Get the free Bank with WSB

Show details

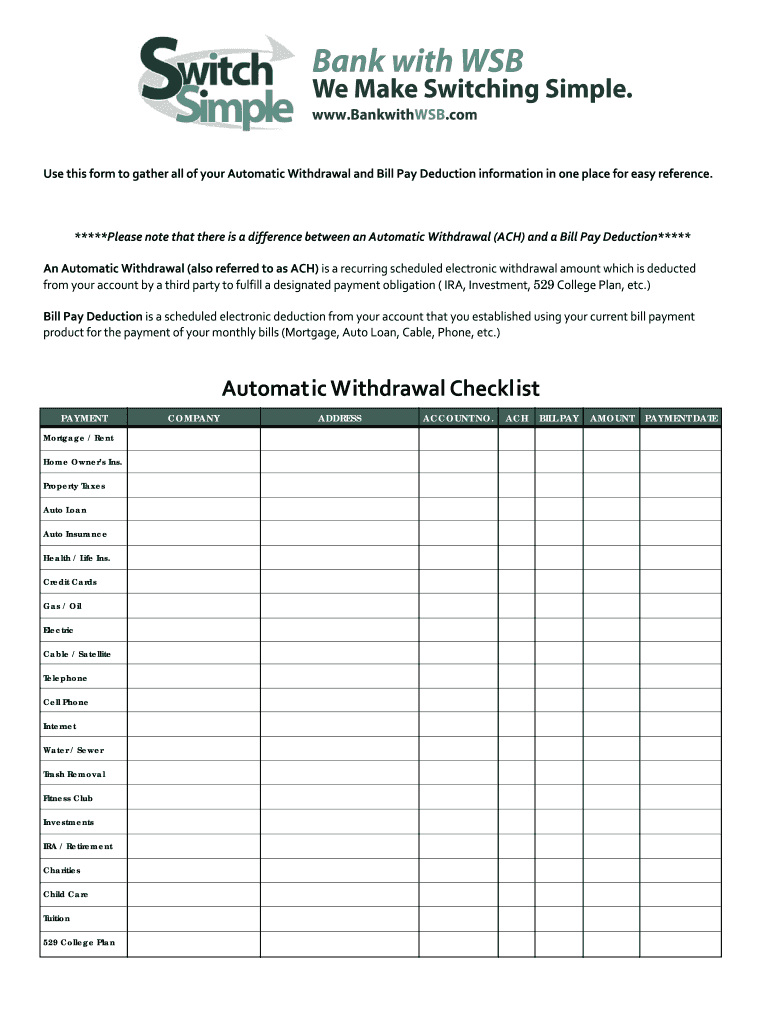

This form is designed to collect and organize information regarding Automatic Withdrawals and Bill Pay Deductions for easier management of recurring payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank with wsb

Edit your bank with wsb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank with wsb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank with wsb online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bank with wsb. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank with wsb

How to fill out Bank with WSB

01

Gather all necessary financial documents, including identification, proof of income, and address verification.

02

Visit the WSB website or the nearest WSB branch to access the bank account application form.

03

Complete the application form accurately, providing all required information.

04

Submit the filled application form along with the necessary documents either online or in-person.

05

Wait for the bank's confirmation on your application status, which may involve a verification process.

06

Once approved, set up your online banking access and familiarize yourself with the account management tools.

Who needs Bank with WSB?

01

Individuals looking for a convenient and reliable banking solution.

02

Small businesses requiring banking services with lower fees.

03

Students or young adults needing their first bank account.

04

Anyone interested in taking advantage of modern banking technology and features.

Fill

form

: Try Risk Free

People Also Ask about

Which bank does WSB use?

World Sports Betting Deposit via Bank Transfer Banking Information and Details ABSAABSA Account Number: 4057057844 Branch Code: 632005 Investec Investec Bank Account Number: 10011917857 Branch Code: 580105 International Deposits ABSA Account Number: 4057057844 Branch Code: 632005Swift Code: ABSAZAJJ3 more rows

How to change US bank to English?

To change your language settings using the U.S. Bank Mobile App Open the main menu. Select Profile & settings, then Language. Choose the language you'd like: English to Spanish: Choose Español, then Aceptar (i.e., accept) to agree to the terms. Spanish to English: Choose English, then Cancelar (i.e., cancel).

What are the top 3 best banks?

The Federal Reserve lists U.S. banks' consolidated assets and number of domestic branches, as of June 30, 2023: JPMorgan Chase. At the top of the list, JPMorgan Chase holds close to $3.64 trillion in assets. Bank of America. Citi. Wells Fargo. U.S. Bank/U.S. Bancorp. Goldman Sachs. PNC. Truist Bank.

Is Lloyds or HSBC better?

So which is better - Lloyds or HSBC? It all depends what you're looking for in a bank and account, but Lloyds and HSBC have a pretty similar offer. Both offer online and mobile banking, a wide choice of accounts (including some with rewards and extra benefits) and robust security and protection for your money.

Which bank in the UK is best?

Finder's best current accounts by score in the UK 2025 BankBest forFinder score Lloyds Bank Best for payment features 8.9/10 Revolut Best all-in-one finance app 9.1/10 Nationwide Best for linked savings account 8.6/10 Kroo Best for in-credit interest 7.1/103 more rows • May 19, 2025

Is HSBC better than Barclays?

HSBC is marginally cheaper with a fee of 2.75%,3 whereas if you use your Barclaycard abroad you'll pay 2.99% of the transaction amount. If you have the HSBC Global Money account, there are no foreign transaction fees to pay. Limits for spending and cash withdrawals are the same as in the UK, for both banks.

Is Lloyds an English bank?

Lloyds Banking Group is a leading UK-based financial services group. We provide a wide range of banking and financial services, focused primarily on retail and commercial customers. Find out more about the structure of the Group, our Directors and governance.

What is the best English bank?

Best Banks in the UK: How Do They Compare? CategoryBest OptionRunner-Ups Best for Everyday Banking Monzo Metro Bank, First Direct Best for Savings Accounts Nationwide Halifax, Money Best for Students Santander UK NatWest, Lloyds Bank Best for Businesses HSBC UK Starling Bank, Barclays Mar 27, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bank with WSB?

Bank with WSB refers to the process of reporting certain financial information to the Washington State Department of Financial Institutions under the Washington State Bank Disclosure Act.

Who is required to file Bank with WSB?

Banks, credit unions, and other financial institutions operating in Washington State are required to file Bank with WSB as part of their regulatory compliance.

How to fill out Bank with WSB?

To fill out Bank with WSB, institutions need to complete the necessary forms provided by the Washington State Department of Financial Institutions, ensuring all required information is accurately reported.

What is the purpose of Bank with WSB?

The purpose of Bank with WSB is to provide transparency and oversight of financial institutions operating within Washington State, ensuring they adhere to state regulations and consumer protection laws.

What information must be reported on Bank with WSB?

Institutions must report information such as financial statements, ownership structure, number of branches, and any changes in business operations or management.

Fill out your bank with wsb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank With Wsb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.