Get the free Certificate of Deposit Application

Show details

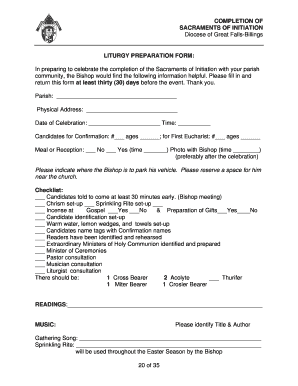

This document is an application form for opening a Certificate of Deposit at Tomah Area Credit Union, requiring personal and financial details from the member and joint member, alongside terms and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of deposit application

Edit your certificate of deposit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of deposit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of deposit application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of deposit application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of deposit application

How to fill out Certificate of Deposit Application

01

Obtain the Certificate of Deposit (CD) Application form from your financial institution, either online or in-person.

02

Fill out your personal information, including your full name, address, date of birth, and Social Security number.

03

Indicate the type of CD you wish to open, including the amount you want to deposit and the term length of the CD.

04

Provide any additional required information, such as employment details or income sources, as specified by the institution.

05

Review all the information for accuracy and completeness.

06

Sign and date the application form to certify that the information provided is true and correct.

07

Submit the completed application form along with your initial deposit, if required, either online or by visiting a branch.

Who needs Certificate of Deposit Application?

01

Individuals looking for a safe investment option with guaranteed returns.

02

People wanting to save for specific goals, such as a down payment on a house or a future education expense.

03

Those who are not in need of immediate access to their funds, as CDs typically have fixed terms.

04

Investors seeking a predictable income from interest without the risk associated with stocks or mutual funds.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a certificate of deposit?

Find a bank or credit union to work with and then submit an application. You must also choose how you want to receive the CD's interest. Finally, you will fund the CD. CD rates vary widely from one bank to another, so be sure to compare your options to get the best return on investment.

How much will $1000 make in a CD?

A $1,000 CD deposit makes $50 of interest in a year if the account pays 5% APY. The CD's total balance would be $1,050 at maturity.

What is the best bank to open a CD account?

The Best 6-Month CD Rates Right Now Northern Bank Direct – 4.60% APY. NASA Federal Credit Union – 4.59% APY. SouthEast Bank – 4.50% APY. Liberty Federal Credit Union – 4.50% APY. Communitywide Federal Credit Union – 4.50% APY. ableBanking – 4.50% APY. Paramount Bank – 4.50% APY. Presidential Bank – 4.50% APY*

What is an example of a certificate of deposit?

To see how this works in action, consider the following certificate of deposit example. Say you allocate $10,000 in a 12-month CD with a 4% APY — your earnings will accumulate as follows: Monthly interest rate: 0.333% (4% annual rate divided by 12 months) Total interest after one year: $407.44.

What if I put $20,000 in a CD for 5 years?

How much interest would you earn? If you put $20,000 into a 5-year CD with an interest rate of 4.60%, you'd end the 5-year CD term with $5,043.12 in interest, for a total balance of $25,043.12. Not all CDs offer that interest rate, though.

How can I get a certificate of deposit?

Find a bank or credit union to work with and then submit an application. You must also choose how you want to receive the CD's interest. Finally, you will fund the CD. CD rates vary widely from one bank to another, so be sure to compare your options to get the best return on investment.

How much will a $10,000 CD make in one year?

Earnings for a $10,000 CD deposit The national average for a one-year CD is 1.62% APY, while the average one-year CD based on the banks we track at CNET is 3.98% APY. If you deposit $10,000 into a one-year CD that pays the national average of 1.62% APY, the value at maturity would be $10,162.00.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Deposit Application?

A Certificate of Deposit Application is a formal document used to open a Certificate of Deposit (CD) account with a financial institution, allowing individuals to invest funds for a fixed term in exchange for interest.

Who is required to file Certificate of Deposit Application?

Individuals or entities looking to invest in a Certificate of Deposit must file a Certificate of Deposit Application with a bank or financial institution.

How to fill out Certificate of Deposit Application?

To fill out a Certificate of Deposit Application, provide personal identification information, select the desired deposit amount, choose the term length, and specify account preferences such as interest payout options.

What is the purpose of Certificate of Deposit Application?

The purpose of the Certificate of Deposit Application is to establish an official request to open a CD account, ensuring that the financial institution has all necessary information to process the investment.

What information must be reported on Certificate of Deposit Application?

The information that must be reported includes the account holder's name, address, social security number or tax identification number, amount to be deposited, chosen term, and any preferred interest payment options.

Fill out your certificate of deposit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Deposit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.