Get the free CREDIT LINE ACCOUNT APPLICATION - sbcu

Show details

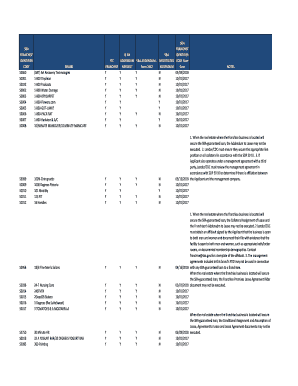

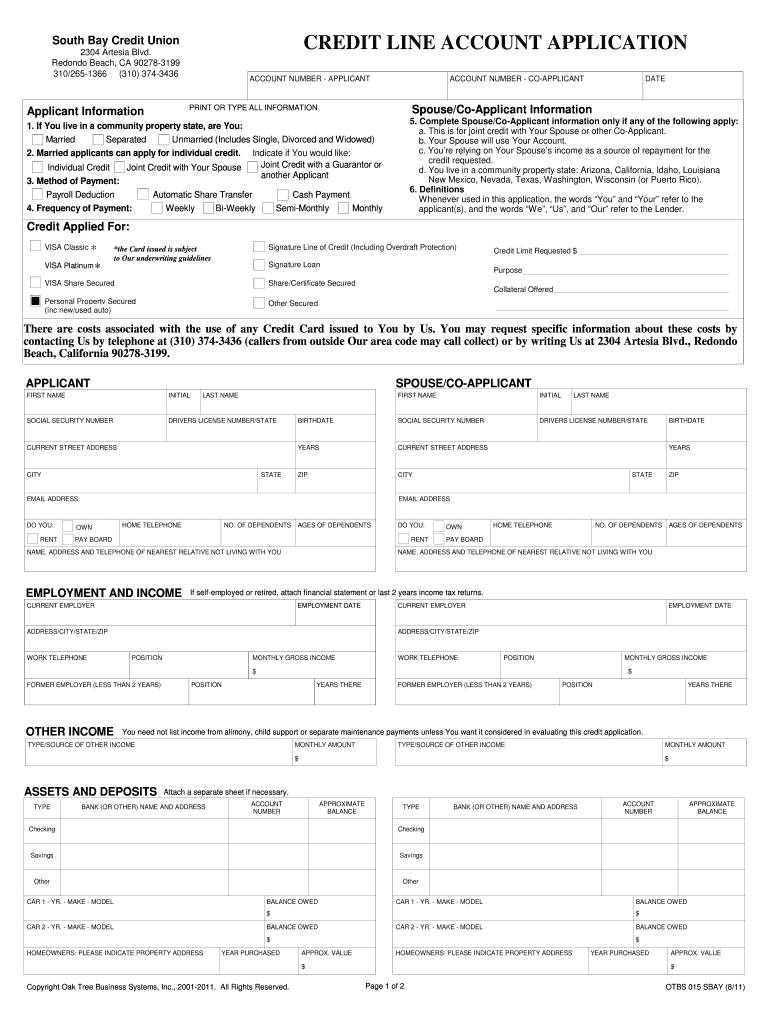

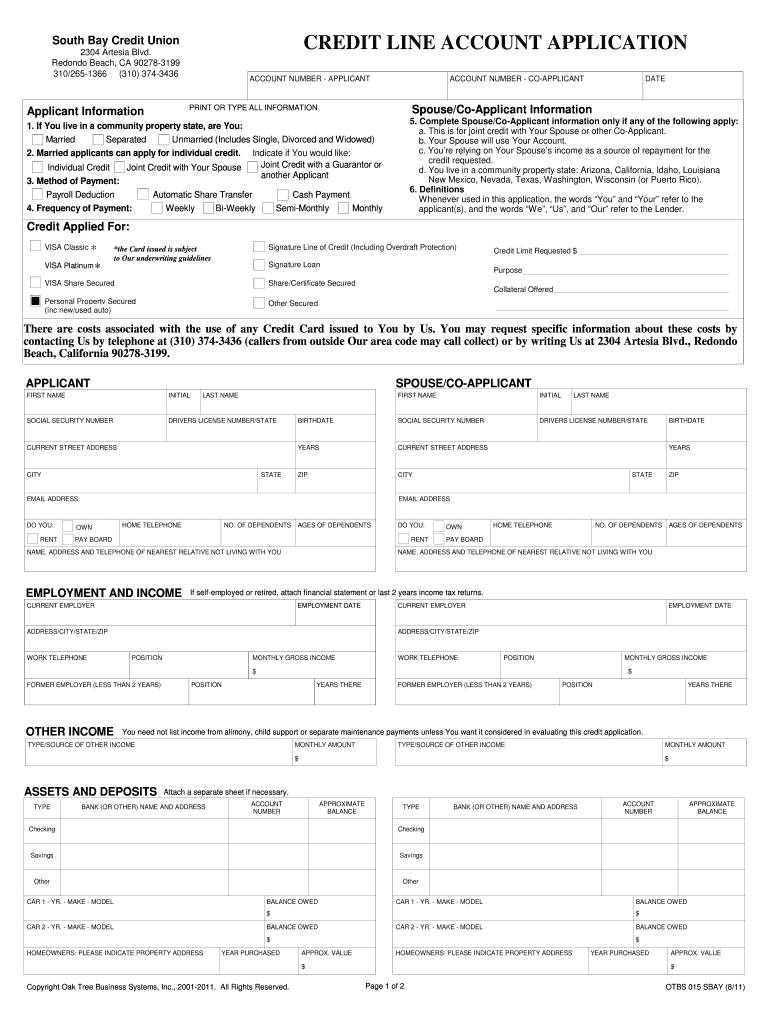

This document is an application for a credit line account with South Bay Credit Union, detailing information required from the applicant and co-applicant, including personal, employment, income, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit line account application

Edit your credit line account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit line account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit line account application online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit line account application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit line account application

How to fill out CREDIT LINE ACCOUNT APPLICATION

01

Gather necessary documentation, such as personal identification, income statements, and any financial information required.

02

Obtain the credit line application form from the lender's website or branch.

03

Fill out the personal information section, including your name, address, phone number, and Social Security number.

04

Provide details about your employment, including your employer's name, address, and your job title.

05

Disclose your income sources and amounts.

06

Complete any additional sections regarding existing debt and financial obligations.

07

Read the terms and conditions thoroughly.

08

Sign and date the application.

09

Submit the application online or in person, alongside any required documentation.

Who needs CREDIT LINE ACCOUNT APPLICATION?

01

Individuals looking to manage their finances through a credit line.

02

Small business owners who need flexible funding for business expenses.

03

Anyone looking to make larger purchases over time without immediate payment.

04

People seeking to build or improve their credit history.

Fill

form

: Try Risk Free

People Also Ask about

What does credit line mean?

A credit line is a flexible loan that allows you to borrow as needed up to a certain limit. Just like a credit card, you don't need to take the whole amount all at once; you can draw against the loan over time, up to your approved limit.

What is a line of credit application?

Understanding Lines of Credit (LOCs) Customers may apply for or be pre-approved for a credit line. The limit on the LOC is based on the borrower's creditworthiness. All LOCs consist of a set amount of money that can be borrowed as needed, paid back, and borrowed again.

What does a credit application mean?

A credit application is a standardized form that a customer or borrower uses to request credit. It may be completed using a paper form or online. The form contains requests for such information as: The amount of credit requested. The identification of the applicant.

What is a credit line application?

