PA AmeriChoice Skip a Loan Payment Form 2014-2025 free printable template

Show details

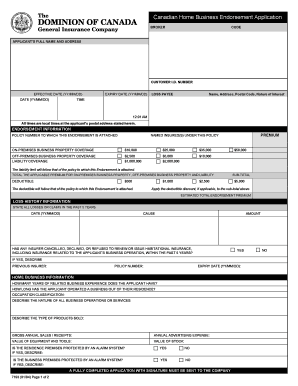

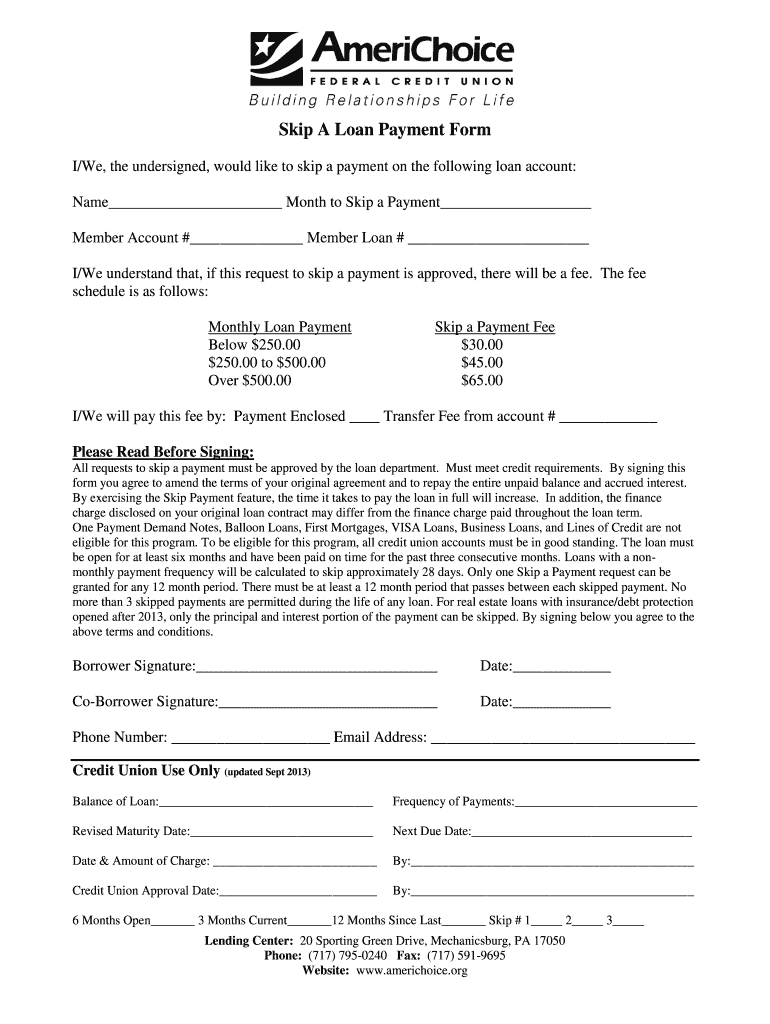

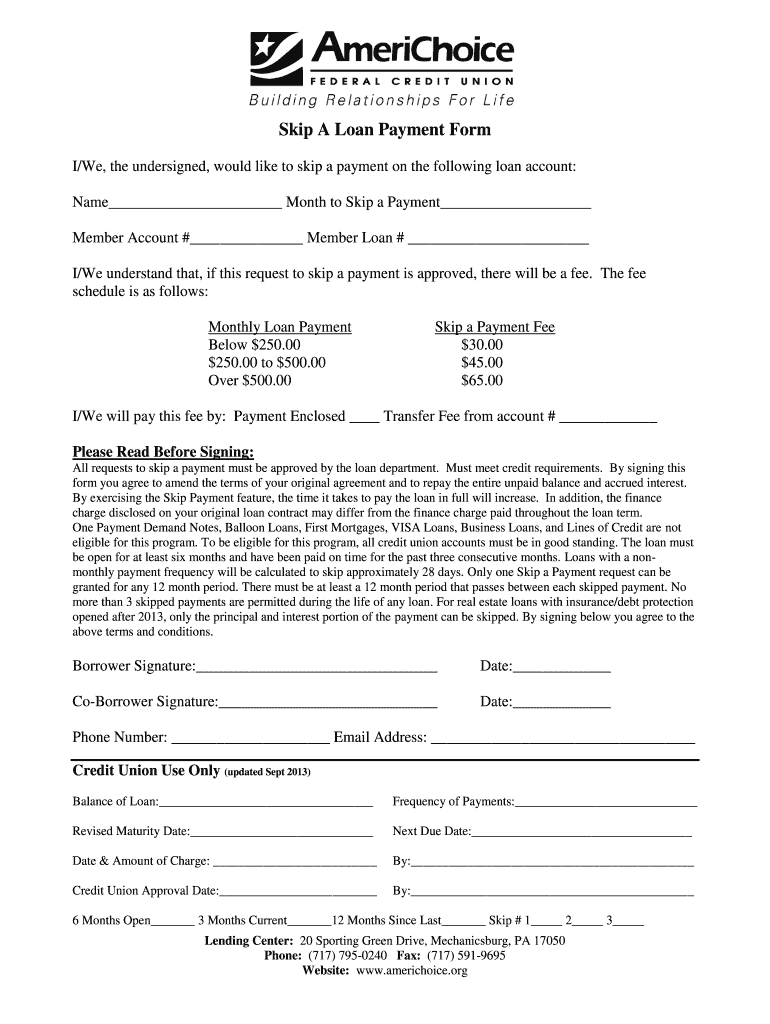

Skip A Loan Payment Form I/We, the undersigned, would like to skip a payment on the following loan account: Name Month to Skip a Payment Member Account # Member Loan # I/We understand that, if this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign skip a loan payment

Edit your skip a loan payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your skip a loan payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing skip a loan payment online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit skip a loan payment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out skip a loan payment

How to fill out PA AmeriChoice Skip a Loan Payment Form

01

Obtain the PA AmeriChoice Skip a Loan Payment Form from the official website or your lender.

02

Fill in your personal information, including your name, address, and loan account number.

03

Specify the payment period for which you are requesting to skip a payment.

04

Review any eligibility criteria and terms related to skipping a payment, including fees or conditions.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to your lender via the preferred method (e.g., email, postal mail, or online submission).

07

Keep a copy of the submitted form for your records.

Who needs PA AmeriChoice Skip a Loan Payment Form?

01

Individuals who have an existing loan with PA AmeriChoice and are facing temporary financial difficulties.

02

Borrowers who want to defer a payment to manage cash flow during challenging financial times.

03

Clients interested in utilizing the option to skip a loan payment for budgeting purposes.

Fill

form

: Try Risk Free

People Also Ask about

Can you skip a loan payment?

Whether you skip a full payment or make a reduced one, it is important to know that you are still liable for the outstanding balance to your lender. Your lender will add that amount to the end of your loan, during which time your account continues to accrue interest.

How do I skip a payment on Sandia Credit Union?

Just fill out the secure online form.Select Which Payment You Want to Skip If you normally make your payment(s) by check, you don't need to send one for the month you select. If your loan payment is made by payroll deduction, it will be deposited into your account where it will be available for withdrawal.

How do I skip a payment on United Federal Credit Union?

Fill out the form below and submit it electronically. We'll automatically transfer the $40 skip payment fee from the United Checking or Savings account you specify below. If you don't have a United Checking or Savings simply give us a call at (888) 982-1400 to help process your request.

