Get the free HSA HEALTH SAVINGS ACCOUNT CHANGE OF BENEFICIARY

Show details

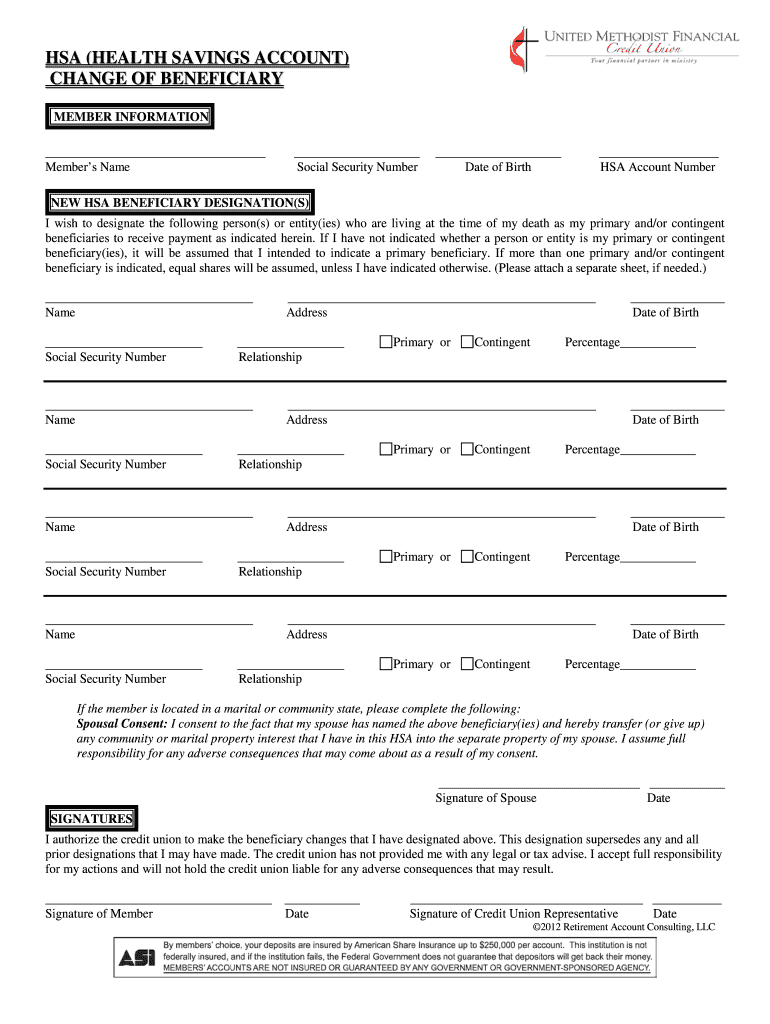

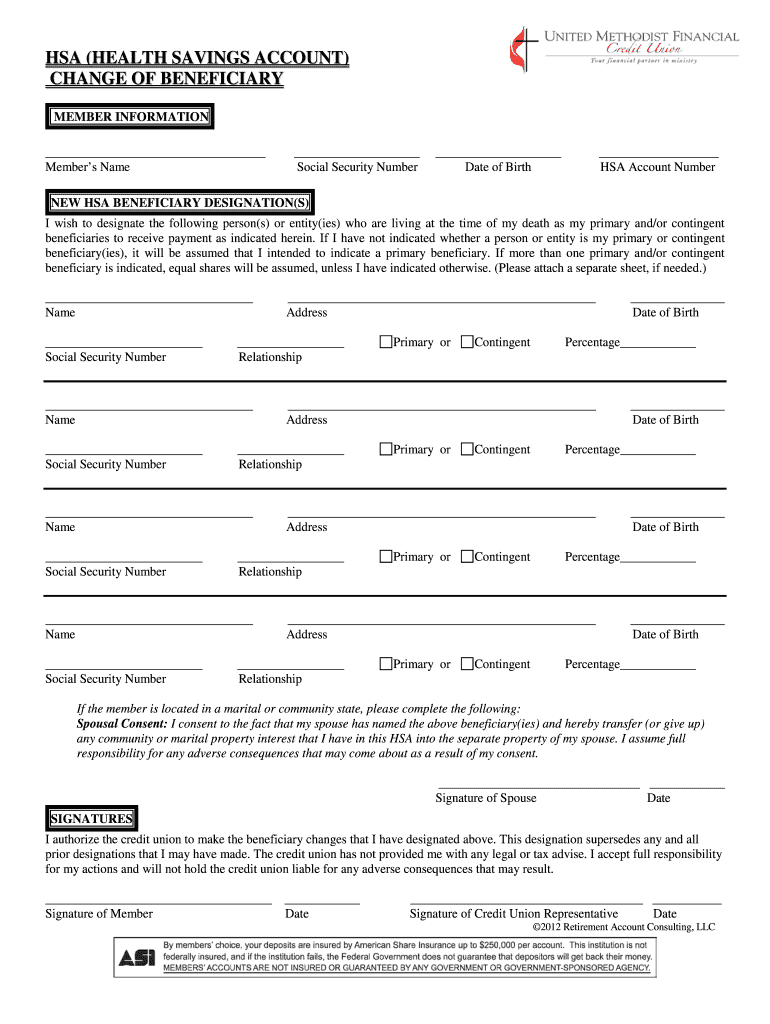

HSA (HEALTH SAVINGS ACCOUNT) CHANGE OF BENEFICIARY MEMBER INFORMATION Members Name Social Security Number Date of Birth HSA Account Number NEW HSA BENEFICIARY DESIGNATION(S) I wish to designate the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa health savings account

Edit your hsa health savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa health savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hsa health savings account online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hsa health savings account. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa health savings account

How to fill out an HSA Health Savings Account?

01

First, determine if you are eligible to open an HSA. Individuals must be covered by a qualifying High Deductible Health Plan (HDHP) to be eligible for an HSA.

02

Research and compare HSA providers to find the best fit for your financial needs. Consider factors such as fees, investment options, and accessibility.

03

Once you have selected a provider, gather the necessary documents to open the account. This may include your Social Security number, proof of eligibility under an HDHP, and any required identification.

04

Complete the necessary forms provided by the HSA provider. This may involve providing personal information, designating a beneficiary, and selecting investment options if applicable.

05

Fund your HSA by making an initial contribution. Decide on the amount you want to contribute, keeping in mind the annual contribution limit set by the IRS.

06

Familiarize yourself with the rules and regulations surrounding HSA contributions, withdrawals, and qualified medical expenses. This will ensure you make informed decisions and maximize the benefits of your HSA.

07

Start using your HSA for eligible medical expenses. Keep track of your expenses and maintain receipts as proof for tax purposes.

08

Monitor your HSA balance and ensure you stay within the contribution limits. It's important to manage your account responsibly to maintain its tax advantages.

09

File your taxes correctly, taking advantage of any tax benefits associated with your HSA. Be aware of reporting requirements and consult with a tax professional if needed.

