Get the free Refinance or Home Improvement Profile - homewise

Show details

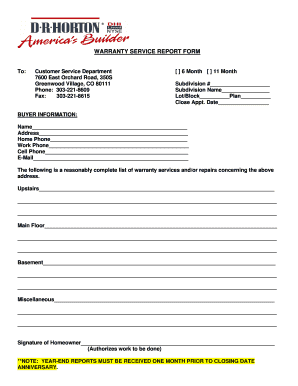

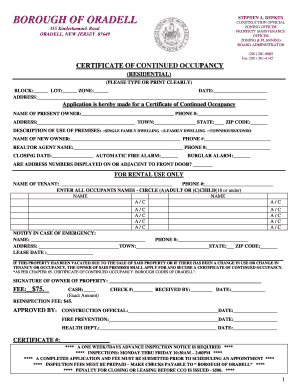

This document serves as a profile application for individuals seeking refinancing or home improvement loans, collecting detailed personal, financial, and property information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refinance or home improvement

Edit your refinance or home improvement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refinance or home improvement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit refinance or home improvement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit refinance or home improvement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refinance or home improvement

How to fill out Refinance or Home Improvement Profile

01

Gather required documents, such as income statements, tax returns, and details about your current mortgage.

02

Access the Refinance or Home Improvement Profile form via your lender's website or through a trusted platform.

03

Fill in personal information including your name, address, and contact information.

04

Provide details about your current property and mortgage, including loan amount, interest rate, and remaining term.

05

Specify the purpose of refinancing or home improvement, detailing the kind of renovations intended.

06

Indicate the desired loan amount and terms you are looking for.

07

Review the information for accuracy before submission.

08

Submit the completed profile electronically or via the designated method provided.

Who needs Refinance or Home Improvement Profile?

01

Homeowners looking to lower their current mortgage interest rate through refinancing.

02

Individuals intending to access equity for home improvements or renovations.

03

Those wishing to consolidate debt using home equity.

04

Homeowners requiring additional funds for significant repairs or upgrades.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside of a home equity loan?

Home equity loans often come with various costs and fees. These include application fees, appraisal fees, upfront charges, closing costs and early payment penalties. These costs can add up, potentially negating some of the benefits of the lower interest rate. Fluctuating home values.

What do you call a home improvement loan?

A home renovation loan — also called a home remodel loan or home improvement loan — gives homeowners access to cash to upgrade their properties.

What's better, a home equity loan or refinancing?

If your mortgage rate is higher than currently available refinance rates, a cash-out refinance may help you lower your rate. If your mortgage rate is below currently available refinance rates, a home equity loan may be a better choice.

What is the point of refinancing a home loan?

There are a number of reasons to consider refinance, such as: To get a more suitable interest rate, or new features such as flexible repayments, redraw facilities or an offset account. To access equity in your home to renovate, invest or travel.

Is it better to refinance or home equity loan?

If your mortgage rate is higher than currently available refinance rates, a cash-out refinance may help you lower your rate. If your mortgage rate is below currently available refinance rates, a home equity loan may be a better choice.

What does it mean to refinance a home?

Refinancing can allow a borrower to get a better interest rate on their mortgage. Refinancing a house means you replace the mortgage you have with a new mortgage that has more favorable terms. Whether or not you should refinance depends on whether doing so will save you enough money.

What is the monthly payment on a $50,000 home equity line of credit?

The interest-only monthly payment on a fully drawn $50,000 Home Equity Line of Credit (HELOC) can range from $375 to $450. This assumes an interest rate between 9% and 10.8%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Refinance or Home Improvement Profile?

The Refinance or Home Improvement Profile is a document or form used to collect information from homeowners who are seeking to refinance their mortgage or make improvements to their home.

Who is required to file Refinance or Home Improvement Profile?

Homeowners who are looking to refinance their existing mortgage or apply for loans specifically for home improvement projects are typically required to file the Refinance or Home Improvement Profile.

How to fill out Refinance or Home Improvement Profile?

To fill out the Refinance or Home Improvement Profile, provide accurate personal information, details about the existing mortgage, desired refinancing terms, and specific information about the planned home improvements.

What is the purpose of Refinance or Home Improvement Profile?

The purpose of the Refinance or Home Improvement Profile is to assess the borrower's financial situation, loan eligibility, and the intended use of funds for refinancing or home improvements.

What information must be reported on Refinance or Home Improvement Profile?

The information that must be reported includes the homeowner's financial details, current mortgage information, the estimated cost of home improvements, and any additional relevant financial obligations.

Fill out your refinance or home improvement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refinance Or Home Improvement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.