Get the free Aggregate Accounting for Calculation of Escrow Accounting

Show details

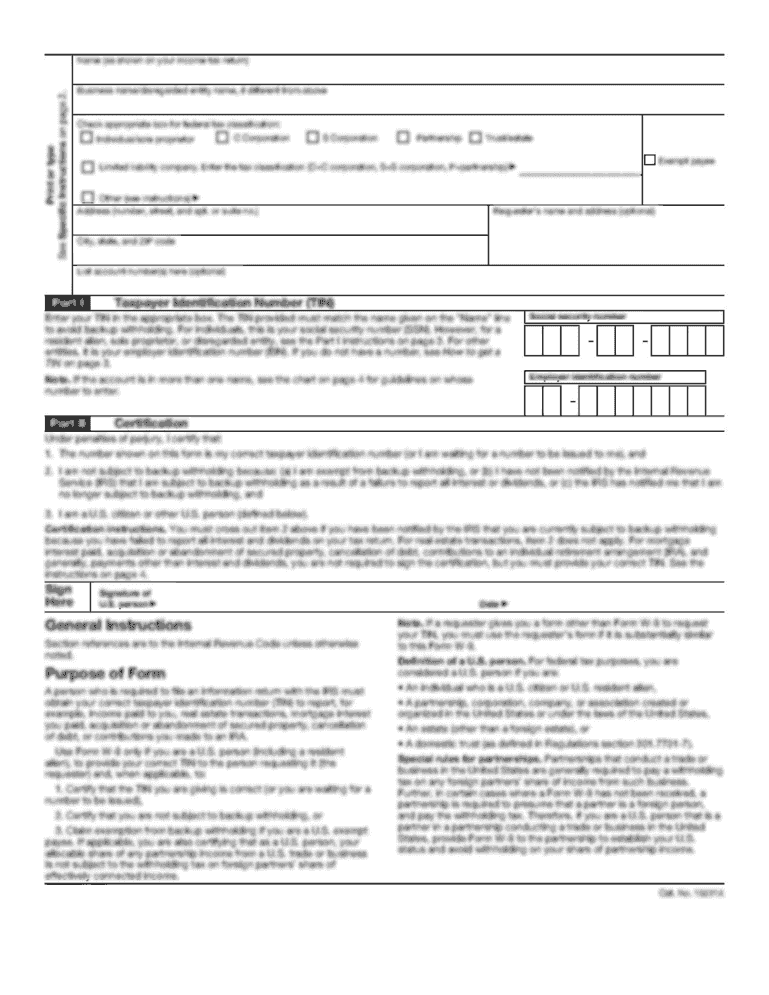

This document outlines the revised Regulation X (Escrow Accounting Procedures) by HUD, detailing requirements for loan servicers on managing escrow accounts, including calculations for initial balances,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aggregate accounting for calculation

Edit your aggregate accounting for calculation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aggregate accounting for calculation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aggregate accounting for calculation online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit aggregate accounting for calculation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aggregate accounting for calculation

How to fill out Aggregate Accounting for Calculation of Escrow Accounting

01

Gather all relevant financial documents related to escrow transactions.

02

Identify the total amount of funds held in escrow for the accounting period.

03

List all transactions that have occurred within the period, including deposits and releases.

04

Calculate the net change in escrow funds by subtracting total releases from total deposits.

05

Ensure all calculations adhere to relevant accounting standards and guidelines.

06

Prepare a detailed report summarizing the escrow accounting for review and submission.

Who needs Aggregate Accounting for Calculation of Escrow Accounting?

01

Individuals and businesses involved in real estate transactions.

02

Escrow agents and financial institutions managing escrow accounts.

03

Accountants responsible for auditing or overseeing escrow transactions.

04

Legal professionals dealing with contracts that require escrow services.

Fill

form

: Try Risk Free

People Also Ask about

What type of account is escrow in accounting?

General escrow accounts: These accounts consist of monies deposited to a file pending satisfaction of the accompanying instructions. These funds belong to the parties to the transaction and are held by the title company subject to the parties' direction.

How to manage an escrow account?

Monitor Your Escrow Balance: When handling your own escrow account, it's essential to keep a vigilant watch over its balance. This ensures you have ample funds to cover impending property tax and insurance payments. Stay proactive by regularly reviewing the escrow account statement furnished by your mortgage servicer.

What is the aggregate accounting method of escrow?

Escrow aggregate or composite analysis is an accounting method used by servicers to evaluate the sufficiency of funds in an escrow account. This analysis considers the account as a whole, rather than item by item. By adopting this method, all payments related to various obligations are combined.

What type of account is an escrow account?

An Escrow Current Account is a Secure Account where a third party holds funds or assets until the terms of an agreement are fulfilled. Transactions are carried out based on a legal agreement, where terms & conditions are predefined to operate the Account.

What is an escrow account considered?

Essentially, escrow is a financial arrangement where a neutral third party holds funds or assets on behalf of two parties involved in a transaction until specific conditions are met. This is especially relevant during the home buying process.

What type of asset is escrow?

Funds or assets held in escrow are temporarily transferred to and held by a third party, usually on behalf of a buyer and seller to facilitate a transaction. "In escrow" is often used in real estate transactions when property, cash, and the property's title are held in escrow until predetermined conditions are met.

How to record escrow payments?

Once your lender completes this transaction, record it in your Escrow Account in your accounting system. To do that in QuickBooks, use the Write Check from the appropriate Escrow bank account and write the check for the amount the paid by your lender. Your escrow balance will then stay in line with your lender.

What is the escrow account in accounting?

Escrow accounting refers to money held in an account by a third party while other parties complete a transaction. Often, a contract outlines the conditions that must be met in order for the money to transfer from one party to the other.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Aggregate Accounting for Calculation of Escrow Accounting?

Aggregate Accounting for Calculation of Escrow Accounting is a method used to consolidate and summarize escrow transactions to provide a clear financial overview. It involves accounting for all funds held in escrow, including deposits, distributions, and interest earned, in an organized manner.

Who is required to file Aggregate Accounting for Calculation of Escrow Accounting?

Typically, entities involved in managing escrow accounts, such as escrow agents, financial institutions, or real estate companies, are required to file Aggregate Accounting for Calculation of Escrow Accounting.

How to fill out Aggregate Accounting for Calculation of Escrow Accounting?

To fill out Aggregate Accounting for Calculation of Escrow Accounting, one must gather all relevant transaction details, including amounts deposited, released, and interest earned. The form usually requires listing each transaction, categorizing them appropriately, and ensuring all figures are accurate and balanced.

What is the purpose of Aggregate Accounting for Calculation of Escrow Accounting?

The purpose of Aggregate Accounting for Calculation of Escrow Accounting is to maintain transparency and accountability in the management of escrow funds, ensuring that all parties involved are aware of their contributions and distributions, and facilitating compliance with regulatory standards.

What information must be reported on Aggregate Accounting for Calculation of Escrow Accounting?

The information that must be reported typically includes the total amount of funds held in escrow, transactions detailing deposits and disbursements, interest earned, the parties involved, and any fees deducted during the management of the escrow account.

Fill out your aggregate accounting for calculation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aggregate Accounting For Calculation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.