Get the free Overdraft Protection Designation Form

Show details

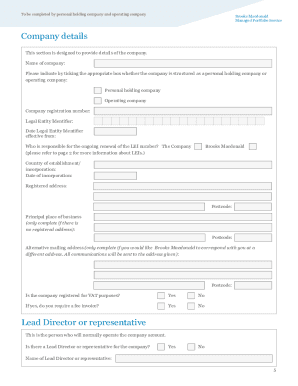

This form is for setting up Overdraft Protection on a Seven Seventeen Checking Account. It requires personal details and information about the overdraft source to ensure proper processing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overdraft protection designation form

Edit your overdraft protection designation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overdraft protection designation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

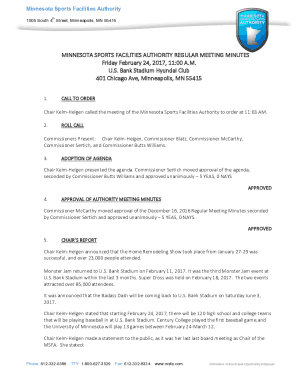

How to edit overdraft protection designation form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit overdraft protection designation form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overdraft protection designation form

How to fill out Overdraft Protection Designation Form

01

Begin by gathering your personal information such as your name, address, and account number.

02

Locate the section of the form where you need to identify your type of account (e.g., checking or savings).

03

Indicate whether you want to enroll in overdraft protection for specific accounts or all eligible accounts.

04

If required, provide information regarding any joint account holders or beneficiaries.

05

Review the terms and conditions associated with overdraft protection and acknowledge them by signing the form.

06

Submit the completed form to your financial institution according to their submission guidelines, which may include mailing, faxing, or delivering in person.

Who needs Overdraft Protection Designation Form?

01

Customers with checking accounts who want to avoid declined transactions due to insufficient funds.

02

Individuals who prefer to have extra funds available for occasional purchases when their account balance is low.

03

Those who frequently overdraw their accounts and want a safety net to cover unexpected expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is ODP in banking?

Overdraft Protection fee. An Overdraft Protection (ODP) fee is charged if you have Overdraft Protection on your chequing account: Monthly Plan Overdraft Protection: $5* per month. Pay-As-You-Go Overdraft Protection: $5 per transaction to a maximum of $5 per day.

What is ODP transfer?

Overdraft protection lets you link accounts so you can transfer funds to your checking account if a check, debit card or ATM transaction exceeds the Available Balance in your account.

What does ODP mean in banking terms?

Overdraft Privilege (ODP) is a program we implemented to provide you with a way to avoid some of the costs and hassles associated with a returned payment.

What is an ODP transaction?

ODP Basics Overdraft Protection allows transactions to go through even when an account lacks sufficient funds by linking a checking account to another funding source, such as a savings account, credit card, or line of credit.

What does ODP stand for in banking?

Overdraft Protection fee. An Overdraft Protection (ODP) fee is charged if you have Overdraft Protection on your chequing account: Monthly Plan Overdraft Protection: $5* per month. Pay-As-You-Go Overdraft Protection: $5 per transaction to a maximum of $5 per day.

Is overdraft protection a form of a loan from a bank?

An overdraft is like any other loan: The account holder pays interest on it and will typically be charged a one-time insufficient funds fee. Overdraft protection is provided by some banks to customers when their account reaches zero; it avoids insufficient funds charges, but often includes interest and other fees.

How to explain overdraft protection?

Overdraft protection is an agreement with the bank or financial institution to cover overdrafts on a checking account. This service typically involves a fee and is generally limited to a preset maximum amount.

What is bank overdraft, DR or CR?

Cash A/c Dr. ₹10,000. To Bank Overdraft A/c ₹10,000. (A bank overdraft facility is utilized for short-term needs) In this case, the company avails a cash overdraft, which means an increase in cash (asset)-hence debit-, and as overdraft is a liability, it gets credited.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Overdraft Protection Designation Form?

The Overdraft Protection Designation Form is a document that allows bank customers to opt into or designate their preferences for overdraft services on their checking accounts.

Who is required to file Overdraft Protection Designation Form?

Typically, bank customers who wish to have protection against overdraft charges or those who want to enable overdraft services on their accounts are required to file the Overdraft Protection Designation Form.

How to fill out Overdraft Protection Designation Form?

To fill out the Overdraft Protection Designation Form, customers need to provide personal information, account details, and indicate their preferences regarding overdraft protection options. This usually requires signing the form to confirm their choices.

What is the purpose of Overdraft Protection Designation Form?

The purpose of the Overdraft Protection Designation Form is to give customers control over how overdrafts are handled on their accounts and to reduce the potential for unexpected overdraft fees.

What information must be reported on Overdraft Protection Designation Form?

The information that must be reported on the Overdraft Protection Designation Form typically includes the account holder's name, account number, contact information, and the specific overdraft options they wish to select or decline.

Fill out your overdraft protection designation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overdraft Protection Designation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.