When you apply for a credit line, you will be approved to borrow up to a certain amount. You decide how much you withdraw and when; you can use all or just part of it. As you borrow from your credit line, you pay back the loan along the way.

Is it good to apply for a line of credit?

A personal Line of Credit is an excellent way to borrow money for unexpected life expenses, consolidate debt, and help manage your cashflow. You can borrow up to your credit limit, and as you pay down your balance, those funds become available to you to borrow again. There is no need to re-apply.

What is a credit account application form?

A credit application form should collect the registered company name, number, and address, along with a separate invoicing address if applicable. It should request financial details such as turnover or balance sheet totals and ask for contacts for credit references.

Is applying for a line of credit a good idea?

Lines of credit, like any financial product, have advantages and disadvantages, depending on how you use them. On one hand, excessive borrowing against a line of credit can get you into financial trouble. On the other hand, lines of credit can be cost-effective solutions to fund unexpected or major expenses.

How do you account for a line of credit?

When using a line of credit, a line of credit account should exist in your chart. This account should be reflected as a liability. In the example, $5,000 is receipted into the bank account and is also setup as a liability. Now that you have drawn money from the line, the liability must be present on your Balance Sheet.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT LINE ACCOUNT APPLICATION?

A Credit Line Account Application is a formal request submitted by an individual or entity seeking to establish a credit line with a financial institution or lender.

Who is required to file CREDIT LINE ACCOUNT APPLICATION?

Individuals or businesses seeking to obtain a credit line must file a Credit Line Account Application with the appropriate financial institution or lender.

How to fill out CREDIT LINE ACCOUNT APPLICATION?

To fill out a Credit Line Account Application, provide personal or business information, financial details, credit history, and any other required documentation as specified by the lender.

What is the purpose of CREDIT LINE ACCOUNT APPLICATION?

The purpose of a Credit Line Account Application is to evaluate the borrower's creditworthiness and to determine if the lender can extend a credit line based on the applicant's financial information.

What information must be reported on CREDIT LINE ACCOUNT APPLICATION?

The application must report personal details (name, address, social security number), employment information, income, existing debts, and other financial assets as required by the lender.

Fill out your credit line account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Line Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.