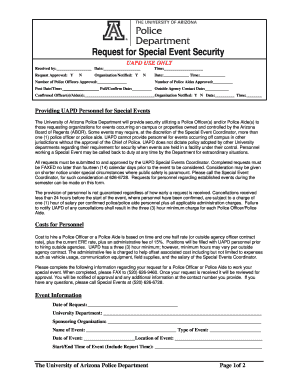

Get the free SA Open Preservation Pension Fund OPTION FORM FOR INVESTMENTS

Show details

SA Open Preservation Pension Fund

OPTION FORM FOR INVESTMENTS

Name (initials and surname): ..............................................................................................................................

Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sa open preservation pension

Edit your sa open preservation pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sa open preservation pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

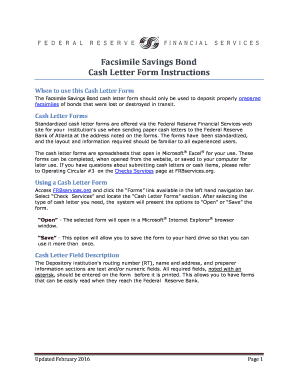

How to edit sa open preservation pension online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sa open preservation pension. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sa open preservation pension

How to fill out sa open preservation pension:

01

Gather necessary documents: Before filling out the sa open preservation pension form, make sure you have all the required documents at hand. These may include your identification proof, proof of address, and any other relevant documentation.

02

Understand the form: Carefully read through the sa open preservation pension form to understand the information required. Pay attention to any specific instructions or guidelines mentioned on the form.

03

Fill in personal details: Start by providing your personal information such as your full name, contact details, and date of birth. Ensure that you enter accurate and up-to-date information.

04

Employment information: Provide details about your current or past employment, including the name of your employer, duration of employment, and your position.

05

Contribution details: Mention the amount you intend to contribute towards the preservation pension. If you have any queries about this, it is advisable to seek guidance from a financial advisor or contact the relevant institution.

06

Beneficiary nomination: If applicable, fill out the beneficiary nomination section. This allows you to designate a person or persons who will receive the pension benefits in the event of your death.

07

Seek professional advice: If you are unsure about any aspect of filling out the sa open preservation pension form, it is strongly recommended to seek professional advice from a financial advisor or contact the relevant institution directly.

Who needs sa open preservation pension:

01

Individuals changing jobs: Those who are switching employers or leaving their current job and planning to start a new one can consider opening an sa open preservation pension. This allows them to preserve their pension savings and continue growing them without incurring any immediate tax penalties.

02

Individuals taking a career break: People who are taking a break from their careers, such as going on parental leave, sabbatical, or pursuing further studies, may opt for the sa open preservation pension to safeguard their retirement savings.

03

Individuals facing redundancy or unemployment: If you have recently been made redundant or anticipate unemployment, the sa open preservation pension can be a beneficial option to keep your pension savings intact until you secure a new job.

04

Individuals planning for early retirement: If you are considering early retirement and want to retain your pension funds, the sa open preservation pension can help ensure the growth of your savings until you reach the desired retirement age.

05

Individuals who prefer flexibility: The sa open preservation pension offers more flexibility compared to other pension options. It allows individuals to continue contributing to their pension fund at their own pace and access the funds when needed, within the framework of preservation pension regulations.

Remember, it is always advisable to consult with a financial advisor or retirement planner to determine if the sa open preservation pension is suitable for your specific circumstances and to receive personalized advice tailored to your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sa open preservation pension?

SA Open Preservation Pension is a retirement savings account that allows individuals to contribute money towards their retirement.

Who is required to file sa open preservation pension?

Individuals who are employed and want to save for retirement are required to file SA Open Preservation Pension.

How to fill out sa open preservation pension?

SA Open Preservation Pension can be filled out by contacting a financial institution or pension provider and opening an account.

What is the purpose of sa open preservation pension?

The purpose of SA Open Preservation Pension is to help individuals save money for their retirement and provide them with financial security.

What information must be reported on sa open preservation pension?

Information such as personal details, employment status, contribution amounts, and investment choices must be reported on SA Open Preservation Pension.

How can I send sa open preservation pension to be eSigned by others?

Once your sa open preservation pension is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in sa open preservation pension without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your sa open preservation pension, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit sa open preservation pension on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit sa open preservation pension.

Fill out your sa open preservation pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sa Open Preservation Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.