Get the free Notice to borrower - Investors Realty - investorsrealty

Show details

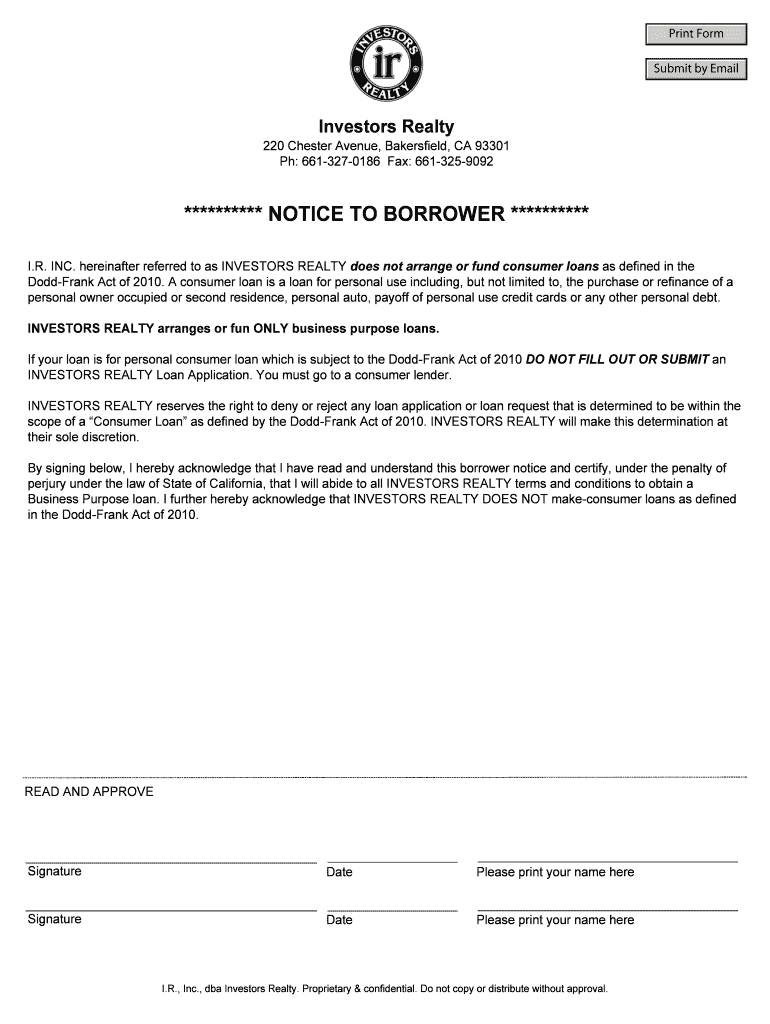

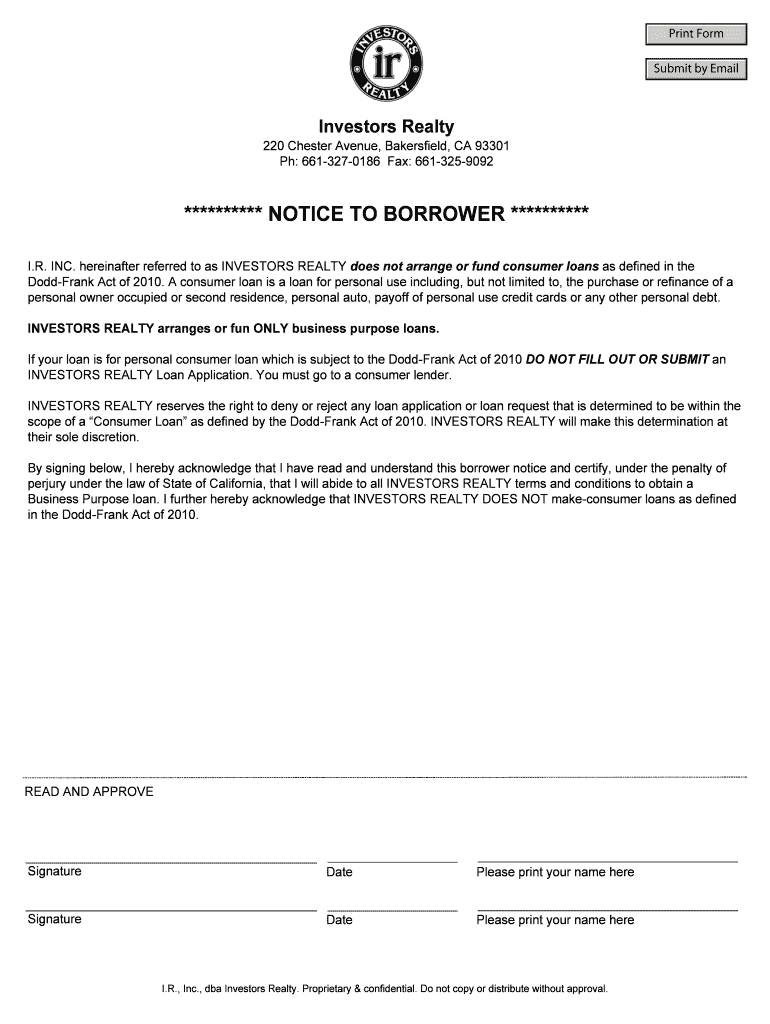

This document serves as a notice to borrowers informing them that INVESTORS REALTY only arranges or funds business purpose loans and does not engage in consumer loans as defined by the Dodd-Frank

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice to borrower

Edit your notice to borrower form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice to borrower form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice to borrower online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit notice to borrower. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice to borrower

How to fill out notice to borrower:

01

Begin by entering the date at the top of the notice. This is important for record-keeping purposes.

02

Include the borrower's name and contact information. Make sure to accurately spell their name and provide their current address.

03

Clearly state the purpose of the notice. For example, if it is a notice regarding late payment or default on a loan, specify it clearly.

04

Provide a brief explanation of the situation or reason for sending the notice. This can help the borrower understand why they are receiving it.

05

Clearly outline any actions that the borrower needs to take in response to the notice. For instance, if they need to make an immediate payment or contact a specific person, provide clear instructions.

06

Include any deadlines or due dates for the borrower to take the required actions. This helps create a sense of urgency and ensures that the borrower understands the timeframe for resolution.

07

If applicable, include any consequences or potential penalties for non-compliance with the notice. This can serve as a reminder of the importance of addressing the matter promptly.

08

Sign the notice with your name and title or position within the organization. This adds credibility to the notice and helps the borrower know who to contact if they have any questions or concerns.

Who needs notice to borrower:

01

Lenders: Lenders often need to send notices to borrowers regarding late payments, default on loans, or changes in loan terms. This helps ensure clear communication between the lender and borrower.

02

Financial institutions: Banks, credit unions, or other financial institutions may send notices to borrowers regarding loan modifications, foreclosure proceedings, or other important matters related to the borrowing agreement.

03

Landlords: In some situations, landlords may need to send notices to tenants who have failed to pay rent or violated the terms of their rental agreement. This helps landlords address any issues and maintain a fair rental relationship.

04

