Get the free Term Loans Commercial Finance Tampa Fl lending loan Business Small Business Commerci...

Show details

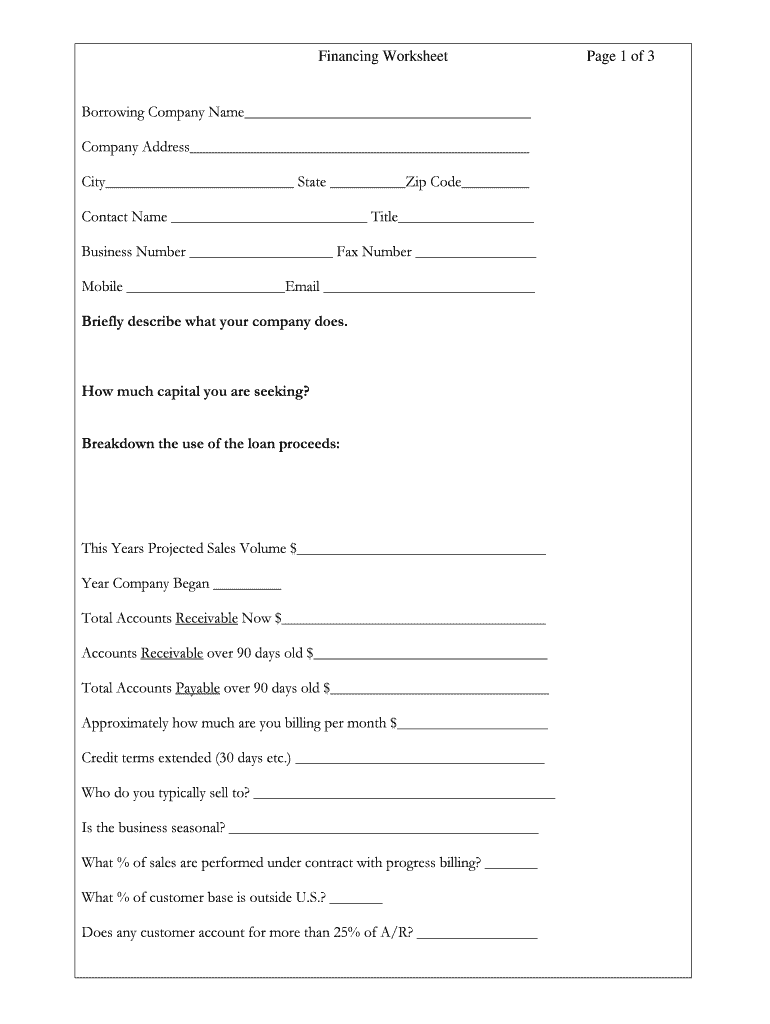

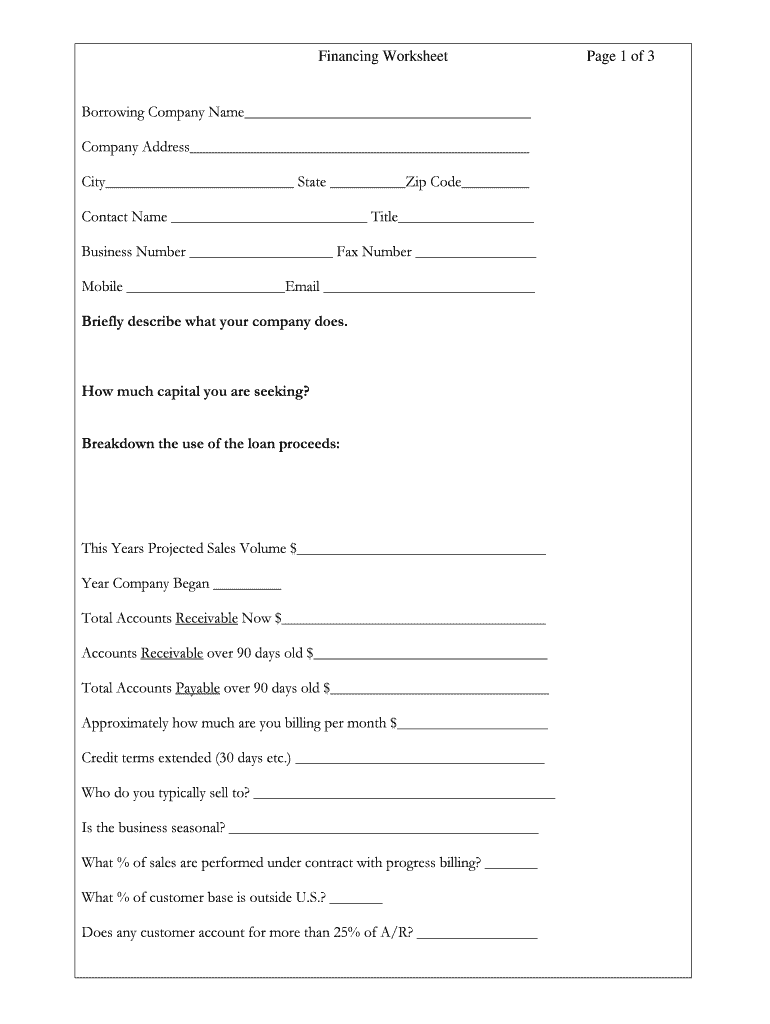

Financing Worksheet Borrowing Company Name Company Address City State Zip Code Contact Name Title Business Number Fax Number Mobile Email Briefly describe what your company does. How much capital

