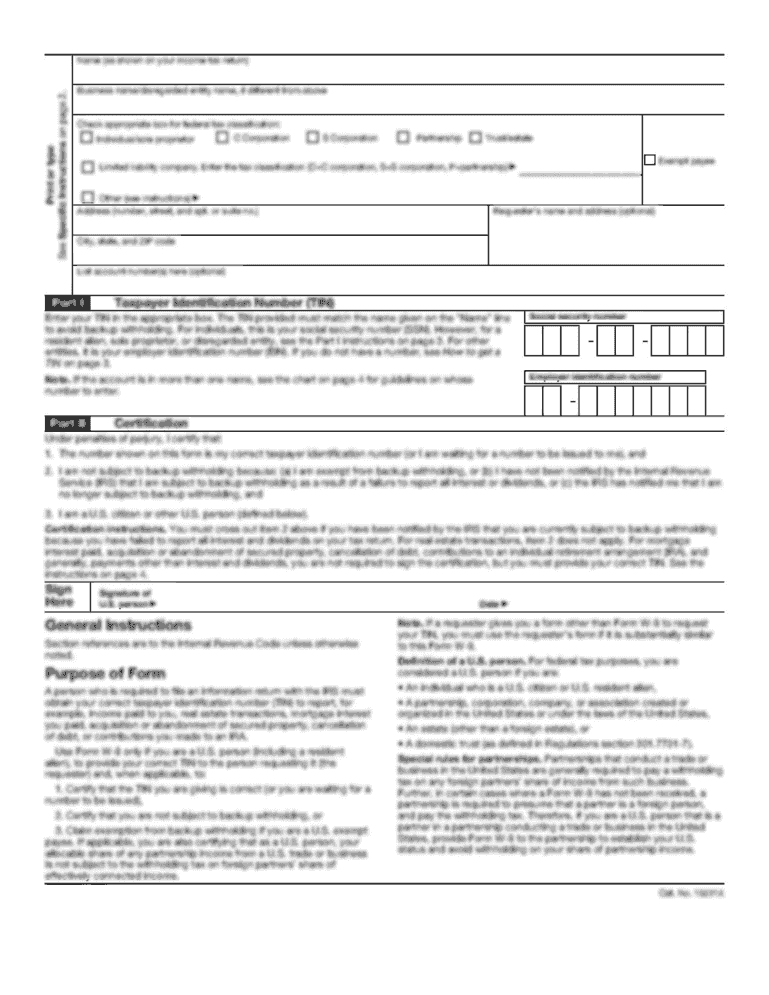

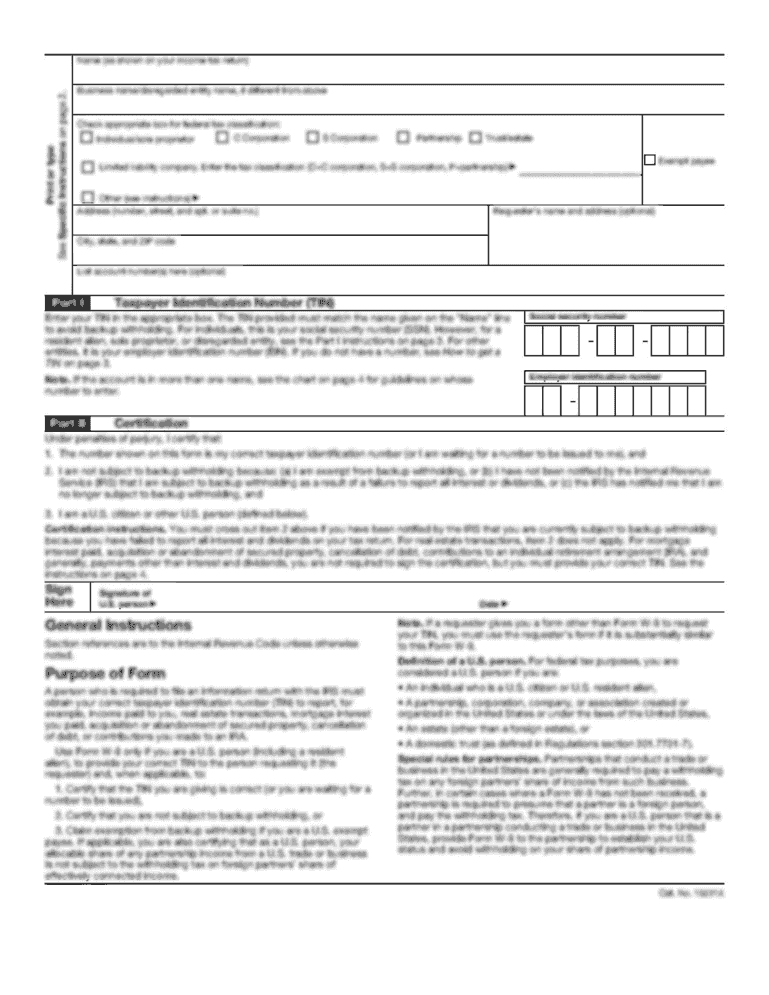

Morning Star Financial Services IRS Notice 2014-7 free printable template

Show details

9400 Golden Valley Rd, Golden Valley, MN 55427 morningstarfs.com 18554506755 IRS Notice 20147 Notice 20147 provides that the IRS will treat qualified Medicaid waiver payments as difficulty of care

