Get the free Home Equity Application - METRO Federal Credit Union - mcu

Show details

METRO Federal Credit Union 2440 E. Rand Road Arlington Heights, IL 60004 Main 8476700456 Fax 8476700401 Dear METRO Federal Credit Union Member: It's EASY to complete Metros “ONLINE “, loan application.....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity application

Edit your home equity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home equity application online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit home equity application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home equity application

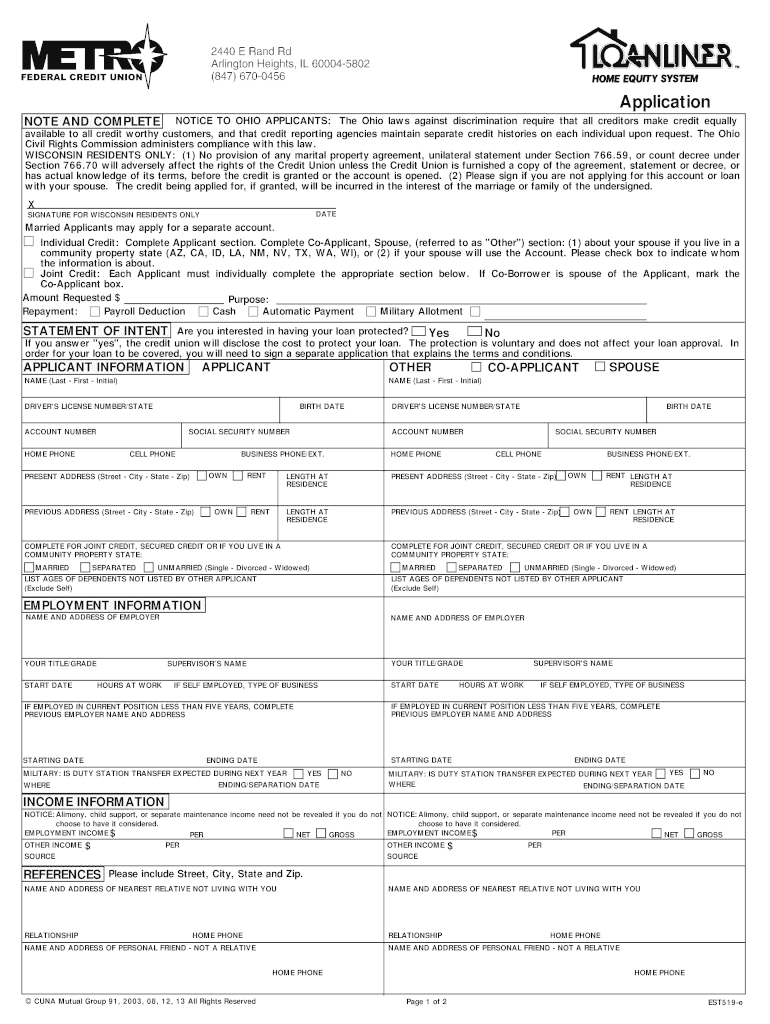

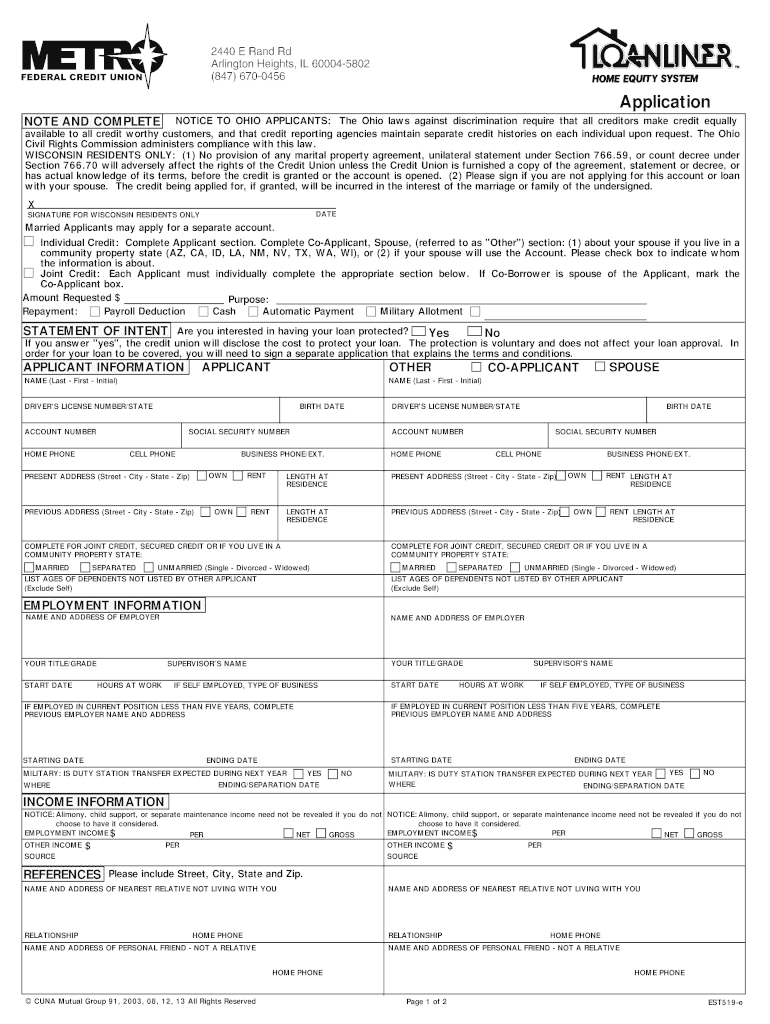

How to fill out a home equity application:

01

Gather all necessary documents: Before starting the application process, gather important documents such as proof of income, tax returns, bank statements, and property information.

02

Begin by providing personal information: The application will require you to enter personal details such as your full name, contact information, date of birth, and social security number.

03

Fill out employment and income details: Provide information about your current employment status, including your employer's name, job title, and length of employment. Additionally, disclose your current income and any other sources of income you may have.

04

Provide information about your property: You will need to give details about the property you are using as collateral for the home equity loan, including the address, market value, and any existing mortgage or liens on the property.

05

Disclose your debts and liabilities: The application will require you to list any outstanding debts, such as credit cards, student loans, or car loans. Include the amount owed, monthly payment, and the name of the creditor.

06

Fill out the loan details: Specify the amount of loan you are requesting, the purpose of the loan, and the desired repayment term. It is also important to mention whether you prefer a fixed or adjustable interest rate.

07

Provide consent and sign: Read through the application thoroughly and ensure that all information provided is accurate. By signing the application, you are giving consent to the lender to process your loan application and perform necessary credit checks.

