Get the free Credit Application Disclosures

Show details

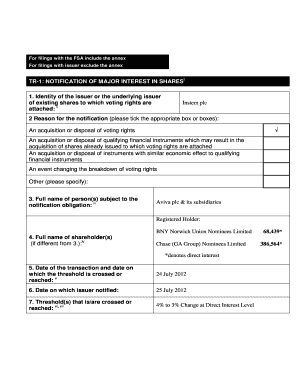

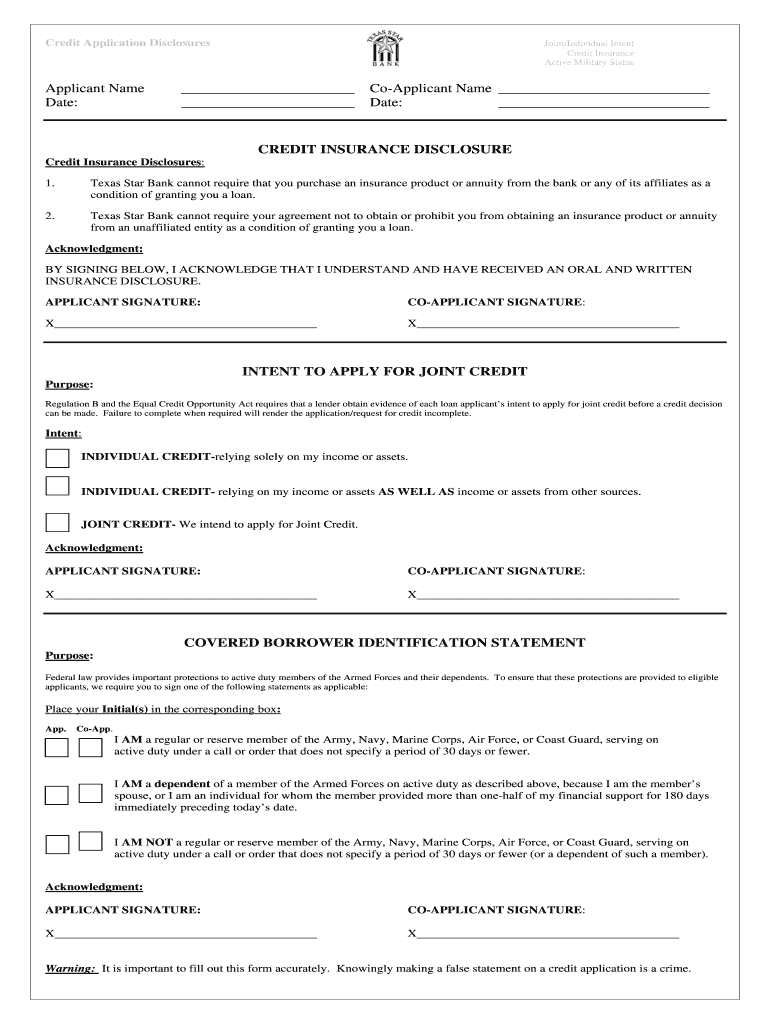

This document provides disclosures related to credit insurance, joint credit intent, and covered borrower identification for applicants seeking credit from Texas Star Bank.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application disclosures

Edit your credit application disclosures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application disclosures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit application disclosures online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit application disclosures. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application disclosures

How to fill out Credit Application Disclosures

01

Gather all necessary personal information: full name, address, social security number, and date of birth.

02

Specify the type of credit you are applying for: personal loan, credit card, mortgage, etc.

03

Provide detailed employment information: employer name, job title, duration of employment, and monthly income.

04

List all financial obligations: current debts including loans, credit cards, and any other financial commitments.

05

Review the sections regarding terms and conditions to ensure understanding of fees, interest rates, and repayment terms.

06

Sign and date the application to certify the information is accurate and complete.

Who needs Credit Application Disclosures?

01

Individuals applying for any type of credit, such as loans, credit cards, or mortgages.

02

Businesses seeking financing options or lines of credit.

03

Any person or entity that needs to disclose financial information to a lender.

Fill

form

: Try Risk Free

People Also Ask about

What are the disclosure requirements for a consumer loan?

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms. TILA disclosures is often provided as part of the loan contract, so the borrower may be given the entire contract for review when the TILA is requested.

What requires disclosures to consumers of all aspects of the credit arrangement?

The Truth in Lending Act, or TILA, also known as regulation Z, requires lenders to disclose information about all charges and fees associated with a loan. This 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit.

What does credit card disclosure mean?

A credit card disclosure is a document that outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card.

When must you provide disclosures concerning the consumer's credit score in FCRA?

As required by FCRA Section 609(g), FIs who use a consumer's credit score in the evaluation of an application for a covered transaction must provide the credit score and other related information to the consumer.

What is a credit disclosure?

A credit score disclosure alerts a consumer about their credit score and other sources of information as required by the Fair Credit Reporting Act (FCRA). The FCRA is a U.S. government legislation that aims to protect consumer information that is collected by consumer reporting agencies or credit bureaus.

What are 6 things your credit card company must clearly disclose to consumers?

The Truth in Lending Act is a federal law that requires creditors to provide clear and accurate information about credit terms and costs to consumers. Credit card companies must disclose important information like the APR, finance charges, grace period, fees, penalties, payment due dates, and minimum payment warning.

What are the main disclosure requirements?

As such, Financial Disclosure Statements must disclose outside compensation, holdings, and business transactions, generally for the calendar year preceding the filing date. In all instances, filers may disclose additional information or explanation at their discretion.

What items are included in the credit score disclosure?

The credit score disclosures generally include the same elements, such as information about the consumer report and credit score and how they impact the cost of credit, the distribution of credit scores among consumers, and what the consumer can do with the information provided in the credit score disclosure, among

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Application Disclosures?

Credit Application Disclosures are documents that provide borrowers with important information about the terms and conditions of credit they are applying for, ensuring transparency in the lending process.

Who is required to file Credit Application Disclosures?

Lenders and financial institutions that offer credit to consumers are required to file Credit Application Disclosures.

How to fill out Credit Application Disclosures?

To fill out Credit Application Disclosures, borrowers should provide accurate personal and financial information, including details about their income, employment, and existing debts, and ensure all sections of the form are completed.

What is the purpose of Credit Application Disclosures?

The purpose of Credit Application Disclosures is to inform borrowers of the costs, terms, and risks associated with credit, and to help them make informed decisions regarding their financial commitments.

What information must be reported on Credit Application Disclosures?

Credit Application Disclosures must report information such as the borrower's name, income, employment details, loan amount requested, interest rates, fees, and any other relevant financial obligations.

Fill out your credit application disclosures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application Disclosures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.