Get the free Closing Preparation

Show details

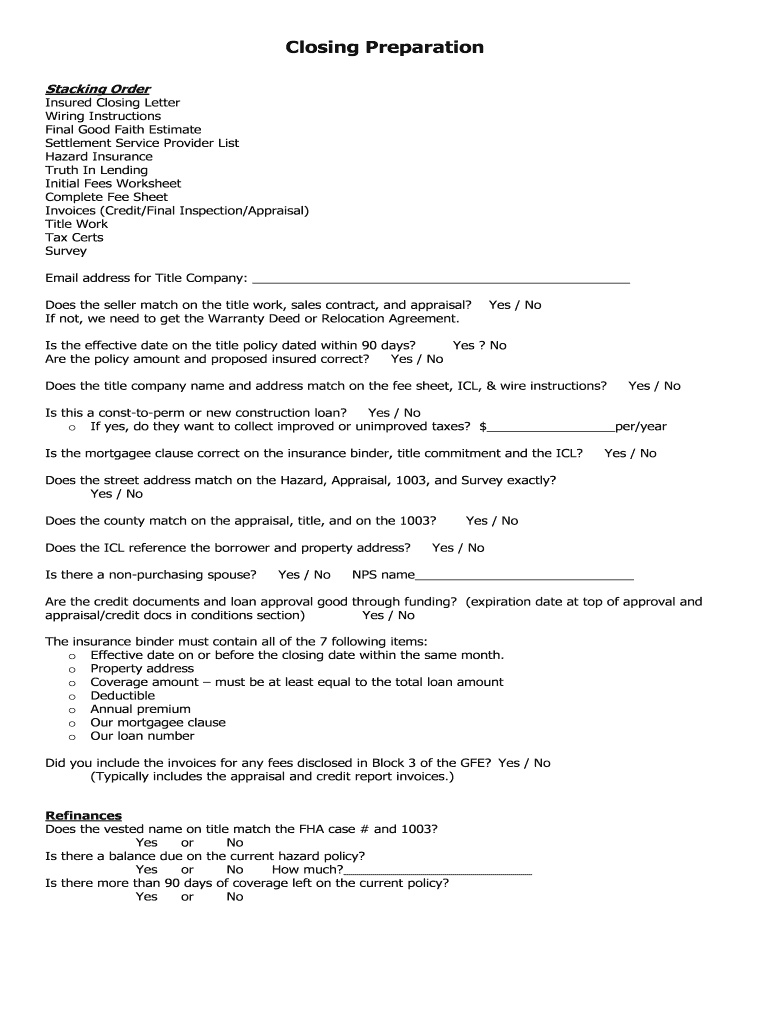

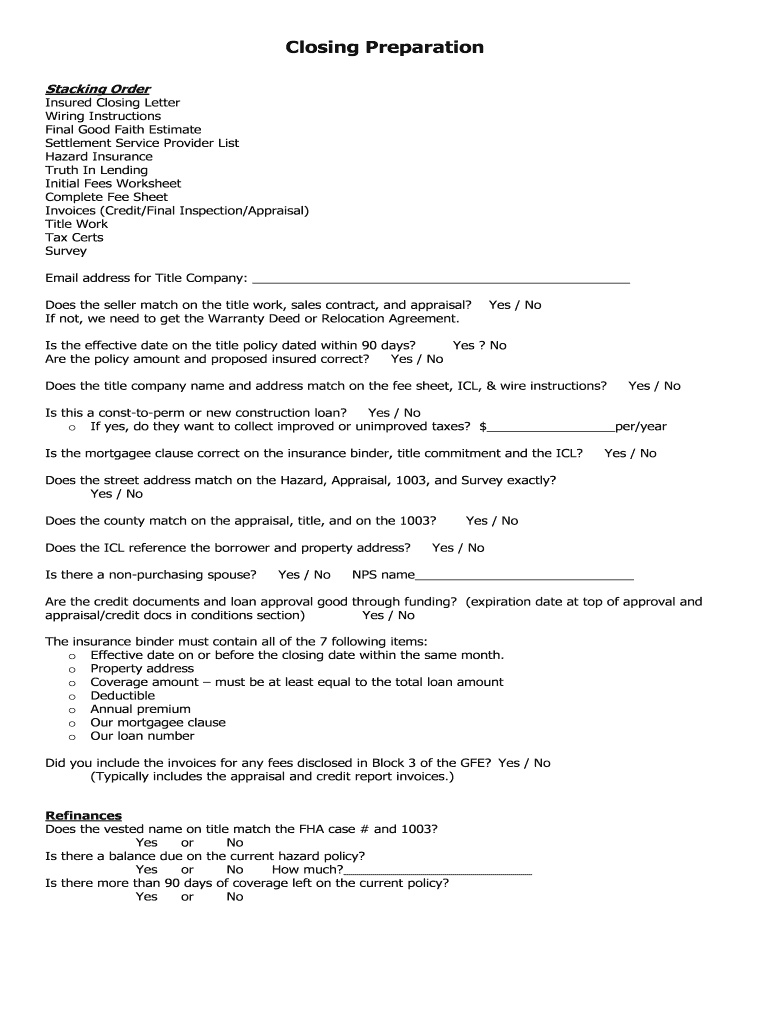

This document serves as a checklist for preparing for a closing, ensuring that all necessary documents and conditions are met before finalizing the transaction.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign closing preparation

Edit your closing preparation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your closing preparation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing closing preparation online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit closing preparation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out closing preparation

How to fill out Closing Preparation

01

Gather all necessary documents related to the closing process.

02

Review the closing disclosure form to understand all fees and terms.

03

Ensure that all required signatures are obtained on the relevant documents.

04

Coordinate with the lender to confirm the funding of the loan.

05

Schedule a final walkthrough of the property to check for any issues.

06

Prepare personal identification and any necessary funds for closing costs.

07

Confirm the closing date and time with all parties involved.

Who needs Closing Preparation?

01

Homebuyers who are purchasing a property.

02

Sellers who are finalizing the sale of their property.

03

Real estate agents assisting clients in the closing process.

04

Lenders providing financing for the property transaction.

05

Title companies handling the title transfer and closing.

Fill

form

: Try Risk Free

People Also Ask about

What does preparing for closing mean?

Preparation for Closing is essentially a catch-all period when everything still left to be done in order to make it to the closing table, is completed.

What is the closing procedure?

The closing procedure, in the context of accounting, refers to the process of finalizing financial records and statements for a specific accounting period, such as a month, quarter, or year.

What is a closing procedure?

Closing is the final phase of a transaction between two parties. A closing typically refers to the final phase of a homebuying process in which the buyer receives the deeds and the seller receives the payment. Both parties sign the final documents to officialize the transaction.

What is the closing process?

The “closing” is the last step in buying and financing a home. The "closing,” also called “settlement,” is when you and all the other parties in a mortgage loan transaction sign the necessary documents. After signing these documents, you become responsible for the mortgage loan.

