Get the free Developing a Risk Management Program for Your Organization - cf rims

Show details

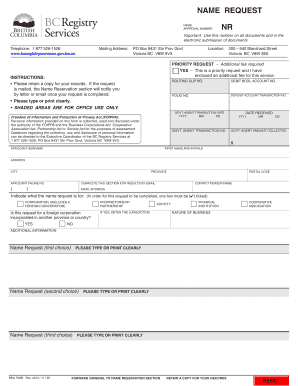

Developing a Risk Management Program for Your Organization February 18 19, 2010 Toronto, ON Name: Title: Organization: Address: City: Prov/State: Postal/Zip: Country: Telephone: Fax: Email: Registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign developing a risk management

Edit your developing a risk management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your developing a risk management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit developing a risk management online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit developing a risk management. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out developing a risk management

Point by point, here is how to fill out developing a risk management:

01

Identify the objectives: Begin by clearly identifying the objectives you want to achieve through risk management. This could include minimizing financial losses, ensuring the safety of employees, protecting company reputation, etc.

02

Assess risks: Evaluate the potential risks that could impact your organization's ability to achieve its objectives. This could involve conducting risk assessments, analyzing historical data, consulting with relevant stakeholders, and considering external factors such as industry trends and regulatory changes.

03

Determine risk tolerance: Define the level of risk your organization is willing to accept. This can be done by considering factors such as financial constraints, legal requirements, and the organization's overall risk appetite. It is important to strike a balance between being too conservative and missing out on opportunities, or being too aggressive and exposing the organization to unnecessary risks.

04

Develop risk mitigation strategies: Identify and develop appropriate strategies to mitigate the identified risks. This may involve implementing controls, transferring risks through insurance or contracts, avoiding high-risk activities, or accepting certain risks that have minimal impact on the organization.

05

Implement and monitor: Put the risk management plan into action by assigning responsibilities, setting timelines, and integrating risk management practices into daily operations. Regularly monitor the effectiveness of the strategies implemented, ensuring that they are aligned with the organization's objectives and adaptable to changing circumstances.

06

Communicate and train: Ensure that all relevant employees are aware of the risk management plan and their roles in implementing it. Provide necessary training and resources to enhance risk awareness and decision-making skills across the organization. Encourage a culture of proactive risk management by fostering open communication channels and encouraging employees to report risks and near-misses.

07

Continuously improve: Regularly review and reassess the risk management plan to identify areas for improvement. Seek feedback from stakeholders, learn from incidents or near-misses, and stay updated on emerging risks and regulatory changes. Adapt the risk management approach as needed to ensure it remains effective and aligned with the organization's objectives.

Who needs developing a risk management?

01

Organizations of all sizes: Risk management is essential for all types and sizes of organizations, including small businesses, multinational corporations, government agencies, and non-profit organizations. Every organization faces risks, and having a systematic approach to managing and mitigating them is crucial for long-term success.

02

Project managers: Project managers are responsible for overseeing specific initiatives or projects within an organization. They need to develop risk management plans to identify potential risks that could impact the project's success and develop strategies to mitigate them. Project managers are key stakeholders in ensuring that risks are effectively managed throughout the project lifecycle.

03

Compliance and governance teams: Compliance and governance professionals are tasked with ensuring that organizations adhere to legal and regulatory requirements. They play a crucial role in developing risk management strategies to prevent non-compliance and mitigate risks associated with legal and regulatory changes.

04

Executive leadership: Executives and senior leaders have a responsibility to oversee the overall risk management approach of the organization. They need to understand the organization's risk profile, make informed decisions regarding risk tolerance, and ensure that risk management practices are embedded at all levels of the organization.

05

Risk management professionals: Risk management professionals, including risk managers and analysts, are experts in identifying, assessing, and mitigating risks. They play a vital role in developing and implementing risk management practices within organizations. Their expertise helps organizations navigate uncertainties and make informed decisions to protect their interests.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is developing a risk management?

Developing a risk management involves identifying, assessing, and prioritizing risks within an organization in order to minimize or mitigate their impact.

Who is required to file developing a risk management?

Developing a risk management is typically required to be conducted by organizations and businesses to ensure they are proactively managing potential risks.

How to fill out developing a risk management?

Developing a risk management plan involves conducting a risk assessment, identifying potential risks, evaluating their likelihood and impact, and developing strategies to manage and mitigate those risks.

What is the purpose of developing a risk management?

The purpose of developing a risk management plan is to proactively identify and address potential threats to an organization's objectives, operations, and reputation.

What information must be reported on developing a risk management?

Information that must be reported on a risk management plan may vary depending on the organization, but typically includes identified risks, their likelihood and impact, mitigation strategies, and responsible parties.

How do I execute developing a risk management online?

Filling out and eSigning developing a risk management is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the developing a risk management electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your developing a risk management in minutes.

How do I fill out the developing a risk management form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign developing a risk management and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your developing a risk management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Developing A Risk Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.