Get the free Self-employed checklist

Show details

This document serves as a checklist for self-employed individuals or single person directors to determine eligibility to enroll in NEST (National Employment Savings Trust). It outlines the necessary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-employed checklist

Edit your self-employed checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employed checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-employed checklist online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self-employed checklist. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

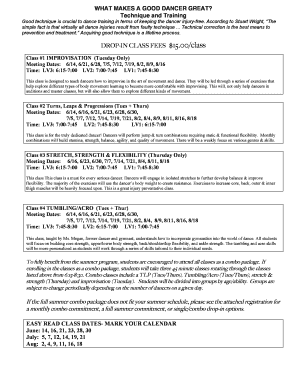

How to fill out self-employed checklist

How to fill out Self-employed checklist

01

Gather all relevant financial documents, including income statements and expense records.

02

Identify your business type and ensure you understand the requirements specific to it.

03

List all your sources of income and include any freelance or contract work.

04

Document all allowable expenses that relate to your business activities.

05

Complete the checklist systematically, ensuring all sections are filled out accurately.

06

Review the checklist for completeness and ensure all figures are correct.

07

Seek assistance or professional advice if you are unsure about any part of the checklist.

Who needs Self-employed checklist?

01

Freelancers and independent contractors who operate their own business.

02

Small business owners who are self-employed.

03

Individuals managing rental properties or other side businesses.

04

Anyone who needs to report their self-employment income for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What do I need if I am self-employed?

Here are twelve steps to take when you become self-employed for the first time – updated in May 2025. Decide to go self-employed. Choose a name for your new business. Register as self-employed with HMRC. Income tax and self-assessment. National insurance contributions. Should you register for VAT?

What documents do I need if I am self-employed?

Personal Details Personal Identification Documents such as a passport, driver's license, or national ID card. National Insurance Number (NINO) is another crucial document that you must have as a self-employed.

How do I check if I am self-employed?

Someone is probably self-employed if they're self-employed for tax purposes and most of the following are true: they put in bids or give quotes to get work. they're not under direct supervision when working. they submit invoices for the work they've done. they're responsible for paying their own National Insurance and tax.

How to avoid 40% tax UK self employed?

Ways you can reduce your tax bill whilst self-employed Claim all your allowable expenses and extras. Contribute towards a pension. How do I claim higher-rate tax relief? You can make donations to charity. You could incorporate your business. You could correct and claim 'overpayment relief' against previous tax years.

How to show proof that you are self-employed?

How to Provide Proof of Income Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

What is the best document for proof of income?

Common documents used as proof of income include: Pay stubs. Tax returns. Bank statements. Court-ordered payments.

How do I prove that I am self-employed?

Types of proof of income documents Your tax returns. Tax returns, including Self Assessment tax returns, are official documents filed with HMRC that detail your income, expenses, and tax liabilities. Bank statements. Invoices and contracts. Profit and loss statements. An accountant's certification.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Self-employed checklist?

The Self-employed checklist is a tool or document that helps individuals who are self-employed organize their financial information and ensure they are meeting all necessary tax and legal obligations.

Who is required to file Self-employed checklist?

Individuals who earn income from self-employment activities, such as freelancers, independent contractors, and business owners, are required to fill out the Self-employed checklist.

How to fill out Self-employed checklist?

To fill out the Self-employed checklist, gather all relevant financial documents related to income and expenses, then systematically complete the checklist by entering details such as income sources, expense categories, and any applicable deductions.

What is the purpose of Self-employed checklist?

The purpose of the Self-employed checklist is to ensure that self-employed individuals accurately track their income and expenses, meet tax filing requirements, and optimize their deductions to potentially reduce taxable income.

What information must be reported on Self-employed checklist?

Information that must be reported on the Self-employed checklist includes total income earned, business-related expenses, deductions like home office or vehicle expenses, and any other relevant financial data for accurate tax reporting.

Fill out your self-employed checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Employed Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.