Service providers: Companies that provide services on credit, such as utility companies or telecommunications providers, may send notices to borrowers regarding outstanding bills or non-payment of services.

05

Collection agencies: When debts are transferred to collection agencies, they may send notices to borrowers informing them of the transfer and requesting payment. This ensures that borrowers are aware of the change in debt ownership.

06

Government agencies: Various government agencies, such as tax authorities or educational loan providers, may send notices to borrowers regarding unpaid taxes, student loan repayment, or other government-related financial obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my notice to borrower directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your notice to borrower and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send notice to borrower for eSignature?

notice to borrower is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete notice to borrower on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your notice to borrower. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is notice to borrower?

Notice to borrower is a document that informs a borrower about important information related to their loan, such as changes in interest rates, payment due dates, or any other significant updates.

Who is required to file notice to borrower?

Lenders or financial institutions are typically required to file notice to borrower. They are responsible for ensuring that borrowers are informed about any relevant changes or updates regarding their loan.

How to fill out notice to borrower?

To fill out a notice to borrower, you need to include the necessary information related to the borrower's loan, such as the borrower's name and contact information, loan identification number, details of any changes or updates, and any additional information required by regulatory authorities. The specific format and requirements may vary depending on the jurisdiction and the type of loan.

What is the purpose of notice to borrower?

The purpose of notice to borrower is to ensure that borrowers are informed about any changes or updates related to their loan. It helps borrowers stay aware of their loan terms, payment obligations, and any significant modifications that may affect their financial situation.

What information must be reported on notice to borrower?

The information that must be reported on a notice to borrower usually includes the borrower's name and contact information, loan identification number, details of any changes or updates to the loan terms, payment amounts, interest rates, and any other information required by regulatory authorities or specified in the loan agreement.

Fill out your notice to borrower online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice To Borrower is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.