Get the free Broker / Correspondent Application

Show details

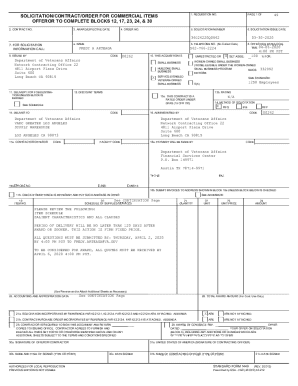

This document is an application form for brokers and correspondents seeking approval to originate mortgage loans for Michigan Mutual, Inc. It includes fields for corporate information, production

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign broker correspondent application

Edit your broker correspondent application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broker correspondent application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit broker correspondent application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit broker correspondent application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out broker correspondent application

How to fill out Broker / Correspondent Application

01

Gather the required documents, such as your license, financial statements, and proof of employment.

02

Download the Broker / Correspondent Application from the official website or obtain it from the relevant authority.

03

Fill out the application form with your personal and business information accurately.

04

Provide detailed information about your business structure and ownership.

05

Include your licensing information, including license number and issuing state.

06

Attach all necessary supporting documentation as specified in the application guidelines.

07

Review the completed application for any errors or missing information.

08

Submit the application along with any required fees to the appropriate regulatory body.

09

Follow up to confirm receipt of your application and inquire about the processing timeline.

Who needs Broker / Correspondent Application?

01

Individuals or companies looking to facilitate mortgage loans.

02

Real estate agents seeking to operate as brokers.

03

Financial professionals aiming to expand their business offerings.

04

Startups wanting to establish themselves in the mortgage market.

05

Anyone needing to fund or broker real estate transactions.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between a broker and a correspondent?

A correspondent lender handles all the functions associated with mortgage origination. They can take your application, underwrite your loan to make sure you qualify and fund the loan. A mortgage broker will take your application and collect all necessary documentation from you.

Which activity is a loan correspondent allowed to perform?

The primary responsibilities of loan correspondents include: Prospecting for clients: Identifying and qualifying potential borrowers, understanding their financial situation and homebuying goals. Loan application processing: Gathering and reviewing loan applications, ensuring completeness and accuracy of documentation.

Which of the following loans and transactions does the ATR rule apply to?

The Bureau's ATR/QM rule applies to almost all closed-end consumer credit transactions secured by a dwelling including any real property attached to the dwelling. This means loans made to consumers and secured by residential structures that contain one to four units, including condominiums and co-ops.

What is the correspondent loan process?

Correspondent mortgage lending is a model where lenders originate, fund, and close home loans using their own capital before selling them to investors. This process allows lenders to maintain liquidity, offer competitive loan products, and efficiently serve borrowers.

What is broker lending?

While a borrower can directly borrow from a lender, a loan broker can help the borrower decide which lender meets the borrower's financial goals. Using a loan broker can help borrower save time, and can usually help the borrower find a lender with lower interest rate.

What is a direct correspondent lender?

Like other mortgage lenders, a correspondent lender originates, underwrites and funds mortgages. But after the mortgage closes, a correspondent lender promptly sells it to an institutional mortgage buyer — often, a government-sponsored enterprise (GSE) like Fannie Mae or Freddie Mac.

What is the difference between a mortgage broker and a correspondent lender?

A correspondent lender handles all the functions associated with mortgage origination. They can take your application, underwrite your loan to make sure you qualify and fund the loan. A mortgage broker will take your application and collect all necessary documentation from you.

What is a correspondent broker?

Correspondent Broker means any member or participant of an Exchange and/or Clearing House of which the Company may not be a member or participant who, as the Company's agent, enters into a Contract on such Exchange and/or clears the same, as the case be.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Broker / Correspondent Application?

The Broker / Correspondent Application is a formal document used by mortgage brokers and correspondents to apply for licensing or registration with relevant regulatory authorities to facilitate mortgage transactions.

Who is required to file Broker / Correspondent Application?

Individuals or entities engaged in mortgage brokerage or correspondent lending activities are required to file the Broker / Correspondent Application to ensure compliance with state and federal regulations.

How to fill out Broker / Correspondent Application?

To fill out the Broker / Correspondent Application, applicants must complete the required sections with accurate and truthful information, including personal identification, business details, financial history, and any necessary supporting documentation as outlined by the regulating body.

What is the purpose of Broker / Correspondent Application?

The purpose of the Broker / Correspondent Application is to provide regulatory authorities with the necessary information to evaluate an applicant's qualifications and ability to operate within the mortgage industry, ensuring consumer protection and industry integrity.

What information must be reported on Broker / Correspondent Application?

The information that must be reported on the Broker / Correspondent Application typically includes the applicant's identity, business structure, previous financial history, any criminal background, disclosure of financial obligations, and professional references.

Fill out your broker correspondent application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Broker Correspondent Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.