How do I ask my loan to skip a payment?

Some lenders offer loan forbearance in times of crisis. A forbearance gives you a temporary pause on payments while you are experiencing hardship. You'll have to contact your lender directly to request a forbearance because in most cases, this is not something that a lender will automatically offer or grant.

How to skip a payment on america first credit union app?

Log in to online banking and click Skip a Payment. Visit a branch. Call 1-800-999-3961.

Can you skip a payment with Navy Federal?

If you're eligible, we can offer a forbearance that temporarily suspends your mortgage payment requirements. Please contact us at our toll-free number 1-800-258-5948, Monday-Friday, 8 am - 9 pm, ET or send us a secured message for additional information regarding the forbearance or to request the forbearance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit skip a loan payment from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like skip a loan payment, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit skip a loan payment online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your skip a loan payment to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit skip a loan payment straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing skip a loan payment, you need to install and log in to the app.

What is PA AmeriChoice Skip a Loan Payment Form?

The PA AmeriChoice Skip a Loan Payment Form is a document that allows borrowers to request the option to skip a scheduled loan payment under certain conditions.

Who is required to file PA AmeriChoice Skip a Loan Payment Form?

Borrowers who wish to take advantage of the skip payment option and meet the eligibility criteria set by their lender are required to file the form.

How to fill out PA AmeriChoice Skip a Loan Payment Form?

To fill out the form, borrowers need to provide their personal information, loan account details, and any supporting documentation as required by the lender.

What is the purpose of PA AmeriChoice Skip a Loan Payment Form?

The purpose of the form is to formally request a temporary deferment of a loan payment, providing financial relief to borrowers in need.

What information must be reported on PA AmeriChoice Skip a Loan Payment Form?

The form typically requires borrowers to report personal details such as name, address, loan account number, and the specific payment they wish to skip.

Fill out your skip a loan payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Skip A Loan Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.