Who needs a home equity application?

01

Homeowners looking to tap into the equity of their property: A home equity application is typically required for individuals who own a property and are seeking to borrow against the equity built up in their home.

02

Individuals in need of funds for major expenses: Those who require funds for various expenses, such as home renovations, education costs, medical bills, or debt consolidation, may find a home equity loan as a viable option.

03

Borrowers with a good credit history and stable income: Lenders often require applicants to have a good credit score and a stable source of income to qualify for a home equity loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send home equity application for eSignature?

When you're ready to share your home equity application, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find home equity application?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific home equity application and other forms. Find the template you need and change it using powerful tools.

How do I make edits in home equity application without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your home equity application, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

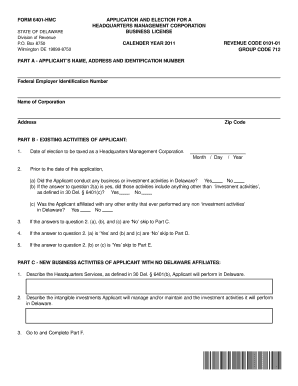

What is home equity application?

A home equity application is a request submitted by a homeowner to borrow against the equity in their property.

Who is required to file home equity application?

Homeowners who are interested in borrowing against the equity in their property are required to file a home equity application.

How to fill out home equity application?

To fill out a home equity application, homeowners must provide information about their property, income, debts, and other financial details.

What is the purpose of home equity application?

The purpose of a home equity application is to request a loan using the equity in a property as collateral.

What information must be reported on home equity application?

Information such as property details, income, debts, and financial details must be reported on a home equity application.

Fill out your home equity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.