Get the free VA LOAN

Show details

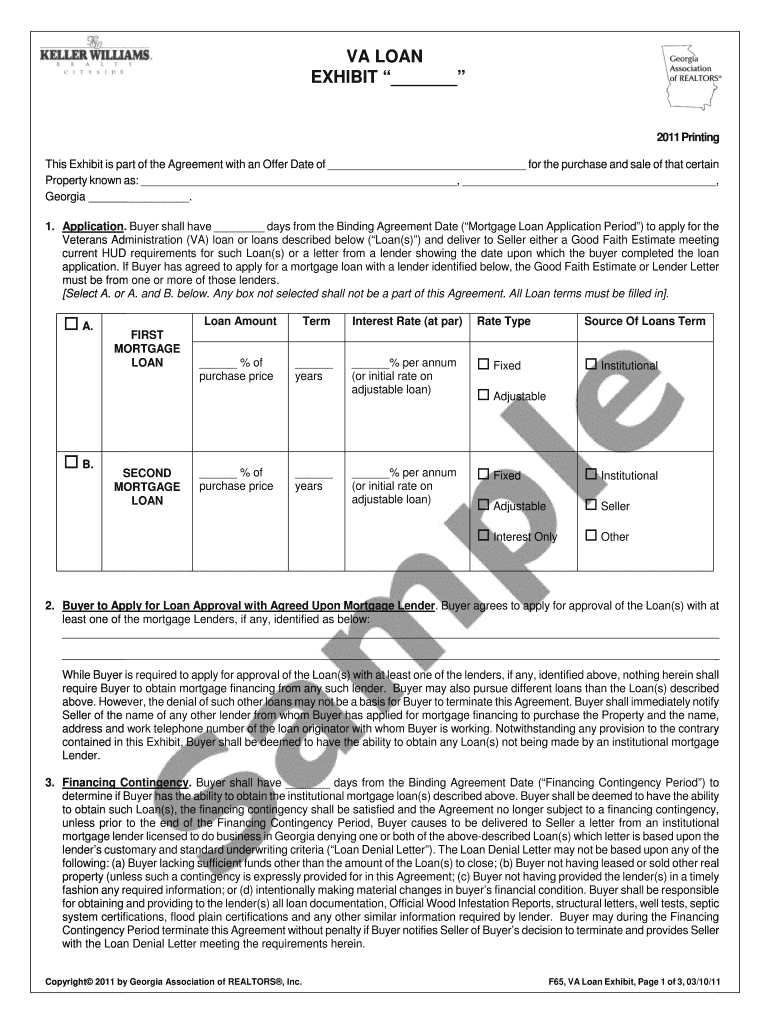

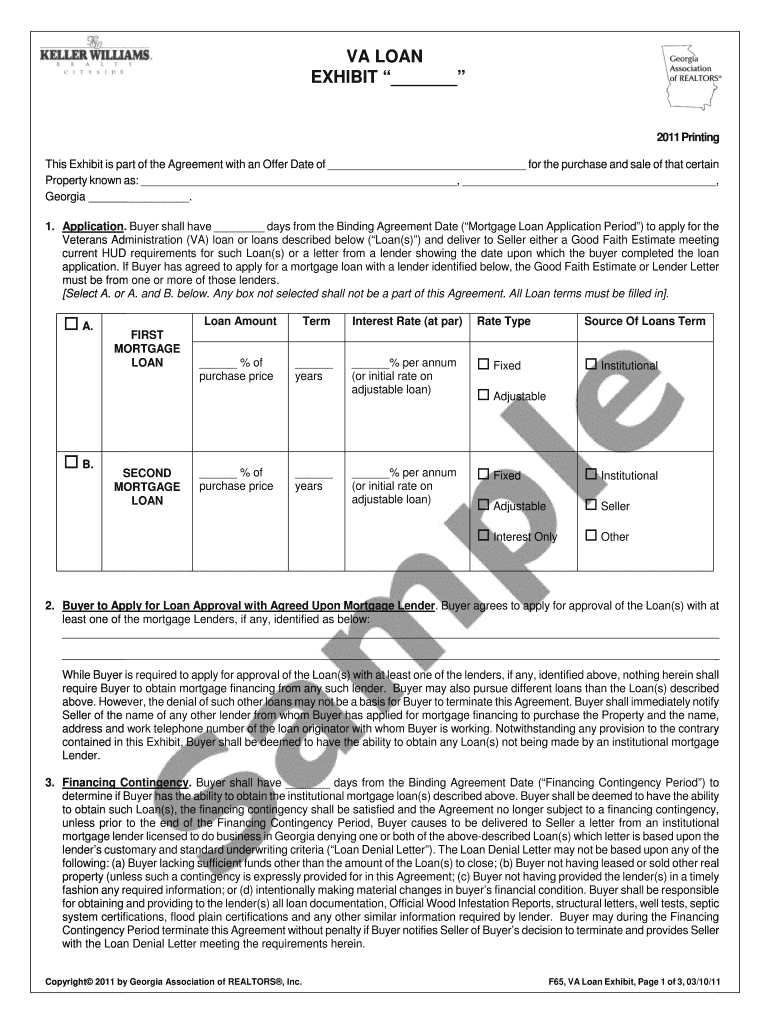

This document serves as an exhibit to a purchase and sale agreement outlining the application process for a Veterans Administration (VA) loan, including provisions for loan approval, financing contingencies,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign va loan

Edit your va loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit va loan online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit va loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out va loan

How to fill out VA LOAN

01

Determine your eligibility for a VA loan by checking your service record and obtaining a Certificate of Eligibility (COE).

02

Choose a lender who participates in the VA loan program.

03

Gather necessary documentation, including income, credit history, and employment information.

04

Complete the VA loan application, providing all required details accurately.

05

Submit the application along with the COE and supporting documents to the lender.

06

Work with the lender to complete the underwriting process and respond to any additional information requests.

07

Once approved, review the loan terms and closing disclosures before finalizing the loan.

08

Attend the closing meeting to sign documents and receive the keys to your new home.

Who needs VA LOAN?

01

Active duty service members, veterans, and certain members of the National Guard and Reserves.

02

Surviving spouses of veterans who meet specific eligibility criteria.

03

Individuals looking to purchase, build, or refinance a home with favorable loan terms.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum for a VA loan?

The VA doesn't impose a minimum credit score for VA home loans. Instead, it requires lenders to look at the borrower's overall risk profile. However, lenders can and do set their own underwriting requirements, and many require VA borrowers to have a credit score of 620 or higher.

What is a VA loan?

The Department of Veterans Affairs (VA) offers loan programs to help servicemembers, veterans, and their families buy homes. The VA sets the rules for loan qualification, arranges the terms under which mortgages may be offered, and guarantees any loan made under the program.

Which of the following best describes a VA loan?

With VA loans, veterans, service members, and their surviving spouses can purchase homes with little to no down payment and no private mortgage insurance and generally get a competitive interest rate.

