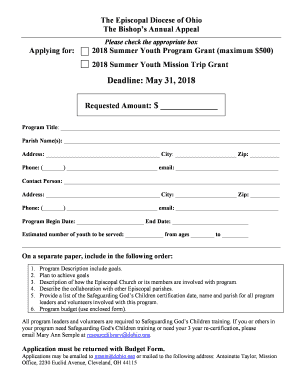

Get the free NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS

Show details

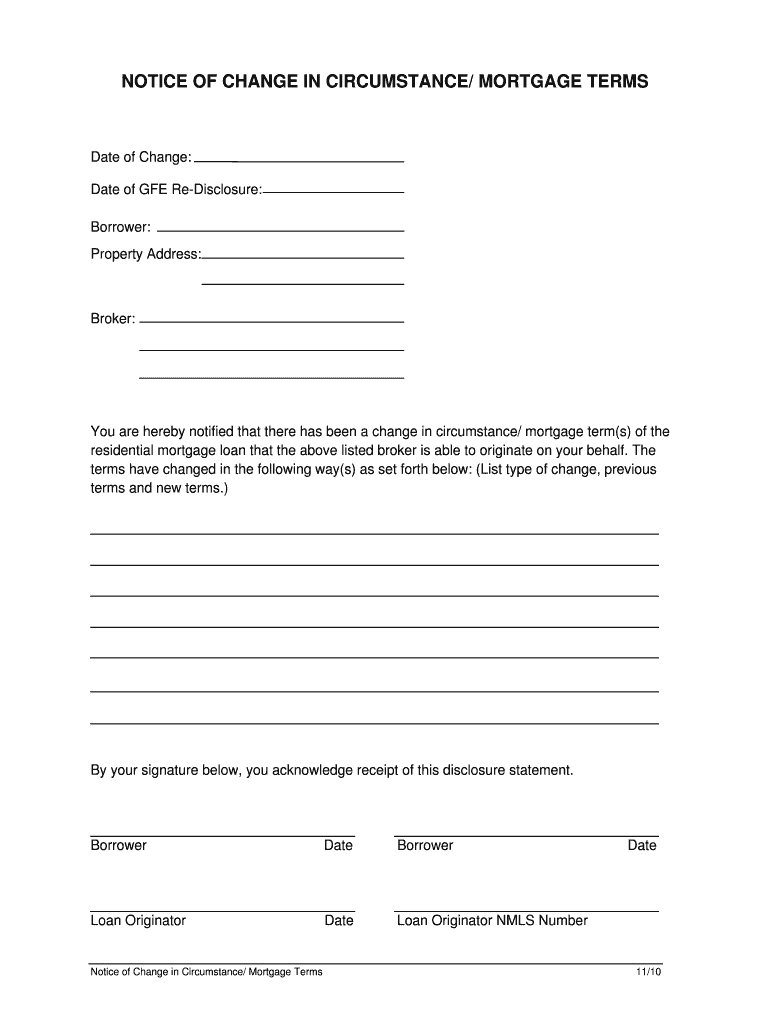

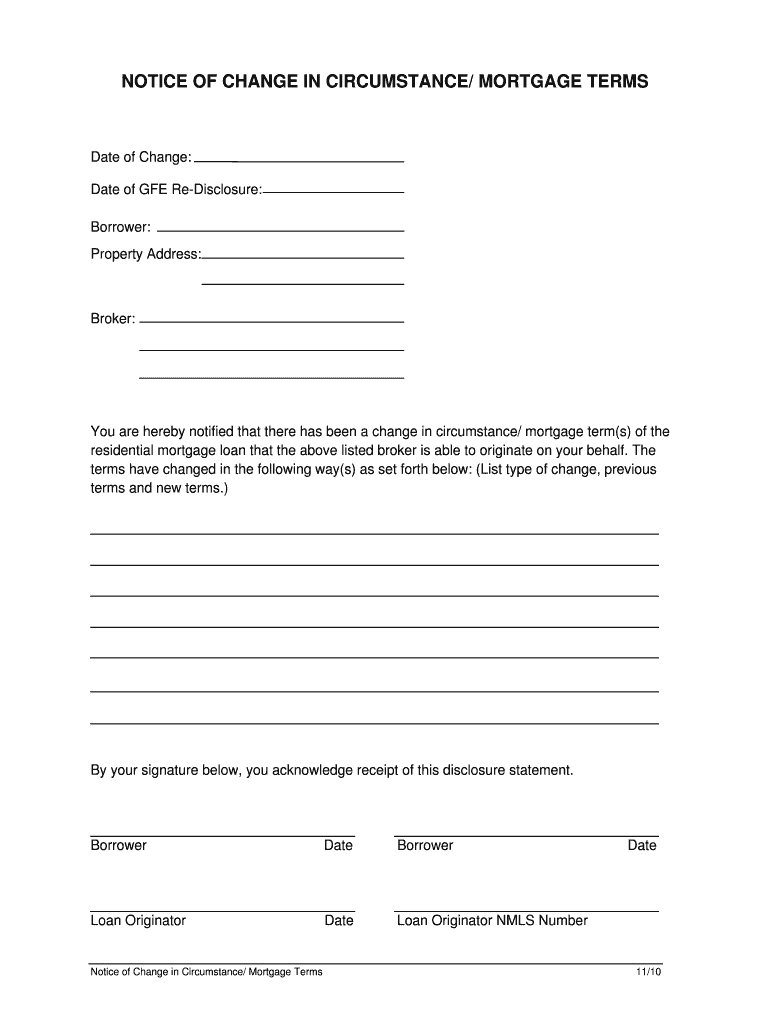

This document notifies borrowers of changes in circumstances or terms of their residential mortgage loan. It includes details of the changes and requires the borrower's acknowledgment of receipt.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of change in

Edit your notice of change in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of change in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice of change in online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice of change in. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of change in

How to fill out NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS

01

Obtain the NOTICE OF CHANGE IN CIRCUMSTANCE/MORTGAGE TERMS form from your lender or online.

02

Read the instructions carefully to understand what information is required.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide the details of your current mortgage, including the loan number and the terms of the original agreement.

05

Clearly state the changes in circumstance or mortgage terms you are reporting.

06

Attach any supporting documents that validate the changes, such as financial statements or other relevant information.

07

Review the completed form for accuracy and completeness.

08

Submit the form to your lender according to their submission guidelines.

Who needs NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS?

01

Homeowners experiencing changes in their financial situation, such as job loss or income change.

02

Borrowers seeking to modify their current mortgage terms due to refinancing or new loan requirements.

03

Individuals applying for assistance programs that require documentation of changes in circumstances.

04

Anyone who has previously agreed to a mortgage and experiences significant life changes affecting their ability to meet the terms.

Fill

form

: Try Risk Free

People Also Ask about

How do you write an official letter of explanation?

What to include in a letter of explanation Your name, mailing address and phone number. The date. The loan application number. The lender's name, mailing address and phone number. Your explanation, along with references to any supporting documents you are including.

How do I write a letter for a mortgage?

You can write a letter of explanation for a mortgage by providing details about items in your application that concern the lender, such as late payments or employment gaps. Adding context helps the lender better understand your ability to repay.

What is a change of circumstance mortgage?

A "change of circumstance" refers to any event that affects the borrower's eligibility for the loan or alters the terms or costs associated with the mortgage transaction. Valid changes of circumstance allow lenders to revise the Loan Estimate without violating the tolerance requirements under the TRID Rule.

How do I write a letter of explanation to a mortgage company?