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign payments notice 2014 7 form

Edit your payments notice 2014 7 certification statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your waiver payments notice 2014 7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payments notice 2014 7 form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payments notice 2014 7 statement form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out waiver notice 2014 7 form

How to fill out 2014 7 form:

01

Start by carefully reviewing the instructions provided with the form. Make sure you understand all the requirements and guidelines.

02

Gather all the necessary information and documents needed to complete the form accurately. This may include personal information, financial records, and employment details.

03

Begin filling out the form by entering your personal information in the designated sections. This typically includes your full name, address, social security number, and contact information.

04

Follow the instructions on each section of the form, providing the requested information accurately and clearly. Double-check your entries to avoid any mistakes or omissions.

05

If there are any specific instructions for particular sections or questions, make sure to read and follow them carefully.

06

Take note of any required attachments or supporting documents that need to be submitted along with the completed form. Make sure to include them before submitting.

07

Review the filled-out form one last time to ensure all the information is correct and complete. Make any necessary revisions before finalizing.

08

Sign and date the form where indicated. If applicable, obtain any required signatures from other parties involved.

09

Keep a copy of the completed form and all supporting documents for your records.

10

Submit the form to the relevant authority or organization as instructed.

Who needs 2014 7 form:

01

Individuals who meet certain eligibility criteria and are required to report specific information to the relevant authority.

02

Typically, the 2014 7 form is used for tax purposes, so individuals who need to report their financial information, income, and deductions for the given year may require this form.

03

It is important to consult the specific instructions or seek professional advice to determine if you need to fill out the 2014 7 form based on your particular situation.

Fill

form

: Try Risk Free

People Also Ask about

What is 2014 7 federal income tax exempt?

On January 21, 2014, the IRS issued Notice 2014-7. The Notice explained that the IRS treats certain payments for personal care services as “Difficulty of Care payments”, which are excluded from being subject to federal income taxes.

Is there a way to get tax penalties waived?

If you have reasonable cause, we may waive penalties. You may file a reasonable cause - claim for refund to request that we waive a penalty for reasonable cause.

What is difficulty of care federal income tax exclusion?

Payment for services provided to the employer, by those who share the individual's home address, are classified as “difficulty of care” payments instead of regular wages. Unlike wages, difficulty of care payment are excludible from federal gross income; therefore, they are not subject to federal income tax.

How do I ask for a waiver from the IRS?

Form 8508-I - To request a waiver from the electronic filing of Form 8966, FATCA Report, use Form 8508-I, Request for Waiver From Filing Information Returns Electronically (For Form 8966)PDF. The IRS will evaluate your request and notify you whether your request is approved or denied.

How to request a waiver of interest and penalties from the IRS?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete waiver payments notice 2014 online?

pdfFiller has made it easy to fill out and sign waiver payments notice 2014. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in waiver payments notice 2014?

The editing procedure is simple with pdfFiller. Open your waiver payments notice 2014 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete waiver payments notice 2014 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your waiver payments notice 2014. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Morning Star Financial Services IRS Notice?

The Morning Star Financial Services IRS Notice is a notification issued by the Internal Revenue Service related to tax matters or compliance issues concerning Morning Star Financial Services.

Who is required to file Morning Star Financial Services IRS Notice?

Entities or individuals associated with Morning Star Financial Services, including clients and partners who have tax obligations or compliance issues, may be required to file the IRS Notice.

How to fill out Morning Star Financial Services IRS Notice?

To fill out the Morning Star Financial Services IRS Notice, individuals should provide accurate personal and financial information as requested in the notice, following the instructions provided by the IRS.

What is the purpose of Morning Star Financial Services IRS Notice?

The purpose of the Morning Star Financial Services IRS Notice is to ensure compliance with tax regulations and to inform individuals or entities of their tax obligations or any discrepancies that need to be addressed.

What information must be reported on Morning Star Financial Services IRS Notice?

The information that must be reported on the Morning Star Financial Services IRS Notice typically includes identification details, financial figures, compliance issues, and any required corrections related to prior tax filings.

Fill out your waiver payments notice 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Waiver Payments Notice 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.