Canada T2201 E 2012 free printable template

Show details

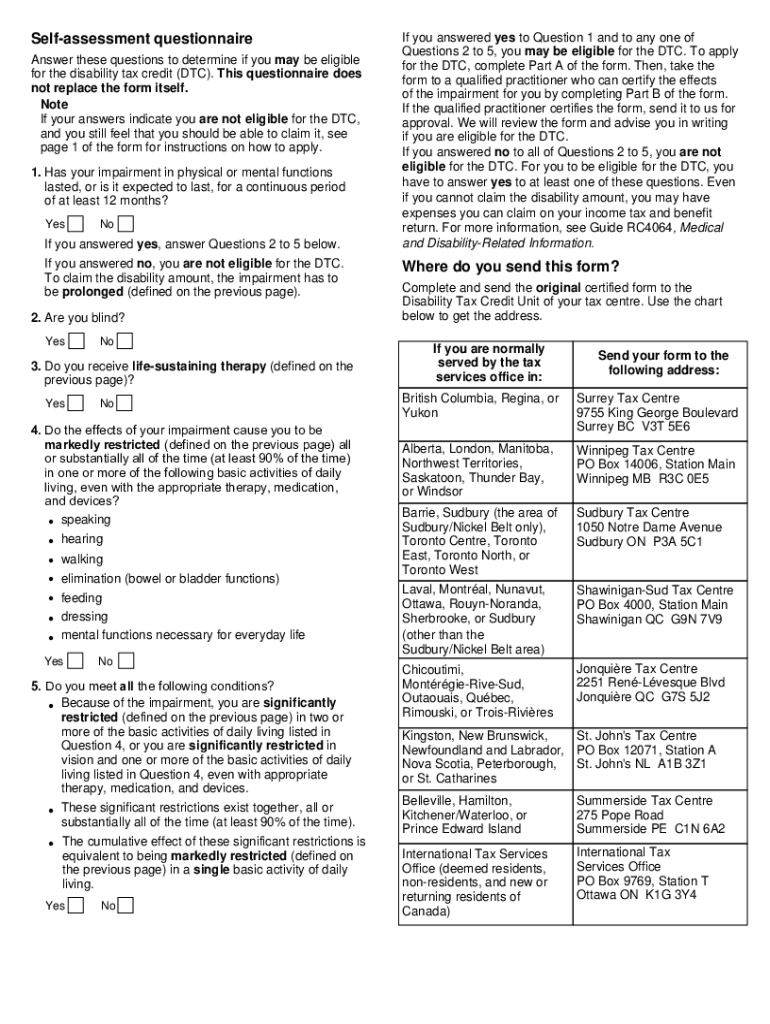

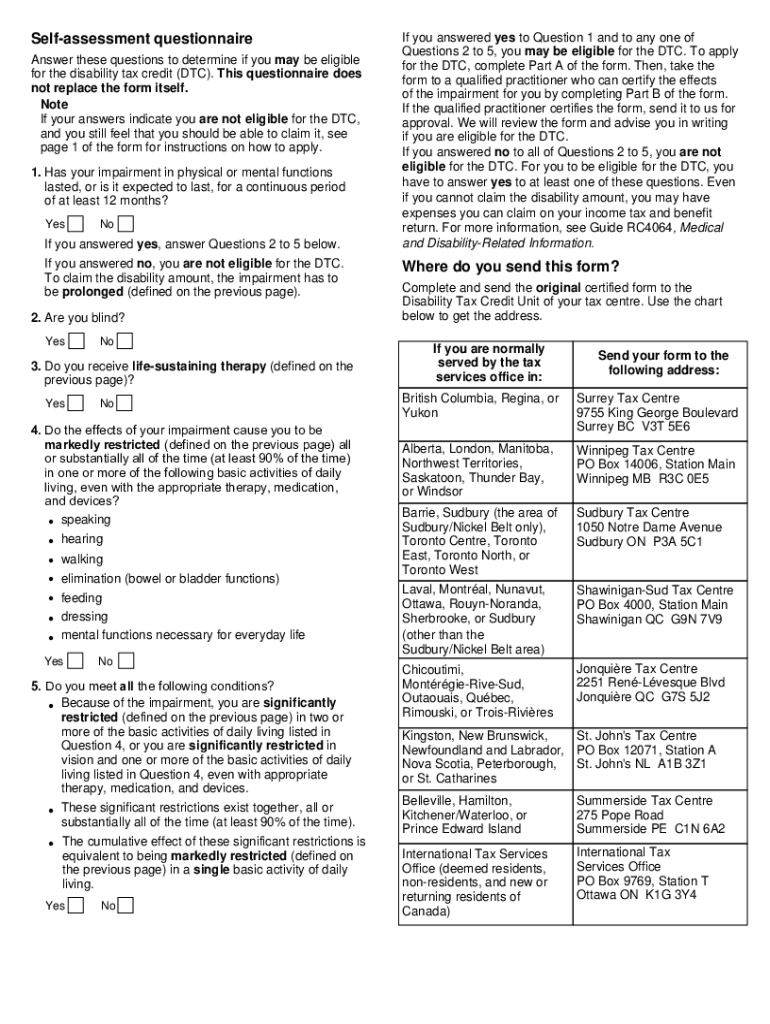

You must tell us immediately if your condition improves. T2201 E 12 You can send the form to us at any time during the year. Clear Data Help DISABILITY TAX CREDIT CERTIFICATE This form is separated into two sections the introduction and the form itself* The introduction includes the following general information about the disability amount definitions how to change your return for previous years what to do if you disagree with our decision about your eligibility a questionnaire to help you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign t2201 disability tax form

Edit your t2201 disability tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t2201 disability tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t2201 disability tax form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit t2201 disability tax form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2201 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t2201 disability tax form

How to fill out Canada T2201 E

01

Obtain the Canada T2201 E form from the Canada Revenue Agency (CRA) website or your local tax office.

02

Fill out Section A: Personal Information, providing your name, address, and phone number.

03

In Section B, indicate if the disability is permanent or temporary and provide details about the nature of the disability.

04

Complete Section C by having a qualified professional, such as a physician or psychologist, verify your disability and sign the form.

05

If applicable, fill out Section D for additional information on the severity of your disability.

06

Review the completed form for accuracy and ensure all sections are filled out.

07

Submit the T2201 E form to the CRA either by mail or online through your CRA account.

Who needs Canada T2201 E?

01

Individuals who have a qualifying disability and wish to claim the disability tax credit.

02

People who require assistance with daily activities due to their disability.

03

Those who need to prove their disability status for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for Ontario disability tax credit?

You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function.

Who qualifies for the Disability Tax Credit Canada?

You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function.

Does Type 2 diabetes qualify for disability tax credit in Canada?

The DTC is available to individuals with diabetes using insulin whose doctor certifies that they spend at least 14 hours per week on specific activities related to determining and administering insulin. You can access the DTC form T2201 here.

How much do you get back for disability tax credit Canada?

