Canada Form 1696 2008-2025 free printable template

Show details

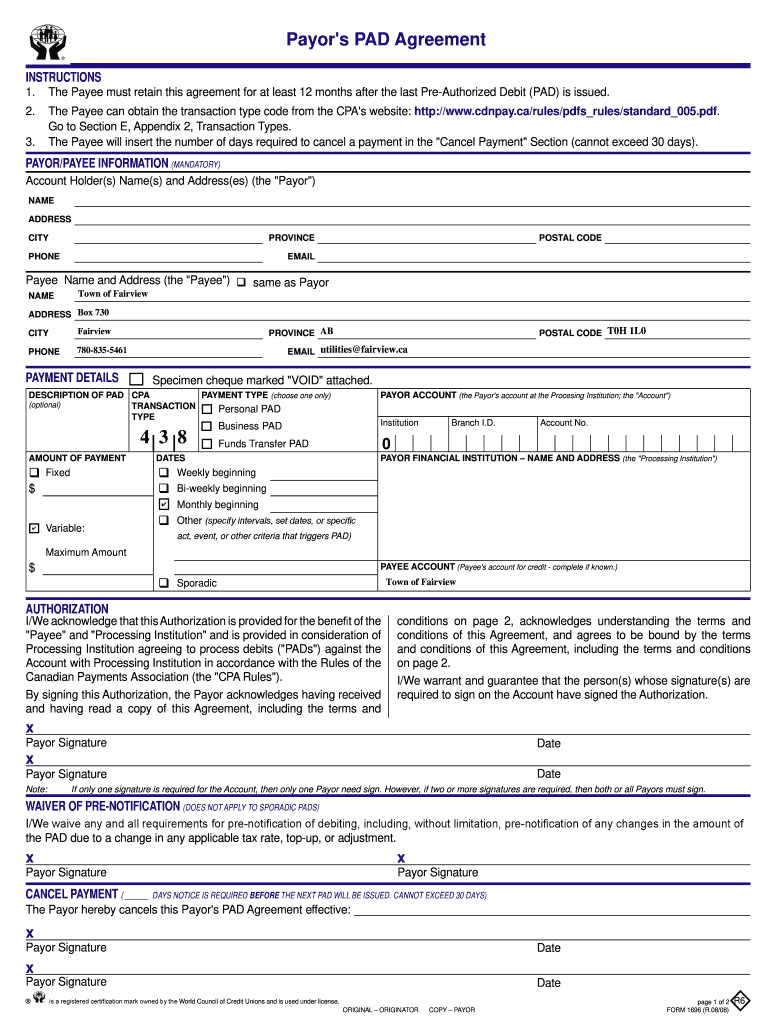

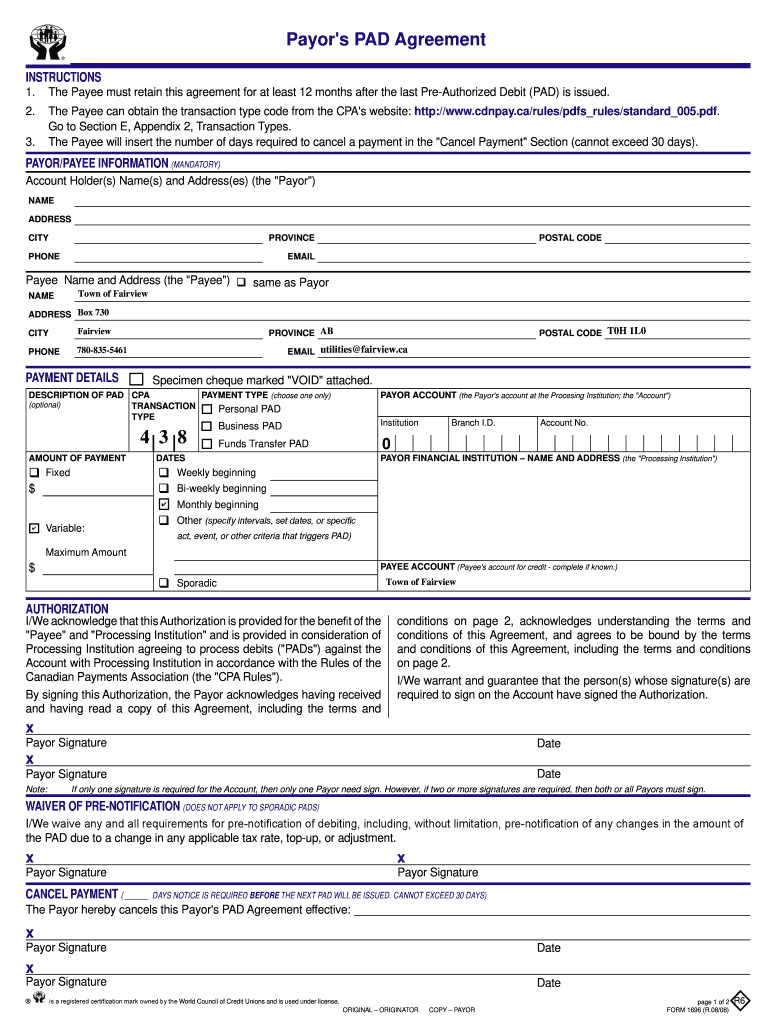

Mayor's PAD Agreement INSTRUCTIONS 1. The Payee must retain this agreement for at least 12 months after the last PreAuthorized Debit (PAD) is issued. 2. The Payee can obtain the transaction type code

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Form 1696

Edit your Canada Form 1696 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Form 1696 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada Form 1696 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada Form 1696. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Canada Form 1696

How to fill out Canada Form 1696

01

Obtain Canada Form 1696 from the official Canada Revenue Agency website or your local office.

02

Read the instructions provided with the form carefully to ensure you understand the requirements.

03

Fill in your personal information, including your name, address, and contact details in the designated sections.

04

Provide any requested information about your business or the nature of the claim.

05

Complete all relevant fields, making sure to double-check for accuracy.

06

Review the form for any errors or omissions before submitting.

07

Sign and date the form where indicated.

08

Submit the completed form according to the instructions, either by mail or electronically, if applicable.

Who needs Canada Form 1696?

01

Individuals or businesses who need to claim a specific tax benefit or refund related to income tax in Canada.

02

Canada Form 1696 may also be required for businesses that need to report changes in their tax status or to update their information with the Canada Revenue Agency.

Fill

form

: Try Risk Free

People Also Ask about

What is a payor's pad agreement?

A pre-authorized debit allows the biller to withdraw money from your bank account when a payment is due. Pre-authorized debits may be useful when you want to make payments from your account on a regular basis.

How do I get a pre authorization form from TD?

Pre-Authorized Deposit (PAD) Form / Monthly Contribution Plan (MCP) Form Click on the link above to open the form. Complete form details and print. You cannot save data typed into this form. Mail to the address indicated on the upper right section of the page.

How do I get a pre-authorized debit form from TD?

