Get the free Overdraft Coverage Authorization

Show details

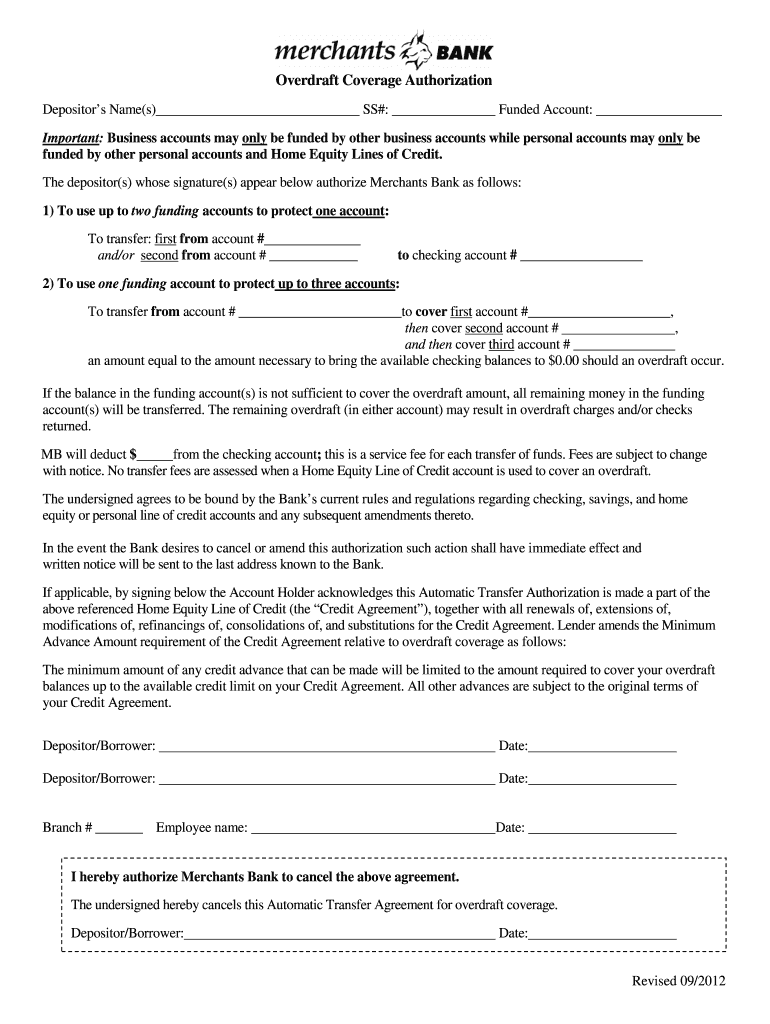

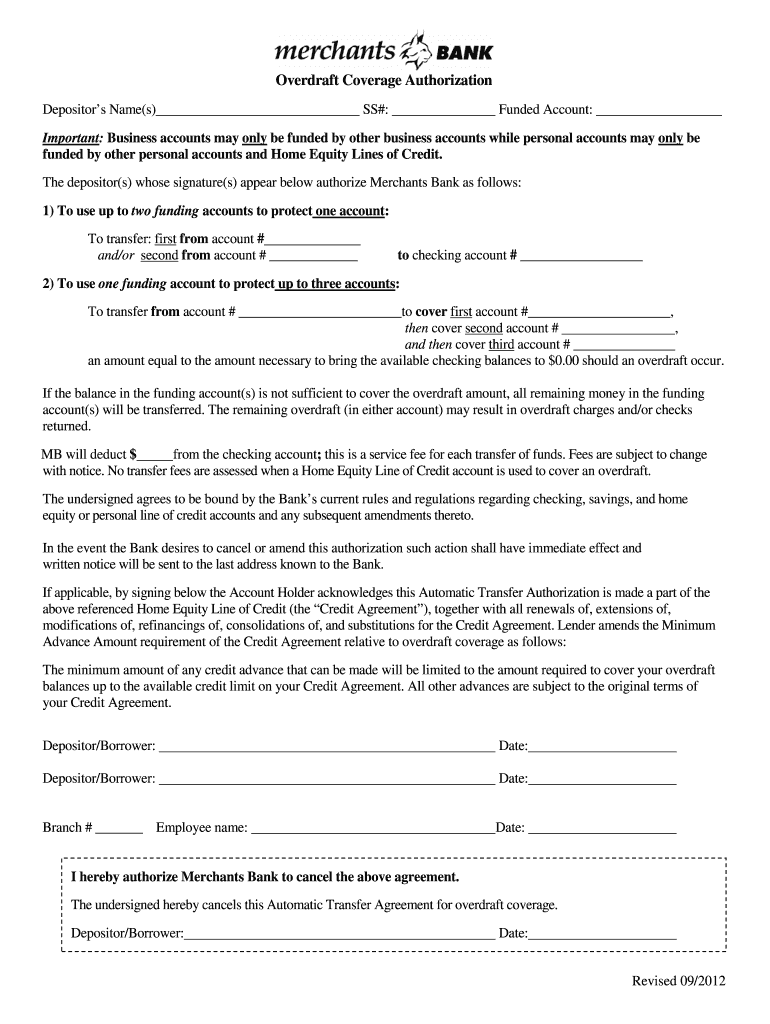

This document serves as an authorization form for depositors to enable Merchants Bank to cover overdrafts through transfers from designated funding accounts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overdraft coverage authorization

Edit your overdraft coverage authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overdraft coverage authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing overdraft coverage authorization online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit overdraft coverage authorization. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overdraft coverage authorization

How to fill out Overdraft Coverage Authorization

01

Read the instructions provided by your bank regarding the Overdraft Coverage Authorization.

02

Gather necessary personal and account information, such as your account number and identification.

03

Decide which transactions you want to cover (e.g., checks, ATM withdrawals, debit card purchases).

04

Fill out the authorization form, ensuring all required fields are completed accurately.

05

Review the terms and conditions associated with the overdraft coverage.

06

Sign and date the form.

07

Submit the completed form to your bank via the specified method (online, in-person, or by mail).

Who needs Overdraft Coverage Authorization?

01

Customers who frequently overdraw their account and want transactions to be covered.

02

Individuals who want peace of mind knowing that certain payments will be processed even if they exceed their account balance.

03

People who manage a tight monthly budget and occasionally face unexpected expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is an authorized overdraft?

Authorised overdrafts: are arranged in advance, so they're also known as 'arranged' overdrafts. You agree a limit with your bank and can spend money up to that limit.

What is Authorised and Unauthorised overdraft?

What's the difference between an authorised and unauthorised overdraft? The difference is straightforward. An authorised overdraft is one you have applied for and had approved by your bank. An unauthorised overdraft is one your bank may let you use even though you haven't applied for it.

Does having overdraft protection guarantee that a transaction will be authorized?

Overdraft protection can guarantee that a check, ATM, wire transfer, or debit-card transaction will clear if the account balance falls below zero. The cost of overdraft protection can include fees and interest, depending on the type of account linked to the checking.

