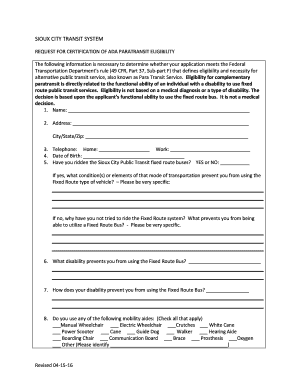

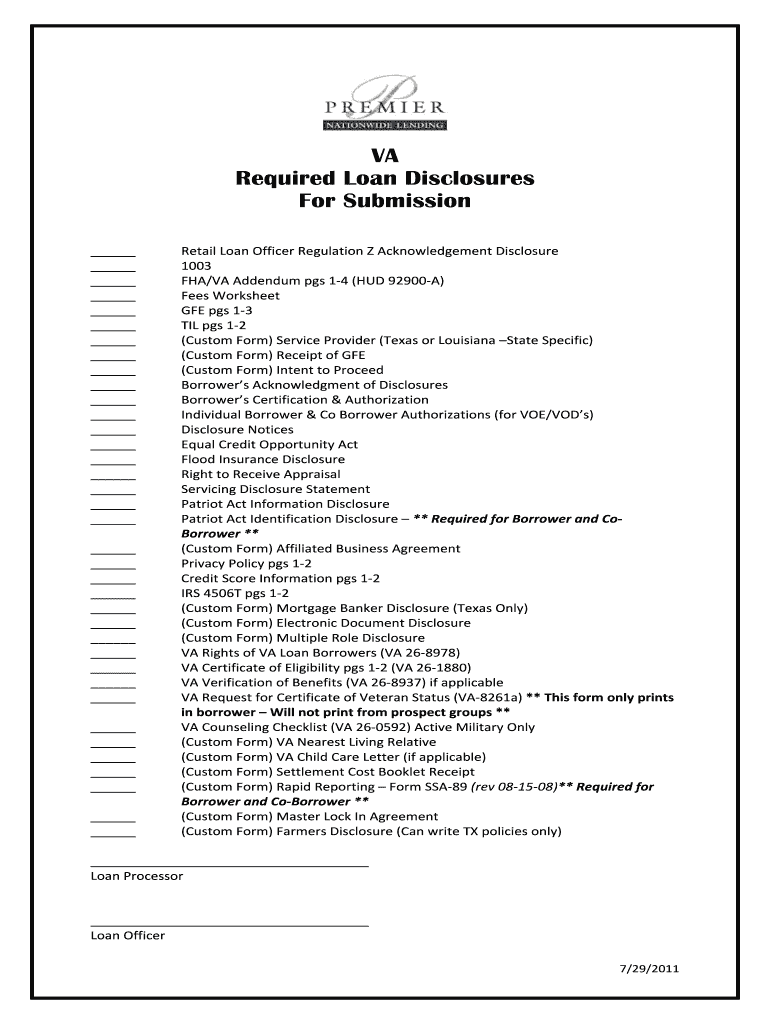

Get the free VA Required Loan Disclosures

Show details

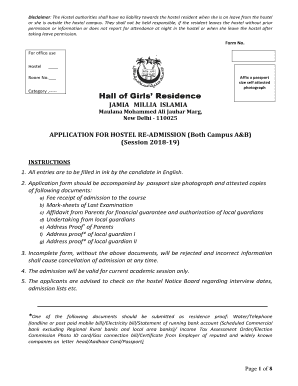

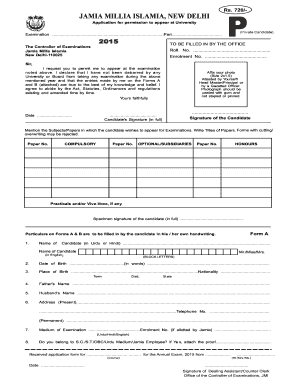

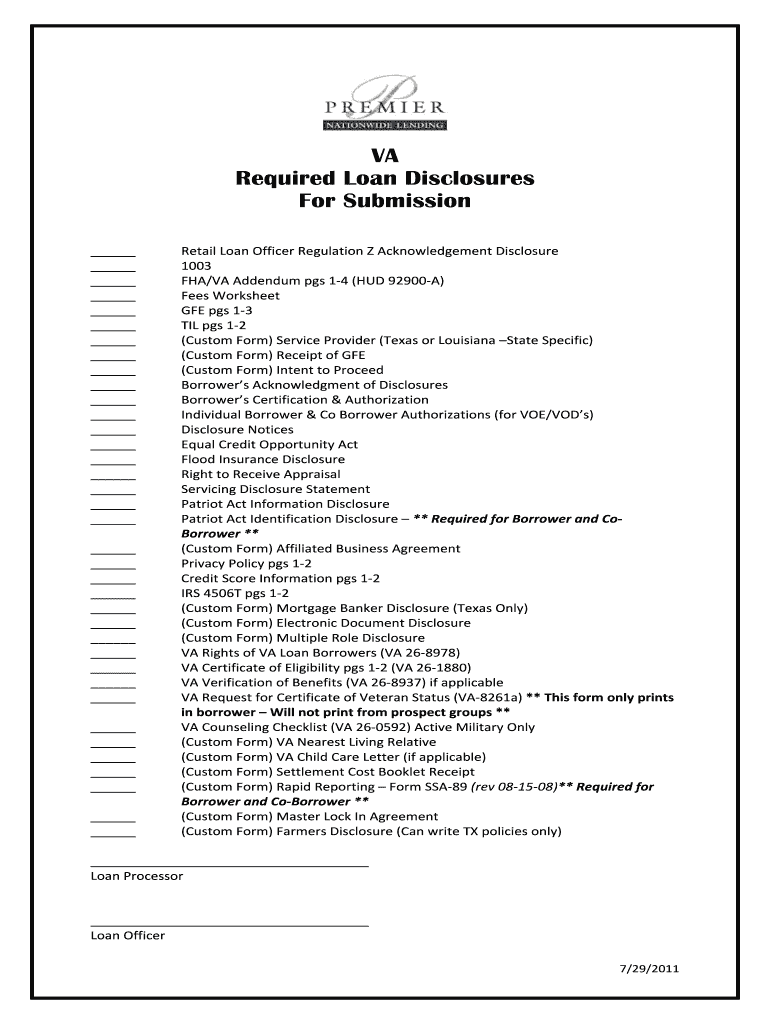

This document outlines the various loan disclosures required for VA loans, including specific forms that need to be submitted and acknowledged by borrowers and co-borrowers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign va required loan disclosures

Edit your va required loan disclosures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va required loan disclosures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing va required loan disclosures online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit va required loan disclosures. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out va required loan disclosures

How to fill out VA Required Loan Disclosures

01

Gather all necessary information about the loan and borrower.

02

Download the VA Required Loan Disclosures forms from the official website or obtain them from your lender.

03

Complete the Loan Estimate form, providing details about the loan amount, interest rate, monthly payment, and closing costs.

04

Fill out the Closing Disclosure form, which reflects the final terms, costs, and conditions of the loan.

05

Ensure all borrower information is accurate, including names, addresses, and Social Security numbers.

06

Review the forms for completeness and accuracy before submission.

07

Provide the completed disclosures to the borrower within the required timeframe.

Who needs VA Required Loan Disclosures?

01

Veterans applying for a VA loan.

02

Lenders processing VA loans.

03

Real estate agents involved in transactions involving VA loans.

04

Borrowers seeking to understand their loan terms and conditions.

Fill

form

: Try Risk Free

People Also Ask about

Can you do a manual underwrite on a VA loan?

While most VA loan applications are processed efficiently through Automated Underwriting Systems (AUS), certain financial circumstances may lead to a “manual underwrite.” This means a human underwriter meticulously reviews your financial profile, offering a more nuanced assessment than an algorithm.

How do you do a VA loan assumption?

