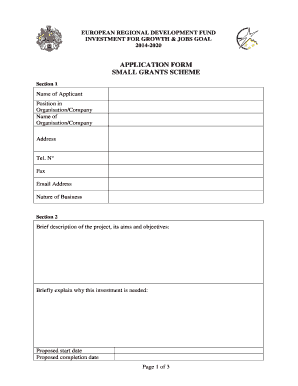

Get the free LOAN SCENARIO

Show details

This document outlines the necessary information and details required for processing a loan application, including borrower details and loan specifics.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan scenario

Edit your loan scenario form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan scenario form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan scenario online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan scenario. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan scenario

How to fill out LOAN SCENARIO

01

Start by gathering all necessary financial documents, including your income, expenses, and any existing debts.

02

Identify the amount of money you need to borrow and the purpose of the loan.

03

Determine the loan term (length of time to repay the loan) and the interest rate you expect.

04

Fill in the personal information section, including your name, address, and contact details.

05

Provide details of your employment, including your job title, employer name, and income.

06

Outline your monthly expenses, detailing necessary costs like housing, utilities, and groceries.

07

List any other debts you currently have, including credit cards, car loans, or other loans.

08

Review the filled-out LOAN SCENARIO for accuracy and ensure all required sections are completed.

Who needs LOAN SCENARIO?

01

Individuals seeking to understand their borrowing capacity.

02

People applying for a loan from banks or financial institutions.

03

Financial advisors assisting clients with loan applications.

04

Businesses looking for funding to support growth or operations.

Fill

form

: Try Risk Free

People Also Ask about

What is loan with example?

A loan is when you receive money from a friend, bank or financial institution in exchange for future repayment of the principal and interest. They can be unsecured, like a personal loan or cash advance loan, or they may be secured, like a mortgage or home equity line.

How does a simple loan work?

A simple interest loan is a type of loan where the interest is calculated solely on the initial principal amount over the entire duration of the loan.

What is the hard money loan scenario?

Hard money loan scenarios Among real estate investors, hard money loans are most often used for the following scenarios: purchase and renovate a distressed or outdated property -- i.e. you want a loan to purchase and rehab a property in order to avoid using a bunch of your own cash.

What is a simple explanation of a loan?

What is a Loan? A loan is a sum of money that one or more individuals or companies borrow from banks or other financial institutions so as to financially manage planned or unplanned events. In doing so, the borrower incurs a debt, which he has to pay back with interest and within a given period of time.

What is the simplest type of loan?

A simple interest loan is a non-compounded loan. This means each month, when you make a payment, part of it goes towards paying back the borrowed money (principal), and the rest takes care of the interest that accumulates daily. Accumulated daily interest is referred to as 'per diem' or 'per day.

What is a simple loan example?

Here's an example. Let's say you took out a simple interest loan of $10,000 with a 5% fixed interest rate and five-year repayment term. Instead of paying 5% on the total $10,000 amount you borrowed, that 5% would be calculated anew each month and spread out across your entire repayment term.

What is the scenario of bridging loan?

A bridging loan is a short-term loan that finances the purchase of a new property while you are selling your existing property. This type of loan can also provide finance to build a new property while you live in your current home.

What is an example of a simple loan?

Car loans, amortized monthly, and retailer installment loans, also calculated monthly, are examples of simple interest; as the loan balance dips with each monthly payment, so does the interest. Certificates of deposit (CDs) pay a specific amount in interest on a set date, representing simple interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOAN SCENARIO?

A LOAN SCENARIO is a detailed projection of the terms and conditions of a loan, including potential interest rates, loan amounts, and repayment options, used to assess the feasibility and implications of borrowing.

Who is required to file LOAN SCENARIO?

Typically, lenders, mortgage brokers, and financial institutions are required to file a LOAN SCENARIO when considering a loan application or presenting financing options to borrowers.

How to fill out LOAN SCENARIO?

To fill out a LOAN SCENARIO, one must provide accurate information about the borrower's financial situation, loan amount requested, purpose of the loan, preferred terms, and any other relevant financial details.

What is the purpose of LOAN SCENARIO?

The purpose of a LOAN SCENARIO is to evaluate the potential loan's impact on the borrower's finances and to offer an outline of possible loan options tailored to meet the borrower's needs.

What information must be reported on LOAN SCENARIO?

Information that must be reported on a LOAN SCENARIO includes borrower details, loan amount, interest rate, loan term, monthly payments, and any fees or additional costs associated with the loan.

Fill out your loan scenario online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Scenario is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.