What are the two types of overdraft?

There are two types of overdraft: arranged and unarranged. An arranged overdraft is when we agree to a limit that lets you spend a bit more money than you have in your current account.

What is the difference between authorized and unauthorized overdraft?

You agree a limit with your bank and can spend money up to that limit. Unauthorised overdrafts: these are also known as 'unplanned' or 'unarranged' overdrafts and happen when you spend more than you have in your bank account without agreeing it in advance. This includes going over the limit of an authorised overdraft.

Should I authorize an overdraft?

Though overdraft protection has benefits and can offer convenience, the potential fees involved may add up quickly. One way to steer clear of such fees is to simply not opt in for overdraft coverage. Your bank will just decline a debit card transaction if you lack sufficient funds.

What is overdraft coverage?

Overdraft protection is an agreement with the bank or financial institution to cover overdrafts on a checking account. This service typically involves a fee and is generally limited to a preset maximum amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Overdraft Coverage Authorization?

Overdraft Coverage Authorization is a service that allows a bank to cover transactions that exceed the account balance, typically through a linked savings account or line of credit, preventing declined transactions and fees.

Who is required to file Overdraft Coverage Authorization?

Customers who wish to enroll in overdraft protection services offered by their bank are required to file an Overdraft Coverage Authorization.

How to fill out Overdraft Coverage Authorization?

To fill out the Overdraft Coverage Authorization, customers typically need to provide their account information, sign the authorization form, and submit it to their bank either in-person or online.

What is the purpose of Overdraft Coverage Authorization?

The purpose of Overdraft Coverage Authorization is to allow customers to authorize their bank to cover overdrafts on their checking accounts, ensuring that transactions are approved even when sufficient funds are not available.

What information must be reported on Overdraft Coverage Authorization?

Information that must be reported includes the customer's name, account number, consent for overdraft coverage, and any linked accounts or lines of credit that will be used for this service.

Fill out your overdraft coverage authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overdraft Coverage Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.