If you were eligible for the DTC in past years but did not claim the disability amount, you may be able to claim it going back up to 10 years.Amounts you may claim for the past 10 years. YearDisability amountSupplement for children (17 and younger)2020$8,576$5,0032019$8,416$4,9092018$8,235$4,8048 more rows • Jan 24, 2023

What is T2201 Canada?

Medical practitioners may complete Part B of Form T2201, Disability Tax Credit Certificate using the DTC digital application. The digital application was updated to reflect expanded eligibility criteria for mental functions and life-sustaining therapy.

What is the benefit of a disability tax credit in Canada?

The DTC helps reduce the income tax that people with physical or mental impairments, or their supporting family members, may have to pay. It aims to offset some of the costs related to the impairment.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify t2201 disability tax form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your t2201 disability tax form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send t2201 disability tax form for eSignature?

Once your t2201 disability tax form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in t2201 disability tax form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your t2201 disability tax form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is Canada T2201 E?

Canada T2201 E, also known as the Disability Tax Credit Certificate, is a form used to determine eligibility for the disability tax credit in Canada, which provides tax relief for individuals with disabilities or their supporting persons.

Who is required to file Canada T2201 E?

Individuals with a disability, or patients who are unable to perform basic daily activities, may need to file Canada T2201 E in order to claim the disability tax credit. This form must be completed by the individual and certified by a qualified medical practitioner.

How to fill out Canada T2201 E?

To fill out Canada T2201 E, the applicant must complete the personal information section, have a qualified medical practitioner complete the medical certifier section regarding the nature and extent of the disability, and then submit the form to the Canada Revenue Agency (CRA) for assessment.

What is the purpose of Canada T2201 E?

The purpose of Canada T2201 E is to provide individuals with disabilities a means to apply for the Disability Tax Credit, which can reduce their tax burden and provide financial support for their needs.

What information must be reported on Canada T2201 E?

Information that must be reported on Canada T2201 E includes personal details of the individual applying, a clear description of the disability, the effects of the disability on daily activities, and the certification from a qualified medical practitioner about the disability.

Fill out your t2201 disability tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t2201 Disability Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.