Get the free tesfcu

Show details

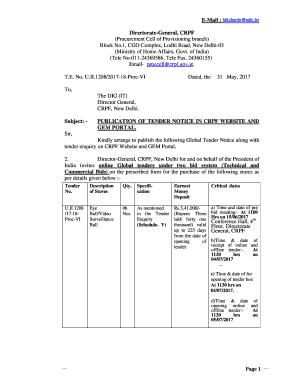

IMPORTANT INFORMATION FOR MEMBERS ABOUT YOUR

T.E.S. CREDIT UNION ACCOUNT

WHAT YOU NEED TO KNOW ABOUT OVERDRAFTS AND OVERDRAFT FEES

An overdraft occurs when you do not have enough money in your account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tesfcu

Edit your tesfcu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tesfcu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tesfcu online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tesfcu. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tesfcu

How to fill out tesfcu:

01

Begin by gathering all necessary documents and information. This may include your identification documents, social security number, employment information, and financial statements.

02

Visit the official tesfcu website or location to obtain the application form. This can usually be found online or at a physical branch.

03

Carefully read and understand the instructions provided on the application form. Make sure you have a clear understanding of the information being asked for.

04

Start filling out the application form by providing accurate and complete personal information. This may include your name, address, phone number, and email address.

05

Provide any additional information as required, such as your employment details, income information, and any joint account holders if applicable.

06

Double-check all the information you have provided on the form to ensure accuracy and completeness.

07

Sign and date the application form where required to certify that all the information provided is true and complete to the best of your knowledge.

08

Submit the completed application form either online or in person at the tesfcu location. If submitting online, it may be necessary to scan and upload any required supporting documents.

09

After submitting the application, wait for a response. This may take a few days to process, and tesfcu will typically contact you with further instructions or to notify you of the status of your application.

Who needs tesfcu:

01

Individuals who are seeking a reliable and secure banking institution.

02

People who are looking for personalized financial services and support.

03

Individuals who want to access a range of banking products and services, such as savings accounts, checking accounts, loans, and credit cards.

04

Those who value convenient banking options, such as online and mobile banking, as well as access to a widespread network of ATMs and branches.

05

Individuals who prioritize competitive interest rates, low fees, and beneficial terms and conditions for their financial needs.

06

People who may be interested in building or rebuilding their credit history, as tesfcu may offer credit-building programs and accessible credit options.

07

Individuals who are looking for a community-focused banking institution that supports and invests in local initiatives and organizations.

08

Those who appreciate excellent customer service and prompt assistance from knowledgeable banking professionals.

09

People who want to join a credit union and become part of a member-owned financial institution where profits are reinvested back into the members.

10

Individuals who are seeking financial education, resources, and tools to better manage their money and achieve their financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tesfcu without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including tesfcu, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit tesfcu on an iOS device?

Create, edit, and share tesfcu from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete tesfcu on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tesfcu. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is tesfcu?

TESFCU stands for Tax Exempt and Government Entities File Conversion Utility.

Who is required to file tesfcu?

Organizations that are tax exempt or government entities are required to file TESFCU.

How to fill out tesfcu?

TESFCU can be filled out electronically using the IRS's online system or manually using paper forms.

What is the purpose of tesfcu?

The purpose of TESFCU is to provide tax exempt and government entities with a tool to convert file formats for easier reporting.

What information must be reported on tesfcu?

Information such as financial data, organizational details, and tax-exempt status must be reported on TESFCU.

Fill out your tesfcu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tesfcu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.