Get the free Sole Proprietorship Resolution of Authority - hvfcu

Show details

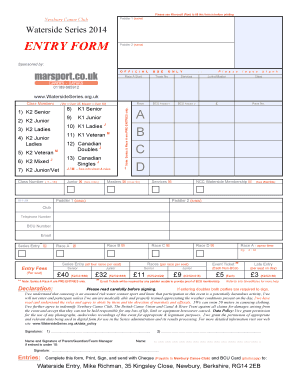

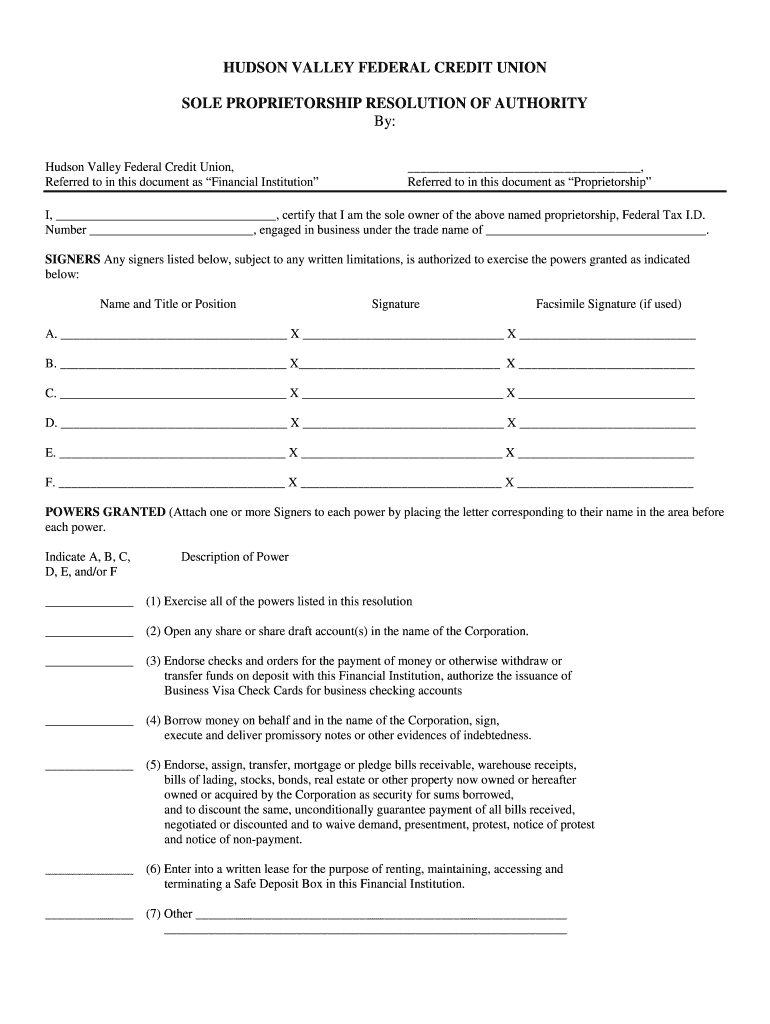

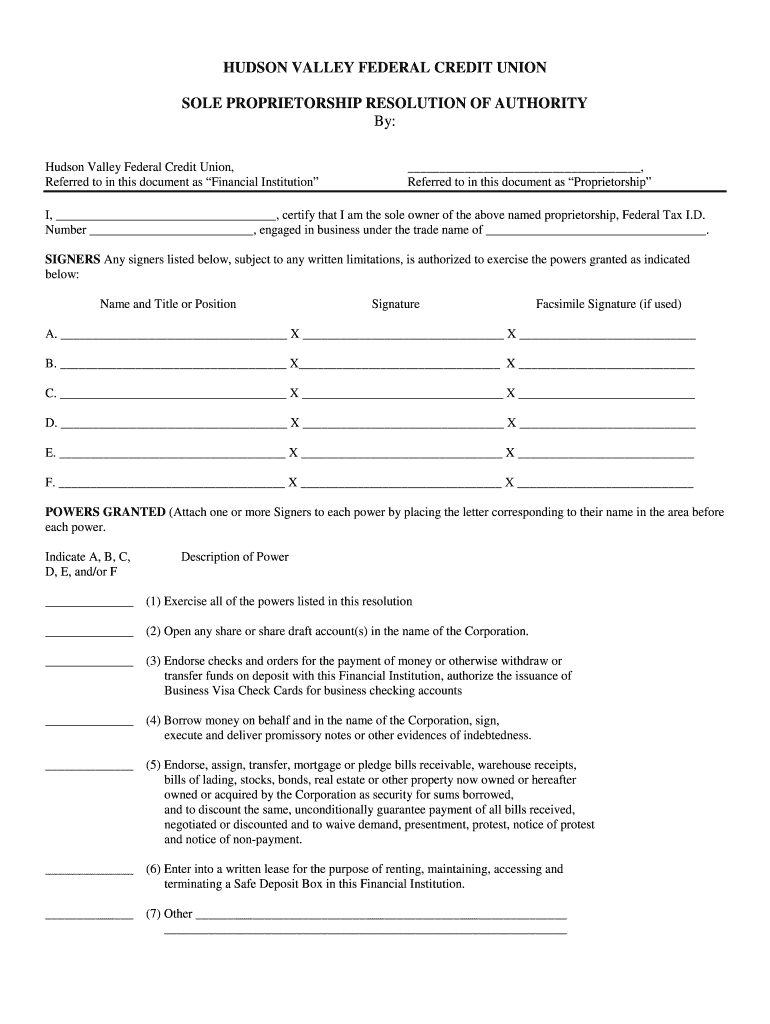

This document certifies the authority of the sole proprietor to act on behalf of their business and specifies the powers granted to signers for conducting business with the Hudson Valley Federal Credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sole proprietorship resolution of

