Get the free ESCROW RECEIPT

Show details

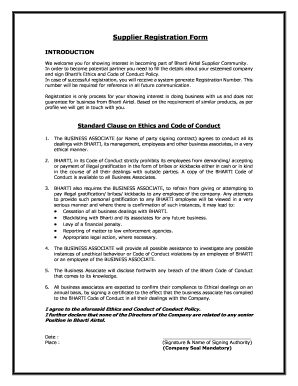

This document serves as a receipt for earnest money received in the escrow process for a property transaction. It outlines the conditions of the escrow and includes details about the parties involved

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign escrow receipt

Edit your escrow receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your escrow receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing escrow receipt online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit escrow receipt. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out escrow receipt

How to fill out ESCROW RECEIPT

01

Begin by obtaining the ESCROW RECEIPT form from your escrow company or applicable source.

02

Fill in the date at the top of the receipt.

03

Enter the names and contact information of the parties involved in the transaction (buyer and seller).

04

Detail the property address or description being involved in the escrow.

05

Specify the amount of money being held in escrow.

06

Provide information about the escrow agent or company handling the transaction.

07

Include the terms and conditions related to the escrow agreement.

08

Sign and date the receipt to validate the transaction.

09

Keep a copy for your records and provide one to the escrow agent.

Who needs ESCROW RECEIPT?

01

Individuals involved in real estate transactions (buyers and sellers).

02

Real estate agents and brokers.

03

Escrow companies and agents handling the transaction.

04

Legal professionals involved in property transfers.

Fill

form

: Try Risk Free

People Also Ask about

What is another name for escrow payment?

An escrow account, sometimes called an impound account depending on where you live, is set up by your mortgage lender to pay certain property-related expenses. The money that goes into the account comes from a portion of your monthly mortgage payment.

What does it mean if a payment is in escrow?

In essence, an escrow is a type of legal holding account for funds or assets, which won't be released until certain conditions are met. The escrow is held by a neutral third party, which releases it either when those predetermined contractual obligations are fulfilled or an appropriate instruction is received.

What is an escrow receipt?

An escrow receipt is a guarantee provided by a bank or clearing firm that certifies an option writer holds enough of the underlying security on deposit and it is readily available for delivery if the holder of that option chooses to exercise it.

What is an example of an escrow transaction?

Escrow Examples In a real estate transaction, the buyer and seller will sign a contract that outlines the terms of the sale. The buyer will then make a deposit into an escrow account. The escrow agent will hold onto the deposit until the seller transfers ownership of the property to the buyer.

What does escrow mean in simple terms?

An Escrow is an arrangement for a third party to hold the assets of a transaction temporarily. The assets are kept in a third-party account and are only released when all terms of the agreement have been met. The use of an escrow account in a transaction adds a degree of safety for both parties.

What is an escrow agreement in English?

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

What is escrow in English?

es·crow ˈe-ˌskrō e-ˈskrō 1. : a deed, a bond, money, or a piece of property held in trust by a third party to be turned over to the grantee only upon fulfillment of a condition. 2. : a fund or deposit designed to serve as an escrow.

What is the escrow receipt?

An escrow receipt is a bank or clearing statement that is part of an options contract. The escrow receipt guarantees that the option writer has enough of the underlying security to satisfy a potential assignment or to actually deliver the security if the option is exercised.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ESCROW RECEIPT?

An escrow receipt is a document that acknowledges the deposit of funds into an escrow account, typically used in real estate transactions to hold deposits until certain conditions are met.

Who is required to file ESCROW RECEIPT?

Generally, parties involved in a real estate transaction, such as buyers, sellers, and agents, may be required to file an escrow receipt to document the deposit of funds.

How to fill out ESCROW RECEIPT?

To fill out an escrow receipt, one should include details such as the names of the parties involved, the amount deposited, the purpose of the escrow, and any conditions under which the funds will be released.

What is the purpose of ESCROW RECEIPT?

The purpose of an escrow receipt is to provide a clear record of the funds held in escrow, ensuring that all parties agree on the terms of the transaction and the conditions for release of the funds.

What information must be reported on ESCROW RECEIPT?

An escrow receipt must report information such as the names of the parties, the total amount of the escrow deposit, the date of the transaction, the purpose of the escrow, and any relevant terms and conditions.

Fill out your escrow receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Escrow Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.