Get the free CHECKING ACCOUNT INFORMATION FORM

Show details

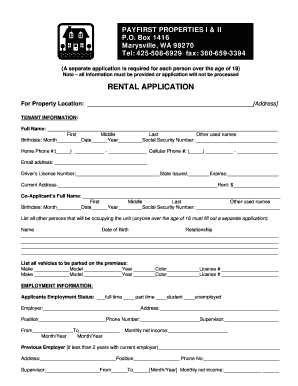

This form is used to collect personal information necessary to open a checking account, including details for individual or joint accounts, along with required identification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checking account information form

Edit your checking account information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checking account information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing checking account information form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit checking account information form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checking account information form

How to fill out CHECKING ACCOUNT INFORMATION FORM

01

Start by writing your name at the top of the form.

02

Provide your current address, including street, city, state, and zip code.

03

Enter your date of birth in the specified format.

04

Fill in your social security number or taxpayer identification number.

05

Provide your contact information, including phone number and email address.

06

Input the name of your bank and the branch location.

07

Write your checking account number and routing number.

08

Review all the information for accuracy before signing and dating the form.

Who needs CHECKING ACCOUNT INFORMATION FORM?

01

Individuals opening a new checking account.

02

Anyone updating their account information with their bank.

03

Customers seeking to apply for joint accounts.

04

People applying for loans that require banking information.

Fill

form

: Try Risk Free

People Also Ask about

How do you write bank account details?

General Information: Please make sure that Last (or Family) name is followed by first name. Account Currency: The base currency in which the banks account is held. Bank Name: Full name without acronyms or abbreviations. Bank Address: Street and city are required; branch name is appreciated if available.

What is a bank document with account details?

A bank statement is a document given to an account holder by a financial institution to detail all transactions occurring over a specific time period.It gives a full overview of one's financial activity, such as deposits, withdrawals, transfers, and other information related to the account.

What are your bank account details?

Your account number is a unique eight-digit code that identifies your personal bank account. You can find it in lots of places, including on your debit card and in the mobile banking app, your bank statements and on printed cheques. Find out more about account numbers below.

What is a bank account details form?

The bank detail form is designed to help businesses like yours gather essential data on banks, covering basic information, regulatory compliance, financial performance, services, and key personnel.

How to provide proof of bank account details?

Bank Name, Account Name, BSB Number, and Account Number are commonly seen on the following: Bank statements. Deposit slips. Cheques. Download 'Proof of account balance' document from bank (blank out account balance)

What to write in bank account details?

General Information: Please make sure that Last (or Family) name is followed by first name. Account Currency: The base currency in which the banks account is held. Bank Name: Full name without acronyms or abbreviations. Bank Address: Street and city are required; branch name is appreciated if available.

What is my checking account information?

At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your check number.

What is a bank detail form?

A bank detail form is an employee checklist that is usually used to record the details of money and check exchanges in banks. By using an online bank detail form, you can track the exchange of money and checks easily — without filling out paper forms or looking for them in a stack.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

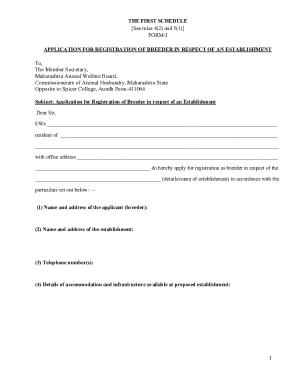

What is CHECKING ACCOUNT INFORMATION FORM?

The Checking Account Information Form is a document used to collect and report details regarding an individual's or business's checking account, including account numbers and banking institution information.

Who is required to file CHECKING ACCOUNT INFORMATION FORM?

Individuals or businesses that need to disclose their checking account information for regulatory, tax, or compliance purposes are typically required to file the Checking Account Information Form.

How to fill out CHECKING ACCOUNT INFORMATION FORM?

To fill out the Checking Account Information Form, one must provide accurate account details, including the account holder's name, account number, and the financial institution's name and address, and may need to sign the form to certify the information is correct.

What is the purpose of CHECKING ACCOUNT INFORMATION FORM?

The purpose of the Checking Account Information Form is to ensure transparency and compliance with financial regulations by documenting account ownership and relevant details.

What information must be reported on CHECKING ACCOUNT INFORMATION FORM?

The form typically requires reporting information such as the account holder's name, address, checking account number, the name of the financial institution, and possibly the type of account.

Fill out your checking account information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checking Account Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.