Here's a breakdown of what you need to do to assume a VA home loan: Find a qualified buyer. Get in touch with the current homeowner and ask if they're interested in doing a loan assumption. Get a credit report from all three major credit reporting agencies (Equifax, Experian, and TransUnion).

What are the requirements for a VA leasehold?

Lease Duration: The lease must generally have a remaining term that is at least 14 years longer than the mortgage term. This requirement ensures that the leasehold interest remains valuable and secure throughout the loan. VA Approval: The lease terms must be reviewed and approved by the VA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VA Required Loan Disclosures?

VA Required Loan Disclosures are documents that provide essential information about the terms, costs, and conditions of a loan that is backed by the Department of Veterans Affairs. These disclosures are designed to help borrowers understand the financial implications of their mortgage.

Who is required to file VA Required Loan Disclosures?

Lenders offering VA loans are required to file VA Required Loan Disclosures. This includes banks, credit unions, and other financial institutions that provide mortgage loans guaranteed by the VA.

How to fill out VA Required Loan Disclosures?

To fill out VA Required Loan Disclosures, lenders must provide accurate information regarding the loan amount, interest rate, loan terms, and any associated fees. They must ensure that all required fields are completed thoroughly and in compliance with VA guidelines.

What is the purpose of VA Required Loan Disclosures?

The purpose of VA Required Loan Disclosures is to inform borrowers about their loan terms and costs, promote transparency in the lending process, and ensure that veterans understand their rights and obligations under the loan.

What information must be reported on VA Required Loan Disclosures?

VA Required Loan Disclosures must report information such as the loan amount, loan purpose, interest rate, monthly payment estimate, closing costs, and any other applicable fees or charges related to the loan.

Fill out your va required loan disclosures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Required Loan Disclosures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.