Get the free APPLICATION FOR CREDIT - baccessmanconzb

Show details

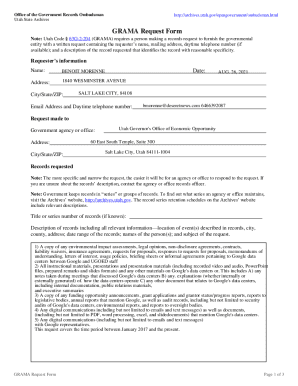

8 Cemetery Road P.O. Box 382 Cromwell pH (03) 445 8020 Fax (03) 445 8024 APPLICATION FOR CREDIT 1. Legal Name: Trade Name: 2. Postal Address: Post code: Street Address: Post code: Business Nos: pH:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for credit

Edit your application for credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for credit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for credit

How to fill out an application for credit:

01

Gather all necessary documents: Before starting the application process, collect all the required documents such as identification proof, income statements, bank statements, and any additional documents specified by the lender.

02

Research the available options: Before choosing a particular credit application, spend some time comparing different lenders and credit options to find the one that suits your needs and financial situation the best.

03

Understand the application form: Read through the application form carefully to understand the information it requires. Make sure you have a clear understanding of the terms and conditions provided by the lender.

04

Provide accurate personal information: Fill in your personal details accurately, including your full name, contact information, date of birth, and Social Security number. Double-check the accuracy of the information you provide to avoid any complications in the future.

05

Provide financial information: Some credit applications may require detailed financial information such as income, expenses, employment history, and current financial obligations. Ensure that you provide accurate and up-to-date financial details.

06

Verify employment details: You may be required to provide details of your current and previous employment, including the employer's name, contact information, job title, income, and length of employment. Make sure to provide accurate and verifiable information.

07

Indicate the desired credit amount: Specify the amount of credit you are applying for. Ensure that the requested amount aligns with your financial needs and repayment capabilities.

08

Read and understand the terms and conditions: Carefully read through the terms and conditions provided by the lender. Make sure you understand the interest rates, repayment terms, fees, penalties, and any other relevant information before submitting your application.

09

Review and double-check: Before submitting the application, review all the information you have provided. Verify the accuracy of the details and make any necessary corrections or adjustments.

10

Submit the application: Once you are confident that all the information is accurate and complete, submit your credit application to the lender through the designated channel, such as online submission, mail, or in-person.

Who needs an application for credit?

01

Individuals seeking financial assistance: Anyone who requires financial assistance, whether for personal, business, or investment purposes, may need to fill out an application for credit. This could include individuals looking for a loan, a credit card, a mortgage, or any other form of credit.

02

Entrepreneurs and business owners: Entrepreneurs and business owners often require credit to fund their ventures, manage cash flow, or expand their operations. They may need to fill out a credit application to access the necessary funds from lenders or financial institutions.

03

Individuals looking to establish credit history: Building a credit history is essential for future financial endeavors. Individuals who want to establish credit, especially those who are new to credit or have limited credit history, may need to fill out an application for credit to initiate their credit journey.

04

Those seeking to improve their credit score: Individuals who aim to improve their credit score may consider applying for credit. By responsibly managing credit and making timely repayments, they can enhance their creditworthiness and overall financial standing.

05

Consumers seeking specific benefits: Some credit applications are associated with specific benefits, such as rewards programs, cashback offers, or special financing options. Those looking to take advantage of these benefits may consider filling out an application for credit.

06

Individuals looking to refinance existing debt: Refinancing existing debt, such as consolidating multiple loans or credit card balances into a single account with better terms, may require filling out a credit application.

07

Graduates and students: Young adults who have recently graduated or are currently pursuing higher education may need to fill out a credit application to access student loans, credit cards, or other forms of credit required for educational expenses or building credit history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for credit in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your application for credit along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete application for credit online?

pdfFiller makes it easy to finish and sign application for credit online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the application for credit form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign application for credit and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is application for credit?

An application for credit is a form that individuals or businesses fill out when applying for a credit card, loan, or line of credit.

Who is required to file application for credit?

Any individual or business seeking to obtain credit from a financial institution or lender is required to file an application for credit.

How to fill out application for credit?

To fill out an application for credit, one must provide personal or business information, financial details, and agree to a credit check by the lender.

What is the purpose of application for credit?

The purpose of an application for credit is for a lender to assess the creditworthiness of the applicant and determine whether or not to extend credit.

What information must be reported on application for credit?

Information such as personal details, employment history, income, expenses, debts, and assets must be reported on an application for credit.

Fill out your application for credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.