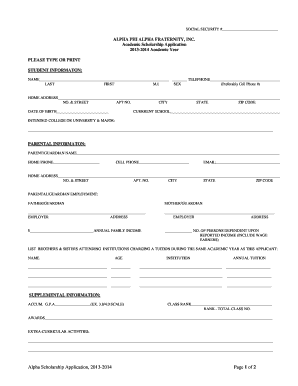

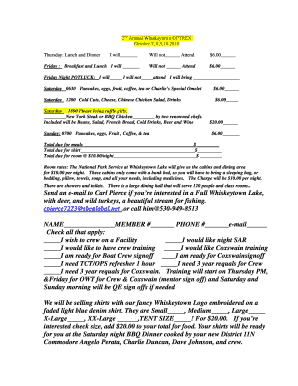

Get the free American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT

Show details

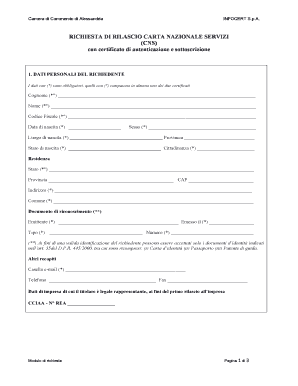

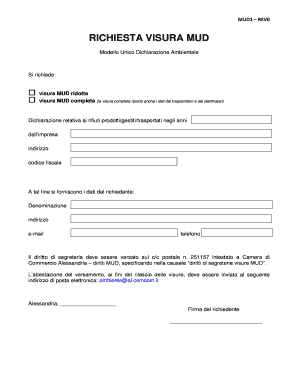

This document is used for enrolling an applicant in the American Express Corporate Card Express Cash Facility, detailing personal information, corporate declaration, and agreement terms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign american express corporate card

Edit your american express corporate card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your american express corporate card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing american express corporate card online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit american express corporate card. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out american express corporate card

How to fill out American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT

01

Obtain the American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT form either online or through your corporate administrator.

02

Begin filling out the required personal information section, including your name, job title, and company information.

03

Provide your corporate email address and contact phone number as requested on the form.

04

Complete the section that asks for your corporate account number and other relevant account details.

05

Indicate the preferred cash access method you would like to enroll in, whether it be through an ATM or other means.

06

Review the terms of use and ensure you agree with the conditions stated.

07

Sign and date the form at the designated location to verify that all information provided is accurate.

08

Submit the completed form electronically or as instructed by your corporate administrator.

Who needs American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT?

01

Employees who frequently travel for business and require a flexible payment solution.

02

Companies looking to streamline their expense management through corporate cards.

03

Corporate employees who need access to cash for business-related expenses.

04

Businesses aiming to enhance their procurement processes with corporate credit solutions.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for Amex corporate card?

To save time, it's best to make sure you can say yes to the following before you apply: Your company annual revenue should be more than Rs 2.75cr. Your business must be operational in any of the below listed cities.

Who is eligible for a corporate credit card?

There are strict requirements for a business to qualify for a corporate credit card account. Companies will typically need to have annual revenue above $4 million, a minimum of $250,000 in annual expenses, and at least 15 authorized cardholders to be approved. The business will also need to have a good credit score.

How to get cash from a corporate credit card?

A cash advance is one way to liquidate a business credit card. This involves advancing cash from your credit limit up to the maximum cash advance amount, which is usually a percentage of your credit limit, to your business bank account or withdrawing it from an ATM (depending on the card policy).

How to qualify for AmEx corporate card?

American Express business card requirements You typically need a personal FICO score of 690 or higher to qualify for an AmEx business card. Beyond that, AmEx also considers factors like your business credit score and annual business revenue.

What is the difference between Amex business and corporate?

One major difference between the Amex Business Platinum card and the Amex Corporate Platinum card is that your personal credit can be used to guarantee the debt on the Amex Business Platinum card, while the business would guarantee the debt on the Amex Corporate Platinum card.

What is the corporate membership program for American Express?

Enrolling your Cards in Corporate Membership Rewards program comes with a $90 annual enrollment fee for each enrolled Corporate Green Card Member. Once you've enrolled your company in the Corporate Membership Rewards program and linked Employee Cards, you can start earning points on eligible purchases.

Who is eligible for AmEx Platinum corporate card?

American Express Platinum Corporate Card Eligibility Criteria. To be eligible for the AmEx Platinum Corporate Card, your company should have an annual revenue of more than ₹2.75 crore and be operational in one of the listed cities. Additionally, you must be a key decision-maker within your company.

Is it hard to get approved for an AmEx business card?

Qualifying for an Amex business card isn't as difficult as you may think. If you're a sole proprietor, you may be able to complete the application using your name as the business name and your Social Security number as your business tax ID.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT?

The American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT is a program that allows cardmembers to enroll in a cash management solution by linking their corporate card for cash access.

Who is required to file American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT?

Cardmembers who wish to access cash through the Corporate Card are required to file the CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT.

How to fill out American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT?

To fill out the enrollment form, cardmembers need to provide their personal information, corporate account details, and any additional required documentation as specified in the instructions.

What is the purpose of American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT?

The purpose is to enable cardmembers to access cash for business-related expenses while maintaining control over spending and transactions.

What information must be reported on American Express® Corporate Card - CARDMEMBER CORPORATE EXPRESS CASH ENROLLMENT?

Required information typically includes the cardmember's name, corporate card number, business address, contact information, and any authorization signatures needed for the account.

Fill out your american express corporate card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

American Express Corporate Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.