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term loans commercial finance

Edit your term loans commercial finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term loans commercial finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term loans commercial finance online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit term loans commercial finance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term loans commercial finance

Point by point, here are the steps to fill out term loans commercial finance:

01

Gather all necessary financial documents: Start by collecting all relevant financial documents such as balance sheets, income statements, cash flow projections, and tax returns. These documents will provide the lender with a clear picture of your business's financial health.

02

Understand the loan requirements: Familiarize yourself with the specific requirements set by the lender for their term loans commercial finance. This may include factors such as credit score, revenue history, collateral, and the purpose of the loan.

03

Prepare a detailed business plan: Create a comprehensive business plan that outlines your business goals, strategies, and financial projections. This will help demonstrate to the lender that you have a clear vision for your business and a plan for repaying the loan.

04

Calculate the loan amount and terms: Determine the exact amount of funds you need and the repayment terms that align with your business's cash flow. Consider factors such as interest rates, repayment period, and any additional fees associated with the loan.

05

Research potential lenders: Explore various lending institutions and compare their terms, rates, and reputation. Look for lenders that specialize in commercial finance and have experience working with businesses in your industry.

06

Complete the loan application: Fill out the loan application form accurately and provide all necessary information. Be prepared to answer questions about your business, personal finances, and the purpose of the loan.

07

Provide supporting documentation: Submit all required supporting documents along with the loan application. This may include financial statements, bank statements, business licenses, contracts, and personal identification.

08

Review and submit the application: Review the loan application and all accompanying documents to ensure accuracy. Double-check for any missing information or errors before submitting it to the lender.

09

Follow up and communicate: After submitting the loan application, stay in touch with the lender to ensure the process is moving forward. Respond promptly to any requests for additional information or documentation.

10

Evaluate loan offers: Once you receive loan offers from different lenders, carefully review the terms, interest rates, fees, and repayment options. Choose the offer that best suits your business's needs and aligns with your financial goals.

Who needs term loans commercial finance?

Term loans commercial finance can be beneficial for a wide range of businesses. Here are some examples of who may need term loans commercial finance:

01

Startups: New businesses often require capital for initial setup costs, inventory purchases, or equipment investments. Term loans commercial finance can provide the necessary funds to help launch and grow the business.

02

Small and medium-sized enterprises (SMEs): Established businesses may need term loans to finance expansion plans, purchase new equipment, or manage seasonal fluctuations in cash flow.

03

Businesses experiencing temporary financial difficulties: If a business is facing temporary financial challenges, such as low cash flow or unexpected expenses, term loans commercial finance can provide the necessary working capital to overcome these hurdles.

04

Companies looking to seize growth opportunities: Businesses that identify growth opportunities, such as acquiring a competitor or expanding their product offerings, may require additional funds to capitalize on these opportunities. Term loans commercial finance can support such endeavors.

05

Businesses aiming to consolidate debt: Some businesses may have multiple existing debts with different interest rates and repayment terms. Consolidating these debts into a single term loan can simplify repayment and potentially reduce costs.

Overall, term loans commercial finance can help businesses of various sizes and industries achieve their financial goals and navigate different stages of their growth journey.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my term loans commercial finance in Gmail?

term loans commercial finance and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get term loans commercial finance?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific term loans commercial finance and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in term loans commercial finance?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your term loans commercial finance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is term loans commercial finance?

Term loans commercial finance is a type of lending where a fixed amount is borrowed and repaid over a set period of time with a pre-determined schedule of payments, typically used by businesses for long-term investments.

Who is required to file term loans commercial finance?

Businesses and organizations that have taken out term loans for commercial purposes are required to file term loans commercial finance.

How to fill out term loans commercial finance?

To fill out term loans commercial finance, you will need to provide information about the loan amount, interest rate, repayment schedule, and any other relevant details.

What is the purpose of term loans commercial finance?

The purpose of term loans commercial finance is to provide businesses with the funding they need for long-term investments, such as equipment purchases or expansion projects.

What information must be reported on term loans commercial finance?

Information such as the loan amount, interest rate, repayment schedule, and any collateral used to secure the loan must be reported on term loans commercial finance.

Fill out your term loans commercial finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Loans Commercial Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.