Get the free AR01 - Annual Return - companieshouse gov

Show details

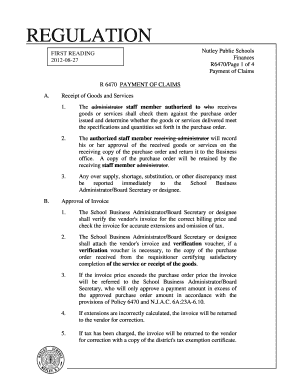

This document serves to report the details of corporate secretaries for a company in accordance with Section 854 of the Companies Act 2006, providing necessary information for public record and registration.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ar01 - annual return

Edit your ar01 - annual return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ar01 - annual return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ar01 - annual return online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ar01 - annual return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ar01 - annual return

How to fill out AR01 - Annual Return

01

Obtain the AR01 form from the official website or your local tax office.

02

Read the instructions carefully to understand each section of the form.

03

Fill in your company's name and registration number at the top of the form.

04

Provide the company's registered address and any changes since last year.

05

Report the company's principal business activity in the designated section.

06

Enter the details of the directors and company secretary, if applicable.

07

Fill in the total number of issued shares and their value.

08

Complete the financial summary section with accurate figures from your accounts.

09

Sign and date the form to confirm the information is correct.

10

Submit the completed AR01 to the relevant authority before the deadline.

Who needs AR01 - Annual Return?

01

All companies registered in the UK, including limited companies and limited liability partnerships (LLPs), must file the AR01 annually.

02

Companies that have undergone changes in their structure or share capital.

03

Companies looking to maintain good standing with the Companies House.

Fill

form

: Try Risk Free

People Also Ask about

What is the point of a confirmation statement?

Every company, including dormant and non trading companies, must file a confirmation statement at least once every year. This confirms the information we hold about your company is up to date. You must file a confirmation statement even if there have not been any changes to your company during the review period.

What is the AR01 annual return?

What is the AR01 Annual Return Form? The AR01 annual return form is a document that companies in the UK were required to file annually with Companies House. It provided updated information about a company's directors, shareholders, and registered office.

What is the annual return in English?

An annual rate of return is the profit or loss on an investment over a one-year period. There are many ways of calculating the annual rate of return. If the rate of return is calculated on a monthly basis, multiplying it by 12 expresses an annual rate of return.

How to file ROC annual return?

How to File ROC Annual Filing Forms? Login to the MCA portal using your Digital Signature Certificate (DSC). Select the appropriate form to be filed, such as Form AOC-4, Form MGT-7, or Form DIR-12. Fill in the required details in the form, making sure to provide accurate and up-to-date information.

What is an annual confirmation statement?

You need to check that the information Companies House has about your company is correct every year. This is called a confirmation statement.

What is a confirmatory statement?

For companies, the confirmation statement contains details of its directors and shareholders, while the confirmation statement of an LLP lists its members. For both limited companies and LLPs, the confirmation statement also shows the business's registered office address.

What is a confirmation statement annual return?

A confirmation statement is an annual legal requirement for UK-registered companies to verify that their company information, such as registered office address and shareholder details, is accurate and up to date with Companies House.

When did confirmation statements replace annual returns?

The company 'Annual Return is replaced by the 'Confirmation Statement' As of 30th June 2016 Companies House removed the need for an 'Annual Return'. Instead all companies (whether active or dormant) need to file a Confirmation Statement. As of 30th June 2016 Companies House removed the need for an 'Annual Return'.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AR01 - Annual Return?

AR01 - Annual Return is a mandatory document that details the financial status and changes in the company's structure that must be submitted to relevant regulatory bodies annually.

Who is required to file AR01 - Annual Return?

Every company registered with the relevant authorities is required to file an AR01 - Annual Return annually, including limited companies and certain types of partnerships.

How to fill out AR01 - Annual Return?

To fill out AR01 - Annual Return, gather the necessary financial information and details about the company's structure, then complete the form following the specific guidelines provided by the regulatory body.

What is the purpose of AR01 - Annual Return?

The purpose of AR01 - Annual Return is to provide an official record of a company's financial situation and structural changes, ensuring transparency and compliance with legal requirements.

What information must be reported on AR01 - Annual Return?

The AR01 - Annual Return must report details such as the company's registered office address, details of directors, shareholders, and any changes in share capital or other significant company information.

Fill out your ar01 - annual return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ar01 - Annual Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.