10

Stay informed and educated about any changes to HSA regulations or policies. This will help you make the most of your HSA and adapt your approach if necessary.

Who needs an HSA Health Savings Account?

01

Individuals with high deductible health plans (HDHP) can benefit from having an HSA. These plans typically have lower monthly premiums but higher deductibles, making an HSA a valuable tool to save for medical expenses.

02

Individuals who anticipate having significant healthcare expenses in the future can benefit from an HSA. By contributing to an HSA, they can save pre-tax dollars and use them for qualified medical expenses, including deductibles, copayments, and prescription medications.

03

Employees who have access to an HSA through their employer can take advantage of employer contributions. Many employers offer matching contributions, effectively doubling your savings.

04

Self-employed individuals can use an HSA to save for medical expenses and enjoy tax advantages. It provides them with a tax-advantaged way to save for healthcare costs while also reducing their taxable income.

05

Those who want to save for healthcare expenses in retirement can use an HSA to accumulate funds over time. Unlike flexible spending accounts (FSAs), HSA funds roll over year after year, allowing individuals to build a significant nest egg for future medical needs.

06

Individuals looking for a tax-efficient way to save for healthcare expenses can benefit from an HSA. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free, providing a valuable tax advantage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in hsa health savings account without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing hsa health savings account and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the hsa health savings account in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your hsa health savings account.

How do I fill out the hsa health savings account form on my smartphone?

Use the pdfFiller mobile app to fill out and sign hsa health savings account on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your hsa health savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Health Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.