Get the Survivor-bias-free us mutual fund guide - CRSP

Show details

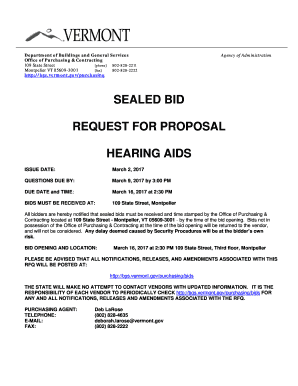

SURVIVORBIASFREE US MUTUAL FUND GUIDE For CRSPSift Updated October 13, 2015 105 West Adams, Suite 1700 Chicago, IL 60603 Tel: 312.263.6400 Fax: 312.263.6430 Email: Support crop. Chicago Booth.edu

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign survivor-bias- us mutual fund

Edit your survivor-bias- us mutual fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your survivor-bias- us mutual fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit survivor-bias- us mutual fund online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit survivor-bias- us mutual fund. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out survivor-bias- us mutual fund

How to Fill Out Survivor-Bias US Mutual Fund:

01

Open an account: Start by contacting a financial institution that offers survivor-bias US mutual funds. They will guide you through the process of opening an account, which usually involves providing personal information and completing relevant paperwork.

02

Research available options: Once your account is set up, research the various survivor-bias US mutual funds available to you. Consider factors such as their performance history, fees, investment strategy, and the fund manager's expertise. This information can often be found on the fund's website or through investment research platforms.

03

Determine investment amount: Decide how much you want to invest in the survivor-bias US mutual fund. This can be based on your financial goals, risk tolerance, and available funds. It's important to align your investment amount with your overall financial plan.

04

Fill out necessary forms: To invest in the survivor-bias US mutual fund, you will typically need to complete subscription forms provided by the financial institution or fund company. These forms will ask for information such as your personal details, investment amount, and any specific instructions you may have.

05

Provide supporting documents: Along with the subscription forms, you may be required to submit additional supporting documents such as identification proof, address proof, and any other documents specified by the financial institution. Ensure you have these documents ready to expedite the process.

06

Review and confirm: Before submitting the forms, carefully review all the information provided to ensure accuracy. Double-check that your investment amount and other details are correct. If everything looks good, sign and date the forms to confirm your investment in the survivor-bias US mutual fund.

Who needs Survivor-Bias US Mutual Fund?

01

Investors focused on long-term wealth preservation: Survivor-bias US mutual funds are designed to capture the performance of surviving mutual funds, meaning they exclude funds that have closed or merged due to poor performance. This can appeal to investors who prioritize wealth preservation over aggressive growth.

02

Risk-averse investors: Survivor-bias US mutual funds tend to have a more conservative investment strategy. They may allocate a larger portion of their portfolio to low-risk assets such as bonds or stable companies. Investors who are risk-averse and seek steady returns may find these funds suitable for their investment goals.

03

Investors seeking diversification: By investing in a survivor-bias US mutual fund, investors can gain exposure to a diversified portfolio of mutual funds. This diversification can help reduce the impact of a single poorly performing fund on their overall investment returns.

04

Individuals with limited investment knowledge: Survivor-bias US mutual funds offer a ready-made investment solution managed by professionals. This can be beneficial for individuals who may not have the expertise or time to actively manage their investments but still want to participate in the market.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is survivor-bias- us mutual fund?

A survivor-bias- us mutual fund is a type of investment fund that can provide returns even if some of the investments within the fund fail.

Who is required to file survivor-bias- us mutual fund?

Any individual or entity that has investments in a survivor-bias- us mutual fund is required to file.

How to fill out survivor-bias- us mutual fund?

To fill out a survivor-bias- us mutual fund, one must gather all necessary investment information and complete the required forms accurately.

What is the purpose of survivor-bias- us mutual fund?

The purpose of a survivor-bias- us mutual fund is to provide diversification and potentially positive returns, even in the event of some investments failing.

What information must be reported on survivor-bias- us mutual fund?

Information such as investment holdings, returns, risk profile, and fees must be reported on a survivor-bias- us mutual fund.

How can I modify survivor-bias- us mutual fund without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including survivor-bias- us mutual fund, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit survivor-bias- us mutual fund online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your survivor-bias- us mutual fund to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the survivor-bias- us mutual fund in Gmail?

Create your eSignature using pdfFiller and then eSign your survivor-bias- us mutual fund immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your survivor-bias- us mutual fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Survivor-Bias- Us Mutual Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.