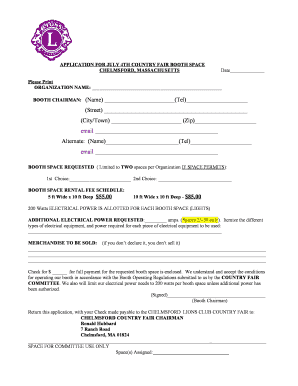

Get the free NEW ISSUE Investment Ratings: Moodys Investors Service Aaa Standard &

Show details

NEW ISSUE Investment Ratings: Moody's Investors Service AAA Standard & Poor Corporation AAA *****REVISED**** ADDENDUM DATED MAY 10, 2011, OFFICIAL STATEMENT DATED APRIL 22, $201120,000,000 THE COUNTY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new issue investment ratings

Edit your new issue investment ratings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new issue investment ratings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new issue investment ratings online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new issue investment ratings. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new issue investment ratings

How to fill out new issue investment ratings:

01

Begin by gathering all relevant information about the new issue investment. This can include details about the company issuing the investment, the type of investment being offered, and any specific terms or conditions.

02

Assess the risk associated with the new issue investment. Evaluate factors such as the company's financial stability, industry trends, and market conditions. This will help determine the investment's potential for returns or losses.

03

Analyze the investment's potential growth prospects. Consider factors such as future market demand, consumer trends, and the company's competitive advantage. This analysis will help gauge the investment's long-term viability.

04

Evaluate the new issue investment's compliance with regulatory requirements. Ensure that the investment meets all necessary legal and regulatory standards, such as proper disclosures and transparency.

05

Consider the investment's fit within your existing investment portfolio. Assess how the new issue investment aligns with your investment goals, risk tolerance, and diversification strategy.

06

Fill out the new issue investment ratings form or template. Provide detailed information and analysis for each section, including risk assessment, growth prospects, regulatory compliance, and portfolio fit.

07

Review the completed new issue investment ratings. Double-check for accuracy and clarity, ensuring that all necessary information has been included and properly documented.

08

Share the ratings with relevant stakeholders, such as investment committees, financial advisors, or internal teams. Seek feedback and input to improve the ratings process and decision-making.

09

Update the ratings periodically as new information becomes available or as investment conditions change. Regularly reviewing and updating the ratings will help maintain accurate and up-to-date information.

10

Store the completed new issue investment ratings in a secure and accessible location for future reference and audit purposes.

Who needs new issue investment ratings?

01

Institutional investors: Institutional investors such as pension funds, insurance companies, and mutual funds often rely on new issue investment ratings to assess potential investment opportunities. These ratings help them make informed decisions based on risk, growth prospects, and compliance.

02

Individual investors: Individual investors who actively manage their own investment portfolios may also seek new issue investment ratings to guide their investment decisions. These ratings provide valuable insights into the investment's risk and potential returns, helping individuals make informed choices.

03

Financial advisors: Financial advisors play a crucial role in guiding their clients' investment decisions. They often utilize new issue investment ratings to educate and advise their clients on suitable investment options based on their financial goals and risk tolerance.

04

Investment committees: Investment committees within organizations, such as corporate entities or non-profit institutions, rely on new issue investment ratings to assess proposed investment opportunities. These ratings help committees assess the feasibility, risk, and potential benefits of the new issue investment.

05

Regulatory bodies: Regulatory bodies and government agencies tasked with overseeing financial markets and investments may utilize new issue investment ratings to monitor compliance and ensure investor protection. These ratings help identify potential risks and ensure that investments meet necessary regulatory standards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new issue investment ratings for eSignature?

new issue investment ratings is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit new issue investment ratings on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing new issue investment ratings.

Can I edit new issue investment ratings on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as new issue investment ratings. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is new issue investment ratings?

New issue investment ratings refer to the evaluation of the creditworthiness and risk associated with newly issued securities or investments.

Who is required to file new issue investment ratings?

Financial institutions, credit rating agencies, and investment firms are typically required to file new issue investment ratings.

How to fill out new issue investment ratings?

New issue investment ratings are usually filled out by analyzing factors such as the issuer's financial health, market conditions, and the specific terms of the investment.

What is the purpose of new issue investment ratings?

The purpose of new issue investment ratings is to provide investors with an independent assessment of the risk and potential return of a new investment.

What information must be reported on new issue investment ratings?

New issue investment ratings must include information on the issuer's creditworthiness, the terms of the investment, and any relevant market conditions.

Fill out your new issue investment ratings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Issue Investment Ratings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.