Pre-Authorized Deposit (PAD) Form / Monthly Contribution Plan (MCP) Form Click on the link above to open the form. Complete form details and print. You cannot save data typed into this form. Mail to the address indicated on the upper right section of the page.

What does business pad mean?

Business PADs arrange payments for goods or services related to your business, for example, payments between franchisees and franchisors, distributors and suppliers, or dealers and manufacturers.

Can I get a pre-authorized debit form online TD Bank?

Download an online form and mail in with a void cheque. Create an online account. Download an online form and mail in with a void cheque or bring the form and a void cheque to a BMO branch. Set up over the phone or in branch.

How do I get a pad form?

Call or visit the website of the company you wish to set up a Pre-Authorized Debit (PAD) with to obtain a PAD Agreement and use your account information when completing the Agreement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada Form 1696 for eSignature?

Canada Form 1696 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in Canada Form 1696 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing Canada Form 1696 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit Canada Form 1696 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing Canada Form 1696.

What is Canada Form 1696?

Canada Form 1696 is a tax document used to report and claim specific deductions or credits related to expenses incurred in carrying out a business or professional activity.

Who is required to file Canada Form 1696?

Individuals and businesses engaged in a profession that incurs eligible expenses must file Canada Form 1696 to claim deductions associated with those expenses.

How to fill out Canada Form 1696?

To fill out Canada Form 1696, complete the sections with accurate personal and business information, itemize the expenses being claimed, and ensure all documents and receipts are attached as proof.

What is the purpose of Canada Form 1696?

The purpose of Canada Form 1696 is to allow taxpayers to report specific business expenses to the Canada Revenue Agency (CRA) in order to reduce their taxable income and thereby lower their overall tax liability.

What information must be reported on Canada Form 1696?

Canada Form 1696 requires taxpayers to report information including their identification details, nature of the business, income earned, and a detailed list of eligible expenses being claimed for deduction.

Fill out your Canada Form 1696 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Form 1696 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.