Get the free Current International Tax Issues in Cross-Border Corporate

Show details

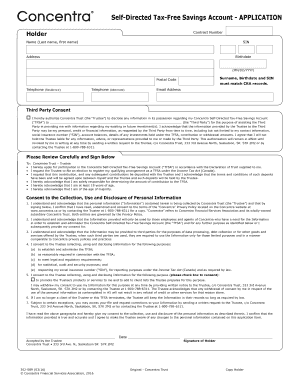

A conference presented by the IBA Taxation Section and supported by the IBA European Regional Forum 5th Annual IBA Tax Conference Current International Tax Issues in Crossover Corporate Finance and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign current international tax issues

Edit your current international tax issues form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your current international tax issues form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing current international tax issues online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit current international tax issues. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out current international tax issues

How to fill out current international tax issues?

01

Conduct thorough research: Start by researching the current international tax laws and regulations to understand the compliance requirements and any recent changes. Stay updated on tax treaties, agreements, and regulations that may impact your tax obligations.

02

Seek professional advice: International tax issues can be complex and vary depending on your specific circumstances. It is advisable to seek expert advice from a tax professional or an international tax consultant who can provide guidance and help navigate through the complexities.

03

Understand your tax obligations: Determine the tax obligations in each country involved in your international transactions. Familiarize yourself with the rules for income tax, value-added tax (VAT), transfer pricing, withholding taxes, and any other relevant tax categories. Ensure compliance with reporting requirements and deadlines.

04

Determine your residency status: Your tax obligations may differ based on your residency status. Understand the concept of tax residency and determine if you are considered a resident or non-resident in the relevant jurisdictions. This will help determine the extent of your tax liabilities and potential benefits.

05

Apply relevant tax treaties: Many countries have tax treaties in place to avoid double taxation and prevent tax evasion. Determine if there are any tax treaties between your country and the countries involved in your international transactions. Utilize these treaties to minimize your tax liabilities and take advantage of any exemptions or benefits they provide.

06

Consider transfer pricing implications: If you have related-party transactions, ensure that you comply with transfer pricing regulations. Transfer pricing determines the pricing of goods, services, or intellectual property transferred between affiliated entities. It is crucial to ensure that the prices are set at an arm's length basis to prevent tax authorities from making adjustments and imposing penalties.

Who needs current international tax issues?

01

Multinational businesses: Businesses operating across borders need to stay updated on current international tax issues to ensure compliance with tax laws and regulations. They need to navigate the complexities of cross-border transactions and determine the most tax-efficient strategies while minimizing any potential tax risks.

02

Individuals with international assets/assets abroad: Individuals who have investments, properties, or other assets abroad may need to understand the international tax implications. This includes understanding the reporting requirements, potential tax liabilities, and any tax planning opportunities or benefits available.

03

Tax professionals and consultants: Tax professionals and consultants need to stay updated on current international tax issues to provide accurate advice and guidance to their clients. They need to understand the latest developments, changes in tax laws, and interpret any new treaties or agreements that may impact international tax planning and compliance.

04

Governments and tax authorities: Governments and tax authorities play a crucial role in enforcing international tax laws and regulations. They need to stay informed about current international tax issues to ensure effective tax administration, prevent tax evasion, and promote fair taxation across borders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is current international tax issues?

Current international tax issues include issues such as transfer pricing, tax treaties, tax avoidance, and global tax compliance.

Who is required to file current international tax issues?

Multinational corporations, individuals with foreign income, and companies engaged in cross-border transactions are required to file current international tax issues.

How to fill out current international tax issues?

Current international tax issues can be filled out by consulting with tax professionals, utilizing specialized software, and ensuring compliance with relevant tax laws.

What is the purpose of current international tax issues?

The purpose of current international tax issues is to ensure that taxpayers comply with international tax laws, report income accurately, and prevent tax evasion.

What information must be reported on current international tax issues?

Information such as foreign income, foreign assets, foreign investments, and details of cross-border transactions must be reported on current international tax issues.

How do I edit current international tax issues in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing current international tax issues and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the current international tax issues in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your current international tax issues in seconds.

How do I fill out current international tax issues using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign current international tax issues and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your current international tax issues online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Current International Tax Issues is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.