Get the free Working Income Tax Benefit Advance Payments Application for 2013 - cra-arc gc

Show details

This form is used to apply for the working income tax benefit (WITB) advance payments for the year 2013, specifically designed for low-income individuals and families with earned income.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign working income tax benefit

Edit your working income tax benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your working income tax benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit working income tax benefit online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit working income tax benefit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out working income tax benefit

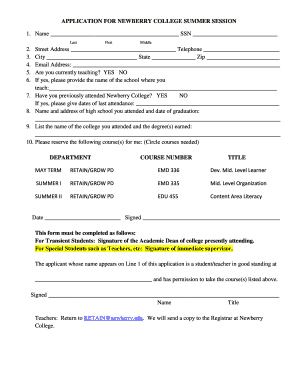

How to fill out Working Income Tax Benefit Advance Payments Application for 2013

01

Obtain the Working Income Tax Benefit Advance Payments Application form for 2013 from the Canada Revenue Agency (CRA) website or local office.

02

Read the instructions provided with the application form carefully.

03

Fill out your personal information, including your name, address, and social insurance number in the designated fields.

04

Provide details regarding your income and family size as requested on the form.

05

Calculate your estimated working income and indicate this amount on the application.

06

Check if you are eligible by reviewing the eligibility criteria listed on the form.

07

Sign and date the application at the bottom of the form.

08

Submit your completed application to the CRA by mail or online, as per the instructions.

Who needs Working Income Tax Benefit Advance Payments Application for 2013?

01

Individuals who are working and earning a low income and are looking for financial support to help supplement their income.

02

Families with children who qualify based on income thresholds set by the CRA.

03

Individuals who have previously claimed the Working Income Tax Benefit and are eligible for advance payments.

Fill

form

: Try Risk Free

People Also Ask about

What is the $300 federal payment in Canada?

The Government of Canada introduced the $300 federal payment as part of its relief funds initiative to provide financial support to eligible beneficiaries. Distributed monthly through direct deposit or mailed cheques, this program targets those receiving Old Age Security, survivor benefits, or retirement pensions.

What is the new $1200 benefit in Canada?

If you're 65 or older and living on a modest income, you might be missing out on a valuable benefit: the Guaranteed Income Supplement (GIS). This monthly, non-taxable payment from the Government of Canada can provide between $500 and $1,200 per month to seniors who already receive Old Age Security (OAS).

What is the working income tax benefit in Canada?

The Canada Workers Benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return.

Who gets the $2000 tax credit in Canada?

If you receive income from sources such as a pension plan, certain annuities, a registered retirement income fund (RRIF) or other locked- in registered retirement income funds, you may be able to claim a tax credit on amount up to $2,000 of that income.

Who is eligible for the $300 federal payment in Canada?

Who is eligible for the $300 federal payment in Canada? The $300 federal payment likely refers to programs like the GST/HST Credit or Canada Workers Benefit (CWB). You're eligible if you're a Canadian resident, 19 or older (or have a spouse/child if under 19), have low to moderate income, and filed your 2024 taxes.

What is the $300 benefit in Canada?

The $300 payment is a one-time, non-taxable financial support measure aimed at helping seniors across Canada who are most in need. The federal government introduced this payment as part of its broader cost-of-living relief strategy in 2025.

Why did I get a federal payment today in Canada?

If the Canada fed deposit you receive says DN Canada fed/fed on your bank statement then you're likely receiving a payment for one of three things - Canada Child Benefit, a GST/HST payment, or the Canada Workers Benefit. This is stating that the payment is for a federal benefit not a provincial or territorial one.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Working Income Tax Benefit Advance Payments Application for 2013?

The Working Income Tax Benefit Advance Payments Application for 2013 was a form that allowed eligible low-income working individuals and families in Canada to apply for advance payments of the Working Income Tax Benefit (WITB), designed to provide financial support and encourage employment.

Who is required to file Working Income Tax Benefit Advance Payments Application for 2013?

Individuals and families who were eligible for the Working Income Tax Benefit (WITB), had working income above a certain threshold, and were filing their income tax for 2013 were required to submit the application to receive advance payments.

How to fill out Working Income Tax Benefit Advance Payments Application for 2013?

To fill out the Working Income Tax Benefit Advance Payments Application for 2013, individuals needed to complete the necessary sections of the application form, providing information about their income, family situation, and any dependents. Specific instructions were provided on the form for correct completion.

What is the purpose of Working Income Tax Benefit Advance Payments Application for 2013?

The purpose of the Working Income Tax Benefit Advance Payments Application for 2013 was to allow eligible individuals and families to receive financial assistance throughout the year, rather than waiting for their tax refund, helping to alleviate financial difficulties associated with low-income employment.

What information must be reported on Working Income Tax Benefit Advance Payments Application for 2013?

The application required individuals to report their total income, marital status, number of dependents, and any other relevant financial information needed to determine eligibility for the Working Income Tax Benefit and to calculate the amount of advance payment.

Fill out your working income tax benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Working Income Tax Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.