Get the free Memorandum D10-13-1

Show details

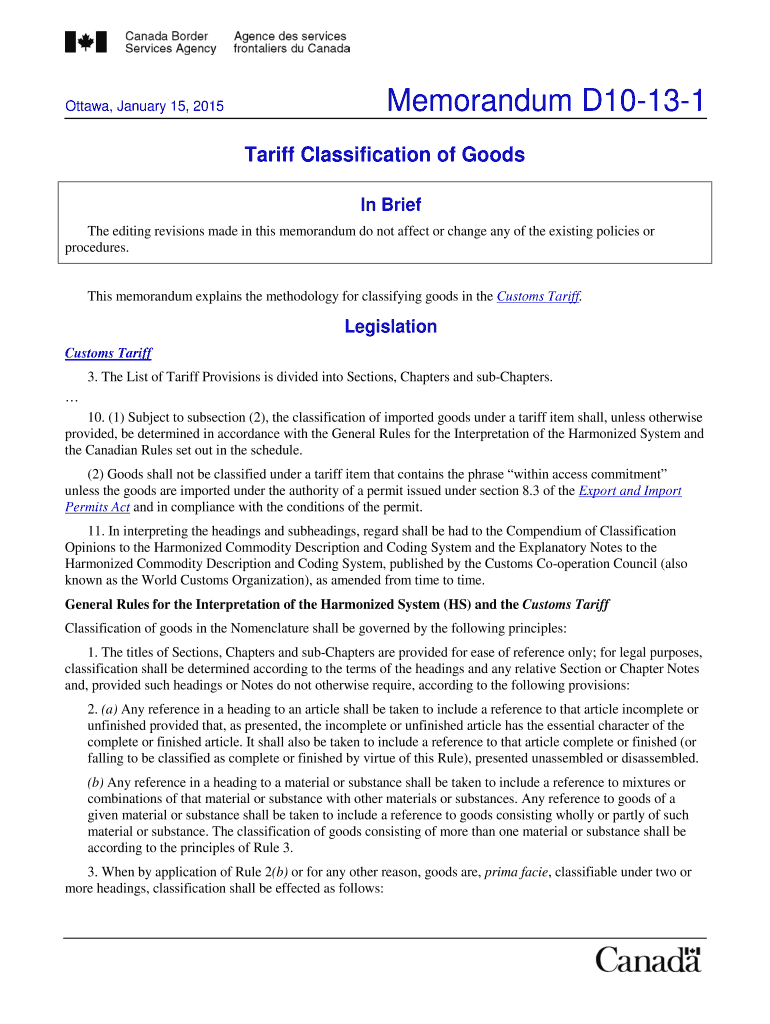

This memorandum explains the methodology for classifying goods in the Customs Tariff and details the legal provisions, rules, and guidelines necessary for accurate tariff classification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign memorandum d10-13-1

Edit your memorandum d10-13-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your memorandum d10-13-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit memorandum d10-13-1 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit memorandum d10-13-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out memorandum d10-13-1

How to fill out Memorandum D10-13-1

01

Obtain a copy of Memorandum D10-13-1 from the official website or relevant authority.

02

Read the instructions carefully to understand the purpose of the memorandum.

03

Gather all necessary documents and information required to fill out the form.

04

Start with Section 1, entering your personal and contact information accurately.

05

Proceed to Section 2, providing relevant details related to the subject of the memorandum.

06

In Section 3, ensure you include any additional information or remarks as needed.

07

Review all entries for accuracy and completeness before submission.

08

Submit the completed memorandum to the designated authority as indicated in the guidelines.

Who needs Memorandum D10-13-1?

01

Individuals or businesses involved in cross-border trade and requiring specific customs guidance.

02

Customs brokers needing clarity on customs regulations and procedures.

03

Importers and exporters looking to ensure compliance with Canadian customs laws.

Fill

form

: Try Risk Free

People Also Ask about

What is customs clearance in Canada?

It will prove that any taxes or duties have been paid. Then, the goods are released for import or export. The customs clearance process is the act of passing a shipment of goods through customs, the government agency responsible for overseeing the compliance of shipments with international trade laws.

What is Section 7.1 of the customs Act?

7.1 Any information provided to an officer in the administration or enforcement of this Act, the Customs Tariff or the Special Import Measures Act or under any other Act of Parliament that prohibits, controls or regulates the importation or exportation of goods, shall be true, accurate and complete.

What is the HS Code 0105.11 22?

0105.11. 22 as broilers for domestic production. Customs Tariff 1. The List of Tariff Provisions is divided into Sections, Chapters and sub-Chapters.

Do I need a tariff code to ship to Canada?

Every shipment to Canada needs a correct tariff number — that's not just a best practice, it's the law.

What are D memos?

Departmental memoranda, also called D-memos, outline the legislation, regulations, policies and procedures that the agency uses to administer its customs and travel operations.

What is a memorandum of understanding CBSA?

An Export Reporting Memorandum of Understanding (MOU) is an administrative arrangement between the CBSA and a carrier or customs service provider designed to enhance the security of international trade, expedite export shipments and increase compliance.

What items need to be declared at customs in Canada?

Use the Customs Declaration Card to declare what you're bringing into Canada, including any: items you must pay duty on, such as: gifts. alcohol. tobacco. amount of money more than CDN $10,000. business goods, plants, food, animals, firearms or other weapons.

What is the CBSA letter in Canada?

If you are returning to Canada by commercial aircraft, you will receive a Canada Border Services Agency (CBSA) Declaration Card to complete before you land. These cards are also used at some locations for travellers arriving by train, boat or bus.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Memorandum D10-13-1?

Memorandum D10-13-1 is a guideline issued by the Canada Border Services Agency that outlines the requirements for the reporting and processing of certain goods entering Canada.

Who is required to file Memorandum D10-13-1?

Importers and individuals or businesses who are bringing specific goods into Canada that fall under the requirements outlined in Memorandum D10-13-1 are required to file this document.

How to fill out Memorandum D10-13-1?

To fill out Memorandum D10-13-1, you must provide accurate details about the goods being imported, including descriptions, values, quantities, and any other relevant information as specified in the memorandum.

What is the purpose of Memorandum D10-13-1?

The purpose of Memorandum D10-13-1 is to ensure compliance with Canadian laws and regulations regarding the importation of goods and to facilitate the proper assessment of duties and taxes.

What information must be reported on Memorandum D10-13-1?

The information that must be reported on Memorandum D10-13-1 includes the description of the goods, the value, quantity, origin, and any applicable tariffs or regulations that apply to the imported items.

Fill out your memorandum d10-13-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Memorandum d10-13-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.