Get the free Small Business Loan Application

Show details

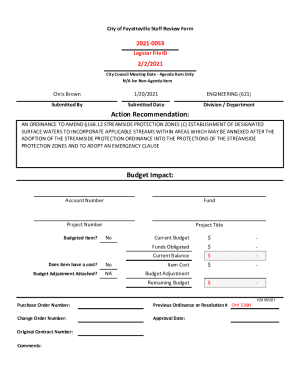

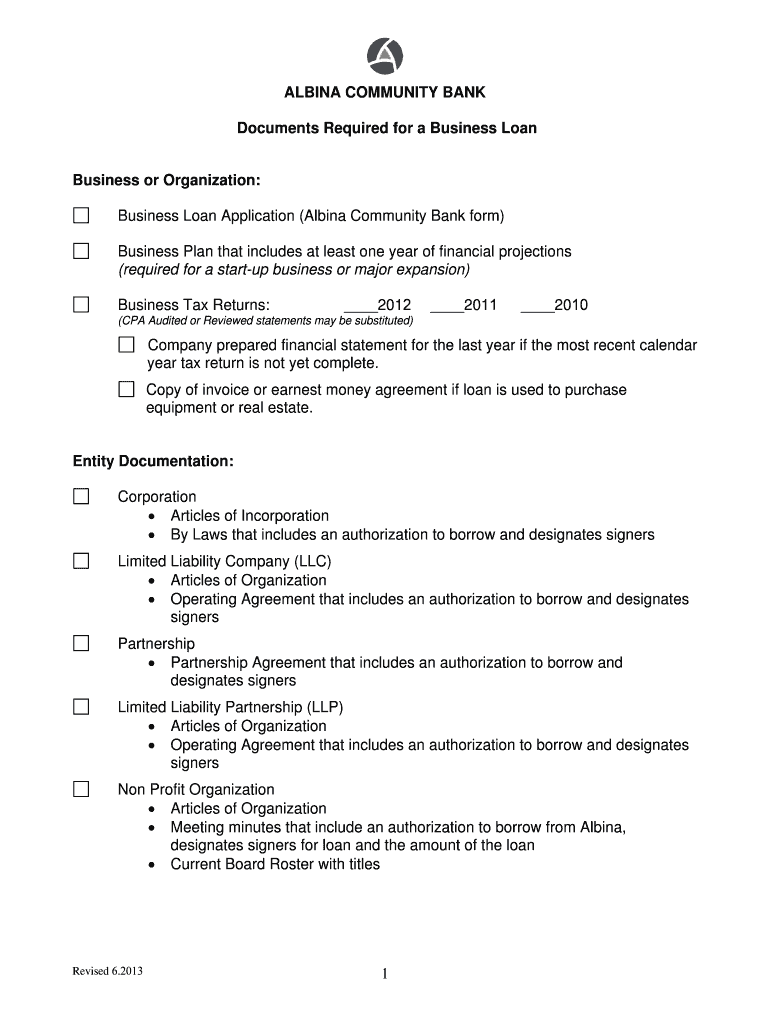

This document outlines the requirements and information necessary for applying for a small business loan from Albina Community Bank, including personal financial statements, documentation, and various

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business loan application

Edit your small business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business loan application online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small business loan application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business loan application

How to fill out Small Business Loan Application

01

Gather necessary financial documents, including tax returns, bank statements, and any relevant business financial statements.

02

Clearly define your business purpose for the loan, outlining how the funds will be used.

03

Fill out your personal information, including your name, address, and social security number.

04

Provide detailed business information, including the name of your business, its legal structure, and any relevant licenses.

05

Complete the financial section, including your income, expenses, and any existing debts.

06

Prepare a business plan that includes your business model, market analysis, and financial projections.

07

Review your application thoroughly to ensure all information is accurate and complete.

08

Submit your application along with any required documents to the lender for review.

Who needs Small Business Loan Application?

01

Entrepreneurs looking to start a new business.

02

Small business owners seeking to expand their operations or enhance cash flow.

03

Individuals looking to finance equipment purchases or inventory.

04

Business owners needing funds for marketing or advertising efforts.

05

Companies aiming to cover operational costs or manage unexpected expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the easiest small business loan to get?

What Disqualifies You From Getting an SBA Loan? The three primary disqualifiers for an SBA loan include a poor credit history, insufficient collateral or equity investment, and lack of a solid business plan. These factors can signal to lenders a high risk of default, making loan approval less likely.

Can a start-up LLC get a loan?

Yes, you can get a business loan with an LLC. Business lenders provide loans to LLCs, sole proprietors, and corporations. More information about business loans is available in my biography description.

How do I get approved for a small business loan?

Yes, you can get a business loan with an LLC. Business lenders provide loans to LLCs, sole proprietors, and corporations. More information about business loans is available in my biography description.

What disqualifies you from getting an SBA loan?

What Disqualifies You From Getting an SBA Loan? The three primary disqualifiers for an SBA loan include a poor credit history, insufficient collateral or equity investment, and lack of a solid business plan. These factors can signal to lenders a high risk of default, making loan approval less likely.

What is the minimum credit score to get a small business loan?

Most lenders will approve you with a personal credit score of 670 or higher. Others will accept fair credit scores in the low 600s, while others will go as low as 500 though options for the lowest scores are rare.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Small Business Loan Application?

A Small Business Loan Application is a document that business owners submit to financial institutions to request funding for their business needs, such as expansion, equipment purchase, or operational expenses.

Who is required to file Small Business Loan Application?

Any small business owner seeking financial assistance or capital to support their business operations or growth is required to file a Small Business Loan Application.

How to fill out Small Business Loan Application?

To fill out a Small Business Loan Application, gather necessary financial documents, complete the application form with accurate business and personal information, detail the purpose of the loan, and provide any required financial statements.

What is the purpose of Small Business Loan Application?

The purpose of a Small Business Loan Application is to outline the funding needs of a business, demonstrate the business's ability to repay the loan, and provide lenders with information to evaluate the creditworthiness of the applicant.

What information must be reported on Small Business Loan Application?

The information that must be reported includes personal identification details, business entity information, financial history, loan amount requested, purpose of the loan, business plan, and any collateral offered.

Fill out your small business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.