Get the free SOLAR ENERGY OUTPUT CREDIT PURCHASE AGREEMENT TRICO - trico

Show details

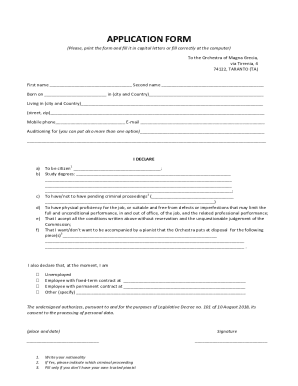

SOLAR ENERGY OUTPUT CREDIT PURCHASE AGREEMENT TRIO SUNHATS SUN FARM Contract Number This Solar Energy Output Credit Purchase Agreement (Agreement) is made and entered into this day of, 20 by and between

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign solar energy output credit

Edit your solar energy output credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your solar energy output credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit solar energy output credit online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit solar energy output credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out solar energy output credit

How to fill out solar energy output credit:

01

Gather necessary information: Before starting the process of filling out the solar energy output credit, you will need to collect all relevant documents and information. This may include receipts or invoices for solar energy system installation, details about the size and capacity of your system, and any other supporting documents that may be required.

02

Determine eligibility: It is important to ensure that you meet the eligibility criteria for claiming the solar energy output credit. Typically, this credit is available to homeowners, businesses, and organizations that have installed a solar energy system. Make sure you understand the specific requirements, such as the minimum capacity of the system, and whether there are any restrictions based on location or other factors.

03

Complete the necessary forms: The process of filling out the solar energy output credit typically involves completing certain IRS forms. The most commonly used form is Form 5695, which is used to claim residential energy credits. You will need to provide information about your solar energy system, including the capacity and the date it was placed into service.

04

Calculate the credit amount: Once you have completed the required forms, you will need to calculate the amount of credit you are eligible to claim. This calculation is based on the costs associated with installing the solar energy system and the capacity of the system. The instructions provided with the IRS form should guide you through this calculation process.

05

Submit the forms: After completing the necessary forms and calculating the credit amount, you will need to submit them to the IRS. Make sure to keep copies of all documents for your records. It is advised to review the filing instructions and any additional requirements to ensure you are submitting the forms correctly.

Who needs solar energy output credit?

01

Homeowners: Individuals who own residential properties and have installed a solar energy system may be eligible for the solar energy output credit. This credit can help homeowners recoup a portion of the expenses associated with installing solar panels, making it a beneficial incentive for those looking to invest in renewable energy.

02

Businesses: Commercial entities that have invested in solar energy systems can also claim the solar energy output credit. This can be particularly advantageous for companies looking to reduce their carbon footprint and save on energy costs in the long run. The credit can help offset the upfront expenses of installing solar panels and encourage sustainable practices.

03

Non-profit organizations: Non-profit organizations can also benefit from the solar energy output credit. By installing solar panels on their facilities, these organizations can reduce their reliance on traditional energy sources, lower their energy bills, and potentially qualify for the credit. This allows them to allocate more resources towards their mission and support sustainable initiatives.

Overall, the solar energy output credit is available to a wide range of individuals, businesses, and organizations who have made investments in solar energy systems. It serves as a financial incentive to promote the adoption of renewable energy and reduce the reliance on fossil fuels.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find solar energy output credit?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the solar energy output credit in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the solar energy output credit in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your solar energy output credit in seconds.

How do I complete solar energy output credit on an Android device?

On Android, use the pdfFiller mobile app to finish your solar energy output credit. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is solar energy output credit?

Solar energy output credit is a credit that allows individuals or businesses to receive a financial benefit for generating electricity from solar energy systems.

Who is required to file solar energy output credit?

Individuals or businesses who have solar energy systems and generate electricity from them are required to file for solar energy output credit.

How to fill out solar energy output credit?

To fill out solar energy output credit, individuals or businesses must provide information about the solar energy system, the amount of electricity generated, and any other relevant details according to the form provided by the tax authorities.

What is the purpose of solar energy output credit?

The purpose of solar energy output credit is to incentivize the use of solar energy and promote renewable energy sources by providing financial benefits to those who generate electricity from solar energy systems.

What information must be reported on solar energy output credit?

Information such as the name and location of the solar energy system, the amount of electricity generated, any relevant costs associated with the system, and other necessary information must be reported on the solar energy output credit form.

Fill out your solar energy output credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Solar Energy Output Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.