5 tips for a good letter of explanation Keep it short and to the point. The mortgage underwriter is looking for clarification on a specific issue, so stick to that topic. Emphasize the circumstances that led to the issue. Explain how your finances have improved. Proofread your letter. Be nice.

How to write a letter explaining financial situation?

What to include in a hardship letter The date, your name, address and phone number. The lender/servicer and loan number. The date or approximate time frame when the hardship started. The expected timeframe of hardship — short term (six months or less) or long term. Describe your goal. State the facts, not emotions.

What is it called when you change your mortgage?

Refinancing: When you refinance, you'll apply for an entirely new mortgage, with a new interest rate and terms, and pay another set of closing costs.

What constitutes a change in circumstance?

A change of circumstances refers to the showing required by a party seeking to modify a prior child support, spousal support, or custody order. Generally, the change in circumstances must be substantial in nature and due to facts that were unknown or unanticipated when the prior order was issued.

How do I start off an explanation letter?

Explain the situation To begin writing this type of letter, you might explain the situation or circumstance and any contributing factors. Consider including information to answer questions like: What happened? How did it happen?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS?

A NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS is a document that notifies relevant parties about any changes to the terms of a mortgage, such as interest rates, loan amount, or payment schedule. It is an important communication tool in the mortgage process to ensure transparency.

Who is required to file NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS?

Lenders and mortgage servicers are typically required to file a NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS when there are significant changes to the mortgage agreement or terms that could affect the borrower.

How to fill out NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS?

To fill out a NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS, provide accurate information regarding the original mortgage terms, the nature of the change, the reason for the change, and any new terms that will apply. Ensure all involved parties are identified and included.

What is the purpose of NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS?

The purpose of the NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS is to inform borrowers and other stakeholders about alterations to mortgage terms so they can understand how it may impact their repayment obligations and overall financial situation.

What information must be reported on NOTICE OF CHANGE IN CIRCUMSTANCE/ MORTGAGE TERMS?

The information that must be reported includes the original mortgage details, specific changes being made (e.g., interest rate changes, adjustments in the payment schedule), reason for the changes, and any new terms and conditions that will replace the previous ones.

Fill out your notice of change in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Change In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.