What is the step 3 closing process?

Step 3) Documentation Preparation – deed, mortgage, and other loan documents are prepared. Payoffs of outstanding mortgages are obtained and a closing statement is completed. Step 4) Closing Day – the paperwork is properly signed and the new owner finally gets the keys.

What is the closing procedure of a project?

The purpose of the closing phase in the project management lifecycle is to confirm completion of project deliverables to the satisfaction of the project sponsor, and to communicate final project disposition and status to all participants and stakeholders.

What are the steps in the closing process?

Home closing process Loan approval. Once you have completed the underwriting requirements set by your lender, they notify you that your mortgage loan has been finalized. Home inspection. Appraisal. Purchase homeowners insurance. Title search. Review the Closing Disclosure. Resolve contingencies. Review the seller's disclosure.

What are the 4 steps of the closing process?

The 4 Steps in the Closing Process Close revenue accounts to income summary (income summary is a temporary account) Close expense accounts to income summary. Close income summary to retained earnings. Close dividends (or withdrawals) to retained earnings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Closing Preparation?

Closing Preparation is the process undertaken to ensure that all necessary steps and documentation are completed for the closing of a financial period, project, or transaction.

Who is required to file Closing Preparation?

Typically, accountants, financial analysts, and company management are required to file Closing Preparation as part of their responsibilities during the closing process.

How to fill out Closing Preparation?

To fill out Closing Preparation, gather all necessary financial documents, ensure all transactions are recorded, reconcile accounts, and complete the designated forms with accurate data reflecting the financial position.

What is the purpose of Closing Preparation?

The purpose of Closing Preparation is to ensure that all financial records are accurate and complete, facilitating a smooth transition to the next financial period or project phase.

What information must be reported on Closing Preparation?

The information that must be reported includes account balances, reconciled statements, transaction summaries, and any adjustments made during the closing process.

Fill out your closing preparation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Closing Preparation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.