What is so great about a VA loan?

Main pillars of the VA home loan benefit No downpayment required. Competitively low interest rates. Limited closing costs. No need for Private Mortgage Insurance (PMI) The VA home loan is a lifetime benefit: you can use the guaranty multiple times.

What best describes a VA loan?

Backed by the U.S. Department of Veteran Affairs, these mortgages offer a range of unique benefits, including no money down and no private mortgage insurance. And because the federal government assumes much of the risk, lenders can offer lower interest rates.

How does a VA loan work?

How does a VA-backed home loan work? With a VA-backed home loan, we guarantee (or stand behind) a portion of the loan you get from a private lender. If your VA-backed home loan goes into foreclosure, the guaranty allows the lender to recover some or all of their losses.

What is VA in finance?

Value averaging (VA) is an investing strategy that works like dollar-cost averaging (DCA) in terms of making steady monthly contributions but differs in its approach to the amount of each monthly contribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VA LOAN?

A VA loan is a mortgage loan backed by the U.S. Department of Veterans Affairs, designed to help veterans, active-duty service members, and eligible surviving spouses qualify for home financing with favorable terms.

Who is required to file VA LOAN?

VA loans are primarily available to veterans, active-duty service members, and certain members of the National Guard and Reserves, as well as eligible surviving spouses.

How to fill out VA LOAN?

To fill out a VA loan application, you need to gather necessary documentation such as your DD-214, Certificate of Eligibility (COE), income verification, and credit history. Then, apply through a VA-approved lender by completing the loan application form and providing the required documentation.

What is the purpose of VA LOAN?

The purpose of a VA loan is to provide veterans and active service members with easier access to home financing, enabling them to buy, build, or refinance a home with little to no down payment and favorable loan terms.

What information must be reported on VA LOAN?

Information required on a VA loan application includes personal identifying information, employment history, income details, credit history, and details about the property being purchased or refinanced.

Fill out your va loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.