Get the free OP 17 Loans - cic gc

Show details

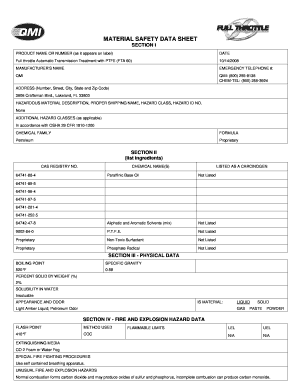

This document outlines the procedures, guidelines, and regulations regarding the Immigration Loans Program, including the types of loans available for familiarization and the respective eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign op 17 loans

Edit your op 17 loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your op 17 loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing op 17 loans online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit op 17 loans. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out op 17 loans

How to fill out OP 17 Loans

01

Gather the necessary documentation, including proof of income and identification.

02

Obtain the OP 17 Loans application form from your local financial institution or online.

03

Fill out personal information, including your name, address, and contact details.

04

Provide financial information, such as your monthly income, expenses, and existing debts.

05

Specify the loan amount you wish to apply for and the purpose of the loan.

06

Review all entered information for accuracy and completeness.

07

Submit the application form along with the required documentation to the lender.

08

Await the lender's response regarding the approval status of your loan application.

Who needs OP 17 Loans?

01

Individuals seeking financial assistance for personal expenses such as education, home repair, or medical bills.

02

Small business owners looking for capital to expand their operations or manage cash flow.

03

Anyone in need of consolidation loans to pay off existing debts.

04

People experiencing financial emergencies that require immediate funding.

Fill

form

: Try Risk Free

People Also Ask about

What is the assisted passage loan scheme in Canada?

The government implemented the Assisted Passage Loan Scheme to help immigrants from Europe who could not pay their own transportation. Loans were to be repaid over the two years following landing.

Are all student loans interest-free in Canada?

Canada Student Loans Permanent Elimination of Interest The Government of Canada permanently eliminated the accumulation of interest on all Canada student loans including loans currently in repayment as of April 1, 2023.

Can a temporary resident get a loan in Canada?

In order to take out a loan in Canada, you must first become a permanent resident. Once you successfully obtain your permanent resident (PR) card, you may be eligible to apply for a personal loan in Canada.

Do immigrants get interest free loans in Canada?

Interest on ILP Loans If you are a refugee or protected person, you may be given a period of time where you make your regular payments interest-free. This means you will not be charged interest on your ILP loan if you pay it off during this period.

Can an immigrant get a loan in Canada?

Newcomers can get any type of loan in Canada so long as they are permanent residents. Newcomers can access various types of loans from banks, alternative lenders, non-profit organizations and government programs. The biggest hurdle for newcomers when it comes to getting credit is their lack of credit history.

What is the $40 000 interest-free loan Canada Energy?

The Canada Greener Homes Loan offers interest-free loans of up to $40,000 to help Canadians make their homes more energy efficient and comfortable. Homeowners are required to complete a pre-retrofit EnerGuide evaluation to participate in the program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OP 17 Loans?

OP 17 Loans refers to a specific form or reporting requirement related to loans, typically used for tracking and reporting loan-related transactions or data within a financial or regulatory context.

Who is required to file OP 17 Loans?

Entities or individuals who are involved in loan transactions and are subject to regulatory reporting requirements are generally required to file OP 17 Loans. This may include banks, financial institutions, and certain businesses that extend loans.

How to fill out OP 17 Loans?

To fill out OP 17 Loans, one must accurately provide all required information such as borrower details, loan amounts, interest rates, and repayment schedules, and follow the specific guidelines outlined by the regulatory authority.

What is the purpose of OP 17 Loans?

The purpose of OP 17 Loans is to ensure transparency and compliance in loan reporting, helping regulatory bodies monitor lending activities and assess financial stability within the market.

What information must be reported on OP 17 Loans?

The information that must be reported on OP 17 Loans typically includes borrower identification, loan terms, loan amounts, interest rates, repayment plans, and any relevant covenants or conditions related to the loans.

Fill out your op 17 loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Op 17 Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.