Get the free NEW ISSUE Investment Rating Standard Poors A

Show details

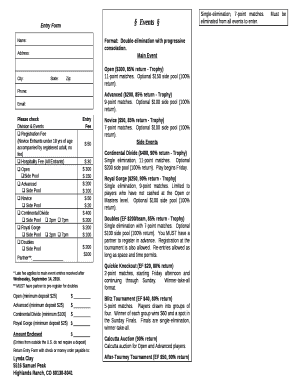

NEW ISSUE

Investment Rating:

Standard & Poor ... A+

ADDENDUM DATED AUGUST 26, 2009,

OFFICIAL STATEMENT DATED AUGUST 14, $20093,500,000

CITY OF MOUNT VERNON

Line County, Iowa

General Obligation Taxable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new issue investment rating

Edit your new issue investment rating form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new issue investment rating form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new issue investment rating online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new issue investment rating. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new issue investment rating

How to fill out a new issue investment rating:

01

Start by gathering all the necessary information about the new issue, including the company's financial statements, business model, competitive landscape, and any relevant industry trends.

02

Evaluate the company's financial health by analyzing its balance sheet, income statement, and cash flow statement. Consider factors such as revenue growth, profitability, debt levels, and liquidity.

03

Assess the company's management team and their track record. Look into their experience, expertise, and past performance to gauge their ability to execute the business plan and deliver results.

04

Analyze the market potential and competitive landscape of the new issue. Consider factors such as market size, growth prospects, competition, and barriers to entry.

05

Evaluate the risks associated with the new issue, including industry-specific risks, company-specific risks, and external factors such as economic or regulatory changes.

06

Consider the valuation of the new issue by comparing it to similar companies in the industry and analyzing key valuation metrics, such as price-to-earnings ratio, price-to-sales ratio, or discounted cash flow analysis.

07

Formulate an investment rating based on your analysis and assessment of the new issue. This rating could be in the form of a buy, hold, or sell recommendation, or a rating scale such as AAA, AA, A, etc.

Who needs new issue investment rating?

01

Individual investors: Individual investors who are interested in investing in new issues can benefit from an investment rating to make informed investment decisions and manage their portfolios effectively.

02

Institutional investors: Institutional investors, such as mutual funds, pension funds, or hedge funds, rely on investment ratings to evaluate new issues for potential inclusion in their portfolios and to assess the risk and return profiles of these investments.

03

Financial advisors: Financial advisors use investment ratings to provide guidance and recommendations to their clients, helping them navigate the complex world of new issue investments and make sound investment choices.

04

Issuing companies: The companies issuing the new issues also benefit from investment ratings as they provide an objective assessment of their investment attractiveness. These ratings can attract potential investors and help the company raise capital more effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new issue investment rating directly from Gmail?

new issue investment rating and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit new issue investment rating from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including new issue investment rating. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit new issue investment rating on an iOS device?

Create, modify, and share new issue investment rating using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is new issue investment rating?

New issue investment rating is a credit rating assigned to a financial security being offered for the first time in the market.

Who is required to file new issue investment rating?

The issuer or underwriter of the financial security is required to file the new issue investment rating.

How to fill out new issue investment rating?

The new issue investment rating is typically filled out by a credit rating agency based on the issuer's financial information and creditworthiness.

What is the purpose of new issue investment rating?

The purpose of new issue investment rating is to provide investors with an assessment of the credit risk associated with a new financial security.

What information must be reported on new issue investment rating?

The new issue investment rating typically includes information on the issuer's financial health, credit history, and the terms of the financial security being offered.

Fill out your new issue investment rating online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Issue Investment Rating is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.