Get the free Health Savings Accounts 2-4-16 - LBA - lba

Show details

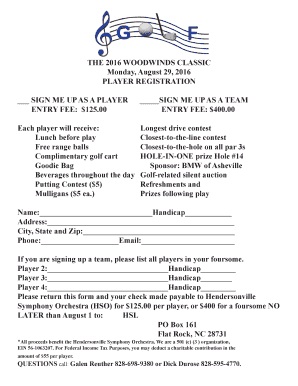

LBA PROFESSIONAL DEVELOPMENT WORKSHOPS Health Savings Accounts February 4, 2016 9:00am 4:00pm The Bankers Center Baton Rouge, LA This seminar is an all day look at all the components of Health Savings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings accounts 2-4-16

Edit your health savings accounts 2-4-16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings accounts 2-4-16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings accounts 2-4-16 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit health savings accounts 2-4-16. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings accounts 2-4-16

How to Fill Out Health Savings Accounts 2-4-16:

01

Gather all necessary information: Before filling out your health savings account (HSA) form, make sure you have gathered all the required documents and information, such as your personal details, employment information, and any financial statements relevant to the account.

02

Review the form instructions: Carefully read through the instructions provided with the HSA form to ensure you understand the requirements and procedures involved in filling out the document accurately.

03

Provide personal information: Start by providing your personal information, including your full name, address, date of birth, social security number, and contact details. Double-check for any typos or errors in this section.

04

Enter employment information: If your HSA is through your employer, include your employer's name, address, and contact information. This information will help link your HSA to your employment benefits.

05

Declare eligibility: Verify your eligibility for an HSA by answering the questions related to your health insurance coverage and any other applicable health care plans. This will ensure that you meet the criteria for having an HSA.

06

Determine contribution amount: Indicate the desired contribution amount to your HSA for the specified period (2-4-16 in this case). Make sure you are aware of the maximum allowable contribution limit set by the IRS, as exceeding it may lead to penalties.

07

Designate beneficiary: Choose and designate a beneficiary for your HSA. This individual will inherit the remaining funds in your account if something were to happen to you.

08

Review and sign: Carefully review all the information you have provided on the HSA form, checking for any mistakes or omissions. Once you are confident in its accuracy, sign the form to certify that the information is correct to the best of your knowledge.

Who Needs Health Savings Accounts 2-4-16:

01

Individuals with high-deductible insurance plans: HSAs are typically available to individuals who have health insurance coverage with a high deductible. If you have such a plan, an HSA can provide you with a tax-advantaged way to save for medical expenses.

02

Those seeking tax advantages: Health savings accounts offer tax benefits. Contributions made to an HSA are tax-deductible, grow tax-free, and withdrawals used for eligible medical expenses are tax-free. If you are looking to reduce your tax liability while saving for healthcare costs, an HSA might be suitable for you.

03

People who anticipate future medical expenses: If you expect to have significant medical expenses in the future, having an HSA can be advantageous. It allows you to set aside funds specifically for healthcare costs, ensuring you have financial resources readily available when needed.

04

Individuals wanting more control over healthcare decisions: Health savings accounts give you more control and flexibility over your healthcare decisions. With an HSA, you can choose the healthcare services and providers that suit your needs, as well as save for potential future care.

05

Those who can afford to contribute: While anyone who meets the eligibility requirements can open an HSA, it's important to consider if you can afford to contribute regularly. Assess your financial situation and determine if you have the means to contribute to your HSA consistently.

Remember, it is always advisable to consult with a financial advisor or tax professional to fully understand the implications and benefits of opening and filling out an HSA.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is health savings accounts 2-4-16?

Health savings accounts (HSAs) are tax-advantaged accounts that individuals can use to save and pay for qualified medical expenses.

Who is required to file health savings accounts 2-4-16?

Individuals who have an HSA account and meet certain eligibility requirements are required to file health savings accounts.

How to fill out health savings accounts 2-4-16?

To fill out health savings accounts, individuals need to report contributions, distributions, and any other relevant information related to the HSA.

What is the purpose of health savings accounts 2-4-16?

The purpose of health savings accounts is to help individuals save for medical expenses while taking advantage of tax benefits.

What information must be reported on health savings accounts 2-4-16?

Information such as contributions made to the HSA, distributions taken from the HSA, and any other relevant financial transactions related to the HSA must be reported.

How can I modify health savings accounts 2-4-16 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including health savings accounts 2-4-16. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit health savings accounts 2-4-16 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing health savings accounts 2-4-16.

How do I fill out the health savings accounts 2-4-16 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign health savings accounts 2-4-16. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your health savings accounts 2-4-16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Accounts 2-4-16 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.