Get the free Texas Cash Out - WesLend Wholesale

Show details

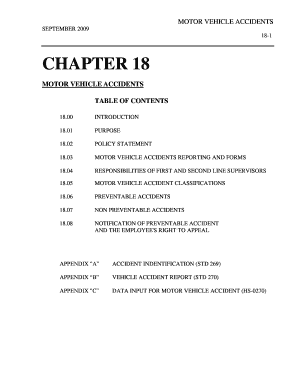

Texas Homestead Cash Out Program Highlights: DU Approved Eligible Conforming Loan Amounts to $417,000 15, 20, and 30 Year Fixed 1 Unit Primary Residence SFR, PUD or Condo Property Must be Borrowers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas cash out

Edit your texas cash out form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas cash out form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas cash out online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit texas cash out. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas cash out

How to fill out Texas cash out?

01

Determine your eligibility: Before filling out the Texas cash out form, it is important to ensure that you meet the eligibility criteria. Generally, you must have at least 20% equity in your home, good credit, and a stable income.

02

Gather necessary documents: To fill out the Texas cash out form accurately, you will need certain documents. These may include bank statements, pay stubs, tax returns, proof of homeowners insurance, and any other relevant financial information.

03

Contact a lender: Reach out to a reputable lender that offers Texas cash out refinancing options. Discuss your financial situation and goals with the lender, and they will guide you through the application process.

04

Complete the application: The lender will provide you with an application form to fill out. Ensure that you accurately fill in all the required information, including your personal details, employment history, and property information.

05

Provide supporting documents: Along with the application form, you will need to submit the necessary documents as mentioned earlier. Make sure to include all the requested paperwork to avoid any delays in processing your application.

06

Await approval and review terms: Once you have submitted your completed application and supporting documents, the lender will review your information. If approved, they will provide you with the terms and conditions of the cash out refinancing, including interest rates, repayment terms, and any fees involved.

Who needs Texas cash out?

01

Homeowners with equity: Texas cash out refinancing is primarily intended for homeowners who have built up equity in their homes. If you have significant equity and need access to cash for various purposes such as home improvements, debt consolidation, or personal expenses, Texas cash out can be beneficial.

02

Individuals seeking lower interest rates: If you currently have a high-interest mortgage, refinancing through the Texas cash out program can help you secure a lower interest rate. This can potentially save you money on monthly mortgage payments and overall interest payments over the life of the loan.

03

Those looking to consolidate debt: Texas cash out refinancing allows homeowners to replace their existing mortgage with a larger loan and obtain the difference in cash. This can be a useful option for consolidating high-interest debts, such as credit card balances or other loans, into a single, more manageable payment.

In conclusion, filling out the Texas cash out requires meeting eligibility criteria, gathering necessary documents, completing an application form, and submitting supporting paperwork. Texas cash out is beneficial for homeowners with equity, those seeking lower interest rates, and individuals looking to consolidate debt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get texas cash out?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific texas cash out and other forms. Find the template you need and change it using powerful tools.

Can I sign the texas cash out electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your texas cash out in minutes.

How do I edit texas cash out on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign texas cash out on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is texas cash out?

Texas Cash Out is a type of refinance that allows borrowers to extract equity from their home in the form of cash.

Who is required to file Texas Cash Out?

Homeowners in Texas who are looking to refinance their mortgages and take out cash are required to file Texas Cash Out.

How to fill out Texas Cash Out?

To fill out Texas Cash Out, borrowers need to provide personal information, details about their current mortgage, and information about the cash they wish to extract.

What is the purpose of Texas Cash Out?

The purpose of Texas Cash Out is to allow homeowners to access the equity in their homes for various financial needs such as home improvements, debt consolidation, or other expenses.

What information must be reported on Texas Cash Out?

Information such as personal details, current mortgage information, cash out amount, and a breakdown of how the cash will be used must be reported on Texas Cash Out.

Fill out your texas cash out online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Cash Out is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.