Get the free INDEPENDENT CONTRACT vs EMPLOYEE CHECKLIST - moreheadcitync

Show details

Named Insured: INDEPENDENT CONTRACT vs EMPLOYEE CHECKLIST: Whenever any public entity retains an independent contractor who does not carry workers compensation insurance and the owner or an employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contract vs employee

Edit your independent contract vs employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contract vs employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contract vs employee online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit independent contract vs employee. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contract vs employee

How to Fill out Independent Contract vs Employee:

01

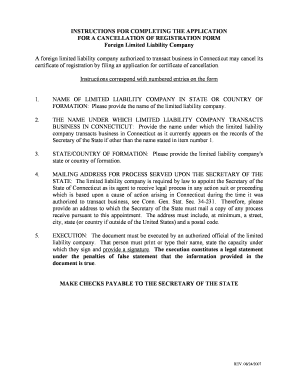

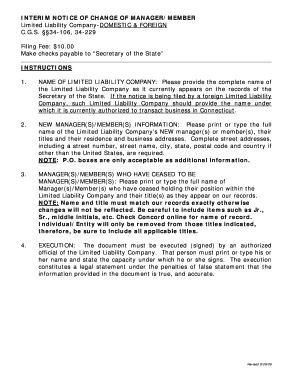

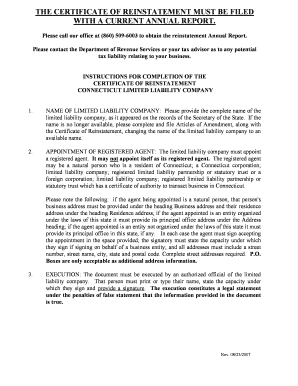

Start by clearly understanding the distinction between an independent contractor and an employee. An independent contractor is self-employed and works on a contract basis, while an employee works for an employer on a regular basis under their control.

02

Determine the classification of the worker based on factors such as control, the level of independence, integration, and economic realities. This will help you identify whether they should be treated as an independent contractor or an employee.

03

If the worker is an independent contractor, create an independent contractor agreement. This agreement should outline the scope of work, payment terms, project duration, and any other relevant details. Be sure to specify that the worker is not an employee and is responsible for their own taxes and benefits.

04

If the worker is an employee, follow the appropriate employee hiring process. This usually involves filling out an employment application, conducting interviews, verifying references, and determining the terms of employment such as salary, benefits, and working hours.

05

Keep accurate records of the worker's classification and any documents related to their status. This will help you in case of any future audits or legal issues.

06

Regularly review the worker's classification to ensure it is still appropriate. As the nature of the work or the relationship between the parties may change over time, it's important to reassess whether the worker should remain as an independent contractor or be reclassified as an employee.

Who needs Independent Contract vs Employee:

01

Businesses or individuals who require specialized services on a project basis may opt for hiring independent contractors. This allows them to access specific expertise without the need for long-term employment commitments.

02

Freelancers and self-employed individuals often choose to work as independent contractors, as it gives them the flexibility to take on multiple clients and control their own work schedule.

03

Employers who have regular, ongoing work that requires the worker to follow their instructions and work under their supervision are more likely to hire employees. This applies to positions where the employer has greater control over the worker and expects them to be an integral part of their operations.

Overall, understanding the differences between an independent contractor and an employee, and knowing how to fill out the necessary paperwork accordingly, is essential for both businesses and individuals to ensure compliance with labor laws and maintain proper working relationships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

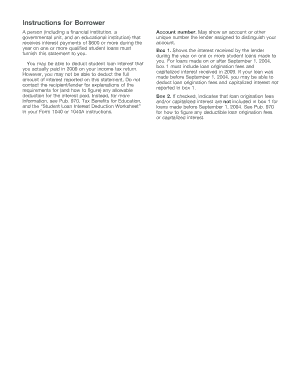

What is independent contract vs employee?

Independent contractors are self-employed individuals who provide services to businesses on a contract basis. They are not employees of the company they work for, so they are responsible for paying their own taxes and do not receive benefits like health insurance or paid time off. Employees, on the other hand, work directly for a company and receive benefits and have taxes withheld from their paychecks.

Who is required to file independent contract vs employee?

Businesses are required to correctly classify workers as independent contractors or employees and file the appropriate tax forms accordingly. The IRS has guidelines to help determine the correct classification.

How to fill out independent contract vs employee?

To fill out the appropriate tax forms for independent contractors or employees, businesses must gather information such as the worker's name, address, taxpayer identification number, and total payments made to them during the year. This information is used to complete Form 1099-NEC for independent contractors and Form W-2 for employees.

What is the purpose of independent contract vs employee?

The purpose of distinguishing between independent contractors and employees is to ensure that workers are classified correctly for tax purposes. This helps businesses comply with tax laws and regulations and ensures that workers receive the benefits and protections they are entitled to based on their classification.

What information must be reported on independent contract vs employee?

For independent contractors, businesses must report the total payments made to them during the year on Form 1099-NEC. For employees, businesses must report their wages, tips, and other compensation on Form W-2.

How can I manage my independent contract vs employee directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your independent contract vs employee and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find independent contract vs employee?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific independent contract vs employee and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my independent contract vs employee in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your independent contract vs employee directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your independent contract vs employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contract Vs Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.