Get the free SME Seminar Accountancy and Financial Management Series

Show details

SME Seminar Accountancy and Financial Management Series: How Business Plans Help Fund Raising for SMEs Many SMEs may have to raise funds from various sources, in particular from banks, for business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sme seminar accountancy and

Edit your sme seminar accountancy and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sme seminar accountancy and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sme seminar accountancy and online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sme seminar accountancy and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sme seminar accountancy and

Point by point, here is how to fill out an SME seminar accountancy form:

01

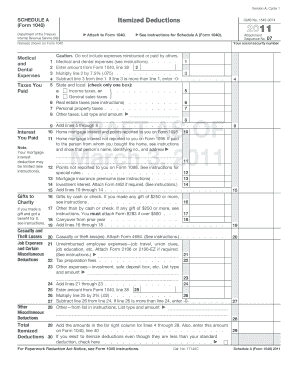

Start by gathering all the necessary information: Make sure you have all the relevant financial and accounting documents ready, such as income statements, balance sheets, and cash flow statements.

02

Provide accurate and complete information: Ensure that all the information you provide on the form is accurate and up to date. This includes details such as the company's legal name, tax identification number, and registered address.

03

Fill out the sections on financial performance: The form may include sections where you need to provide information about the company's financial performance. This may include details on revenue, expenses, assets, liabilities, and equity. Be sure to provide accurate figures and explanations where required.

04

Include any additional documentation: If the form requests any additional documentation, such as bank statements or tax returns, make sure to attach those as required.

05

Double-check your entries: Before submitting the form, take the time to review all the information you have provided. Make sure there are no errors or missing details. It is essential to ensure the accuracy of the information to avoid any potential issues down the line.

Who needs an SME seminar accountancy?

01

Small and medium-sized business owners: SME seminar accountancy is beneficial for business owners who want to enhance their understanding of accounting principles and practices. It can help them make informed financial decisions and manage their business more effectively.

02

Entrepreneurs and aspiring business owners: Those who are starting a new business or planning to do so can benefit from an SME seminar accountancy. It provides them with essential knowledge on financial management and helps them set up a strong accounting foundation for their business.

03

Individuals involved in financial roles within a company: Employees involved in financial roles, such as accountants, bookkeepers, or finance managers, can take advantage of SME seminar accountancy to refine their skills, stay up to date with developments in the field, and ensure compliance with accounting regulations.

04

Investors and stakeholders: Investors and stakeholders of SMEs may benefit from attending seminars on accountancy. It equips them with the knowledge to analyze financial statements and evaluate the financial health of a company, aiding them in making informed investment decisions.

Overall, anyone looking to enhance their understanding of accounting principles and practices, whether for personal or professional reasons, can benefit from attending an SME seminar on accountancy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sme seminar accountancy and?

SME seminar accountancy and is a specialized seminar that focuses on accounting practices tailored for small and medium-sized enterprises.

Who is required to file sme seminar accountancy and?

Small and medium-sized enterprise owners, managers, and employees who are responsible for financial reporting are required to attend or file an SME seminar accountancy and.

How to fill out sme seminar accountancy and?

To fill out sme seminar accountancy and, participants must attend the seminar sessions, take notes, and apply the principles learned to their respective companies' financial reporting.

What is the purpose of sme seminar accountancy and?

The purpose of sme seminar accountancy and is to enhance the accounting knowledge and skills of individuals working in small and medium-sized enterprises, ultimately improving financial reporting accuracy and compliance.

What information must be reported on sme seminar accountancy and?

Information regarding financial statements, accounting methods, tax implications, and compliance requirements specific to small and medium-sized enterprises must be reported on sme seminar accountancy and.

How can I edit sme seminar accountancy and on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sme seminar accountancy and.

How do I fill out the sme seminar accountancy and form on my smartphone?

Use the pdfFiller mobile app to fill out and sign sme seminar accountancy and. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out sme seminar accountancy and on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your sme seminar accountancy and by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your sme seminar accountancy and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sme Seminar Accountancy And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.