Get the free CONVENTIONAL FINANCING CONTINGENCY

Show details

Este documento es una parte del acuerdo para la compra y venta de una propiedad, que detalla los términos y condiciones relacionados con la obtención de financiamiento convencional, incluyendo plazos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conventional financing contingency

Edit your conventional financing contingency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conventional financing contingency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

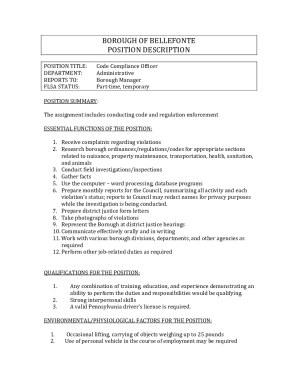

Editing conventional financing contingency online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit conventional financing contingency. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conventional financing contingency

How to fill out CONVENTIONAL FINANCING CONTINGENCY

01

Begin by indicating the date of the contract on the first line.

02

Specify the property address clearly beneath the date.

03

State the buyer's name and the seller's name in appropriate sections.

04

Clearly define the loan amount required for the conventional financing in the appropriate field.

05

Include the type of financing (e.g., fixed-rate, adjustable-rate) in the designated section.

06

Outline the terms of the loan, including interest rate and payment details.

07

Mention the closing date or timeframe for securing financing.

08

Detail any contingencies related to the buyer’s ability to secure financing, if applicable.

09

Sign and date the document as required.

Who needs CONVENTIONAL FINANCING CONTINGENCY?

01

Homebuyers seeking to purchase a property using a conventional loan.

02

Real estate investors financing their acquisitions through conventional means.

03

Sellers requiring assurances that buyers can secure financing.

04

Lenders assessing the loan application based on the contingency terms.

Fill

form

: Try Risk Free

People Also Ask about

What are the three types of contingencies?

There are three types of group contingencies – dependent, independent, and interdependent. A dependent group contingency offers a reward to an entire group based upon the behavior or performance of one or more of its members.

What is another name for a loan contingency?

1. Loan Contingency. This is also known as a financing or mortgage contingency. It specifies the amount of time a buyer has for securing financing to buy a home.

What is another name for a contingency plan?

Contingency plans can also be referred to as 'Plan B' because it can work as an alternative action if things don't go as planned.

What is a contingency offering in finance?

However, in a Best Efforts offering, parties may agree to implement a contingency in the offering; this is known as a "Contingency Offering." In a contingency offering, the parties agree that unless and until a specified event occurs, the offering will not close, i.e., there is a condition precedent implemented into

What is a financing contingency?

A mortgage contingency may also be referred to as a financing or loan contingency. With a mortgage contingency in place, if the homebuyer cannot secure a loan before the time agreed on with a seller, they can walk away from the deal without the risk of getting penalized or losing their earnest money deposit.

What is the other name for contingency?

Some common synonyms of contingency are crisis, emergency, exigency, juncture, pinch, straits, and strait.

What is a loan contingency?

A mortgage contingency may also be referred to as a financing or loan contingency. With a mortgage contingency in place, if the homebuyer cannot secure a loan before the time agreed on with a seller, they can walk away from the deal without the risk of getting penalized or losing their earnest money deposit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CONVENTIONAL FINANCING CONTINGENCY?

A Conventional Financing Contingency is a clause in a real estate contract that allows the buyer to back out of the agreement if they cannot secure financing from a conventional lender within a specified timeframe.

Who is required to file CONVENTIONAL FINANCING CONTINGENCY?

The buyer is typically required to file the Conventional Financing Contingency as part of the purchase agreement to protect their interests in the transaction.

How to fill out CONVENTIONAL FINANCING CONTINGENCY?

To fill out a Conventional Financing Contingency, the buyer must provide details such as the loan amount, the type of financing being pursued, the timeline for securing financing, and any specific lender information if available.

What is the purpose of CONVENTIONAL FINANCING CONTINGENCY?

The purpose of the Conventional Financing Contingency is to ensure that the buyer has a valid financing option to complete the purchase, thereby minimizing the risk of losing their earnest money deposit if they are unable to obtain a loan.

What information must be reported on CONVENTIONAL FINANCING CONTINGENCY?

Information that must be reported on a Conventional Financing Contingency includes the buyer's financial qualifications, the amount of the loan being sought, terms of the mortgage, and the deadline for securing the financing.

Fill out your conventional financing contingency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conventional Financing Contingency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.