving your credit in 30 days is possible. Ways to do so include paying off credit card debt, becoming an authorized user, paying your bills on time and disputing inaccurate credit report information.

How to get business credit immediately?

Registering your business and applying for a business credit card can help you start building business credit right away. As your business grows, establish trade lines with your suppliers and make sure to borrow from lenders that report payments to business credit bureaus.

How do I write a credit application?

Key Components of a Credit Application Form Business Information. Legal Name: The full legal name of the business entity as registered with the appropriate authorities, such as the ASIC. Contact Information. Financial Information. Guarantees and Security. Terms and Conditions.

How quickly can I get business credit?

Many businesses find it takes three years for it to build a strong credit score. The timeline depends on several factors, including how quickly you establish credit accounts, how consistently you make payments, and how often your vendors and creditors report your activity to business credit bureaus.

Can you build business credit in 30 days?

While building excellent business credit takes time, you can lay the groundwork for a stronger credit profile in just 30 days. You likely won't build perfect credit scores overnight, but you can take concrete steps right now to start establishing your business's creditworthiness.

How do you ask a customer to complete a credit application?

“Hi Joe, I am very happy to know that you will be sending us business and I want to make sure we can accommodate your future needs in regards to credit. My bank line of credit requires that we have a credit application on file to insure we are following their guidelines in establishing credit with our customers.

How to build a business credit score fast?

If you want to build business credit quickly here are five simple steps. Step 1 – Choose the Right Business Structure. Step 2 – Obtain a Federal Tax ID Number (EIN) Step 3 – Open a Business Bank Account. Step 4 – Establish Credit with Vendors/Suppliers Who Report. Step 5 – Monitor Your Business Credit Reports.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quick Response Small Business Credit Application?

The Quick Response Small Business Credit Application is a streamlined form designed for small businesses to apply for credit quickly and efficiently, facilitating faster credit decisions.

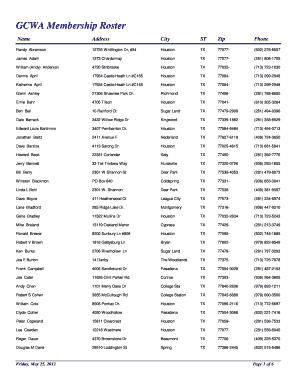

Who is required to file Quick Response Small Business Credit Application?

Small business owners seeking credit from a financial institution or lender are required to file the Quick Response Small Business Credit Application.

How to fill out Quick Response Small Business Credit Application?

To fill out the application, provide personal and business information, including business name, address, financial details, and other required documentation as specified by the lender.

What is the purpose of Quick Response Small Business Credit Application?

The purpose of the application is to expedite the credit approval process for small businesses, allowing them to receive necessary funding quickly.

What information must be reported on Quick Response Small Business Credit Application?

Information that must be reported includes the business name, contact details, ownership structure, financial statements, credit history, and any other relevant data requested by the lender.

Fill out your quick response small business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quick Response Small Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.