Get the free Business Membership Account Card

Show details

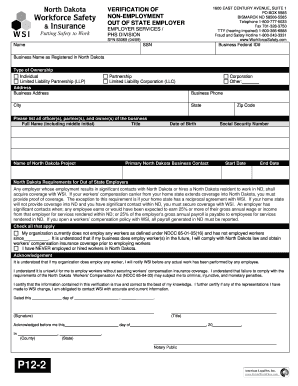

This document is used to establish accounts and services for business members at Mid-Hudson Valley Federal Credit Union, requiring basic business and owner information for membership and account setup.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business membership account card

Edit your business membership account card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business membership account card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business membership account card online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business membership account card. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business membership account card

How to fill out Business Membership Account Card

01

Obtain a Business Membership Account Card application form from the relevant organization.

02

Fill in the Business Name in the designated field.

03

Provide the physical address of the business.

04

Enter the contact information, including phone number and email address.

05

Indicate the type of business or industry category.

06

Specify the number of employees in the business.

07

Include additional required information, such as tax identification number or business registration details.

08

Review the form for accuracy and completeness.

09

Submit the completed form along with any necessary documents (e.g., proof of identity, business license).

10

Wait for confirmation of your application and any membership details.

Who needs Business Membership Account Card?

01

Business owners looking to access member benefits and services.

02

Companies wanting to join a professional network or community.

03

Organizations seeking discounts or specialized resources for businesses.

04

Entrepreneurs looking for support and resources specific to their industry.

Fill

form

: Try Risk Free

People Also Ask about

What is the credit limit for Navy Federal business card?

What are the minimum and maximum limits for a Navy Federal GO BIZ® Rewards card? The minimum credit limit is $5,000; the maximum is $25,000. Credit limits are determined during the underwriting (verification and approval) process.

What are the disadvantages of a business bank account?

A business bank account can have disadvantages such as higher costs, more administration, and potential tax complications. Limited flexibility, hidden fees, cybersecurity risks, and challenges in switching accounts can add to the burden. Choosing a neobank can help minimize these drawbacks.

Is a Navy Federal business credit card good?

Business Credit Card The Navy Federal GO BIZ Rewards credit card is a great financial tool for businesses. With a competitive 18 percent variable APR and no annual fee, it's cost-effective for growing companies. The card's reward structure is straightforward: earn one point for every dollar spent.

What is the best business bank account for small business?

Best Small Business Bank Accounts for July 2025 Best Overall, Best Online Business Checking: Amex Business Checking. Also Great Online Business Checking: Axos Bank Basic Business Checking. Best for Earning Interest: Grasshopper Innovator Checking. Best for Large/Frequent Cash Deposits: Chase Performance Business Checking.

What are the benefits of Navy Federal business card?

Both of Navy Federal's business card options offer cash-back rewards: one point per dollar spent on eligible purchases, with no cap on earnings. Fraud protection. Most cards offer zero-liability policies, which means cardholders aren't held liable for unauthorized purchases made in-store, over the telephone or online.

What qualifies as a business account?

A business checking account is a dedicated bank account for managing a business's day-to-day funds. It serves a different purpose than a business savings account, which might provide overdraft protection or act as a rainy-day fund.

What are the benefits of a Navy Federal card?

Navy Federal's Zero Liability Policy1 ensures you won't pay for confirmed unauthorized charges. 24/7 fraud monitoring alerts you to suspicious behavior. Contactless chip technology encrypts each transaction with a unique code to safeguard your card and personal information.

Are there benefits to a business credit card?

Perks. A business credit card may offer more perks than your personal cards, such as more points for cash-back or frequent-flyer programs, waived airline baggage fees, airline lounge memberships, and hotel and car rental discounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Membership Account Card?

The Business Membership Account Card is a document that provides identification and details of a business's membership status with an organization or association.

Who is required to file Business Membership Account Card?

Businesses that wish to be recognized as members of a particular organization or association are required to file a Business Membership Account Card.

How to fill out Business Membership Account Card?

To fill out a Business Membership Account Card, provide the necessary business information such as business name, address, contact details, and any relevant membership information as specified by the organization.

What is the purpose of Business Membership Account Card?

The purpose of the Business Membership Account Card is to officially document a business's membership, facilitate communication, and provide access to resources and benefits offered by the organization.

What information must be reported on Business Membership Account Card?

The information that must be reported on a Business Membership Account Card typically includes the business name, business address, contact information, type of business, and other details as required by the organization.

Fill out your business membership account card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Membership Account Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.