Edit your sole proprietorship resolution of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sole proprietorship resolution of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sole proprietorship resolution of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sole proprietorship resolution of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sole proprietorship resolution of

How to fill out Sole Proprietorship Resolution of Authority

01

Begin with the title of the document: 'Sole Proprietorship Resolution of Authority'.

02

Clearly state the name of the sole proprietorship at the top of the document.

03

Include the date of the resolution.

04

Insert a statement acknowledging that the sole proprietor is authorized to make decisions on behalf of the business.

05

Specify the powers granted to the proprietor, such as signing contracts, obtaining loans, or handling business transactions.

06

Provide space for the signature of the sole proprietor, along with the date of signing.

07

Optionally, add a witness signature line for additional legal validation.

Who needs Sole Proprietorship Resolution of Authority?

01

Individuals operating a business as a sole proprietorship who need to formalize authority for specific actions.

02

Banks, financial institutions, or vendors requiring confirmation of the decision-making authority of the sole proprietor.

03

Legal professionals or advisors assisting the sole proprietor with business dealings.

Fill

form

: Try Risk Free

People Also Ask about

Who is the head of a sole proprietorship?

The sole proprietor takes all the decisions and manages the business on his own. In addition, he keeps the profits of the business and is personally liable for all its debts. In simple words, the owner and the sole proprietorship are considered one and the same.

What are the owner limits for a sole proprietorship?

In summary, a sole proprietorship is an unincorporated business owned by one person. They own all of the profits and debts the company incurs. Because there are no other owners and no legal restrictions on ownership, the solitary proprietor is free to do whatever it takes to keep the business running.

How much control does a sole proprietorship have?

As a sole proprietor, you have complete control over decision-making and enjoy flexibility in running the business. However, you also have unlimited personal liability. Sole proprietorships allow you to report business income and expenses directly on your personal tax return.

How are decisions made in a sole proprietorship?

Control: The sole proprietor has complete control and decision-making power over the business. Without any partners, you are the sole owner of the business, and can therefore run it as you choose.

How much control does a sole trader have?

As a sole trader, you have total control over any business assets and profits. This also means you are personally liable for all the debts of the business. A limited company is a separate legal entity, distinct from you as its owner (or shareholder).

How to take over a sole proprietorship?

A takeover agreement or sale agreement needs to be entered into between the sole proprietor and company. The Memorandum of Association (MOA) needs to carry the object “The take over of a sole proprietorship”. All the assets and liabilities of the sole proprietorship must be transferred to the company.

Who has control of a sole proprietorship?

Control: The sole proprietor has complete control and decision-making power over the business. Without any partners, you are the sole owner of the business, and can therefore run it as you choose.

What is the resolution of a sole proprietorship?

What is a resolution of a sole proprietorship? The term "resolution" means this agreement or any other agreement granting authority to others to act on behalf of the Proprietorship.

Who makes all decisions in a sole partnership?

A sole proprietorship is a business that is run by a single individual who makes all the decisions, although the proprietor may engage employees. The sole proprietor is personally entitled to all of the profits and is responsible for any debts that the business incurs.

Who makes the decisions in a sole proprietorship?

A sole proprietorship, as its name states, has only one owner. The sole proprietorship is merely an extension of its owner: a sole proprietor owns his own business, and no one else owns any part of it. As the only owner, the sole proprietor has the right to make all the management decisions of the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sole Proprietorship Resolution of Authority?

A Sole Proprietorship Resolution of Authority is a document that grants authority to a specific individual, usually the owner, to act on behalf of the sole proprietorship in various business matters.

Who is required to file Sole Proprietorship Resolution of Authority?

The owner of the sole proprietorship is typically required to file the Sole Proprietorship Resolution of Authority, especially when establishing formal agreements or opening business accounts.

How to fill out Sole Proprietorship Resolution of Authority?

To fill out a Sole Proprietorship Resolution of Authority, the owner should provide their name, business name, the resolution text that specifies the authority granted, and any additional relevant details required by the institution or governing body.

What is the purpose of Sole Proprietorship Resolution of Authority?

The purpose of the Sole Proprietorship Resolution of Authority is to formally document the authority granted to the owner or an appointed representative to make decisions and manage the business on behalf of the sole proprietorship.

What information must be reported on Sole Proprietorship Resolution of Authority?

The information that must be reported typically includes the name of the sole proprietorship, the owner's name, specific powers granted, date of the resolution, and any required signatures.

Fill out your sole proprietorship resolution of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sole Proprietorship Resolution Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.