Canada B240 E 2006 free printable template

Show details

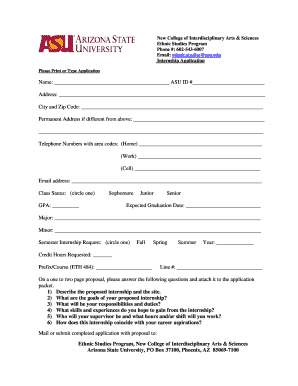

Help Aide Restore/Restorer Canada-Chile Free Trade Agreement PROTECTED (when completed) BP ROT G (one foil temple) B PROTEIN (candy Lenddo) B CERTIFICATE OF ORIGIN (Instructions on reverse) 1 Exporter's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada B240 E

Edit your Canada B240 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada B240 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada B240 E online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada B240 E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada B240 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada B240 E

How to fill out Canada B240 E

01

Begin by downloading the Canada B240 E form from the official website.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate your reason for filing the form in the designated section.

04

Provide any required financial information, ensuring accuracy.

05

Review the completed form for any errors or omissions.

06

Sign and date the form as required.

07

Submit the completed form via the appropriate channel, whether online or by mail.

Who needs Canada B240 E?

01

Individuals or businesses seeking to report specific transactions.

02

Taxpayers who need to provide certain information to the Canada Revenue Agency.

03

Those applying for a refund or rebate related to tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is CBSA CETA statement of origin?

The CBSA uses rules of origin to determine which goods are entitled to a particular tariff treatment. The rules of origin set out how much production must occur in Canada or in another country for the goods to be considered "originating in" that foreign country and entitled to a specific tariff treatment.

What is proof of origin under Ceta?

The CETA Certificate of Origin is the document that includes the Origin Declaration statement. The Origin Declaration statement may be provided on an invoice or any other supporting document that describes the originating product in sufficient detail to enable its identification.

Does Chile require a certificate of origin?

The importer must also be prepared to provide Chilean Customs, upon request, with a certificate of origin (or other information demonstrating that the good qualifies as originating). In general, a certification of origin can take many forms.

What is the certificate of origin to Chile?

What is the US-Chile FTA Certificate of origin for? In general, the certificate of origin attests that the goods in an export shipment were produced, manufactured or processed in a particular country (in US or Chile in this case). The exporter of goods has the right to obtain duty benefits with this certificate.

Which form is used for proof of origin under the Chile Canada trade agreement?

B240 – Canada-Chile Free Trade Agreement – Certificate of Origin.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my Canada B240 E in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your Canada B240 E and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit Canada B240 E on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing Canada B240 E.

Can I edit Canada B240 E on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Canada B240 E. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Canada B240 E?

Canada B240 E is a form used by certain businesses and organizations in Canada to report their annual corporate income and financial information to the Canada Revenue Agency (CRA).

Who is required to file Canada B240 E?

Entities such as corporations, organizations, or businesses with specific financial reporting requirements are obligated to file Canada B240 E, especially if they meet certain income thresholds.

How to fill out Canada B240 E?

To fill out Canada B240 E, obtain the form from the CRA website, carefully enter your financial data and corporate information as required, ensuring accuracy, and review the instructions provided along with the form for guidance.

What is the purpose of Canada B240 E?

The purpose of Canada B240 E is to provide the CRA with necessary information about an organization's financial position and income for the assessment of taxes owed.

What information must be reported on Canada B240 E?

Information reported on Canada B240 E includes details about annual income, expenses, assets, and liabilities, as well as identification information for the corporation or organization filing the form.

Fill out your Canada B240 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada b240 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.