Get the free Contribution Increase Salary Reduction Agreement - guidestone

Show details

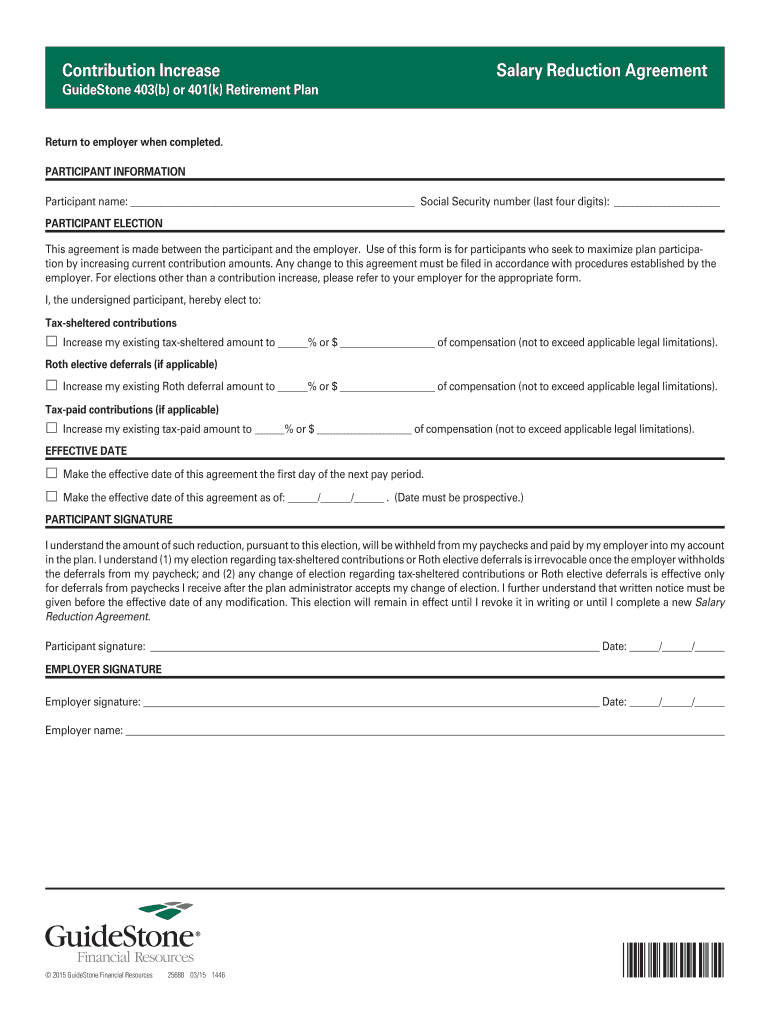

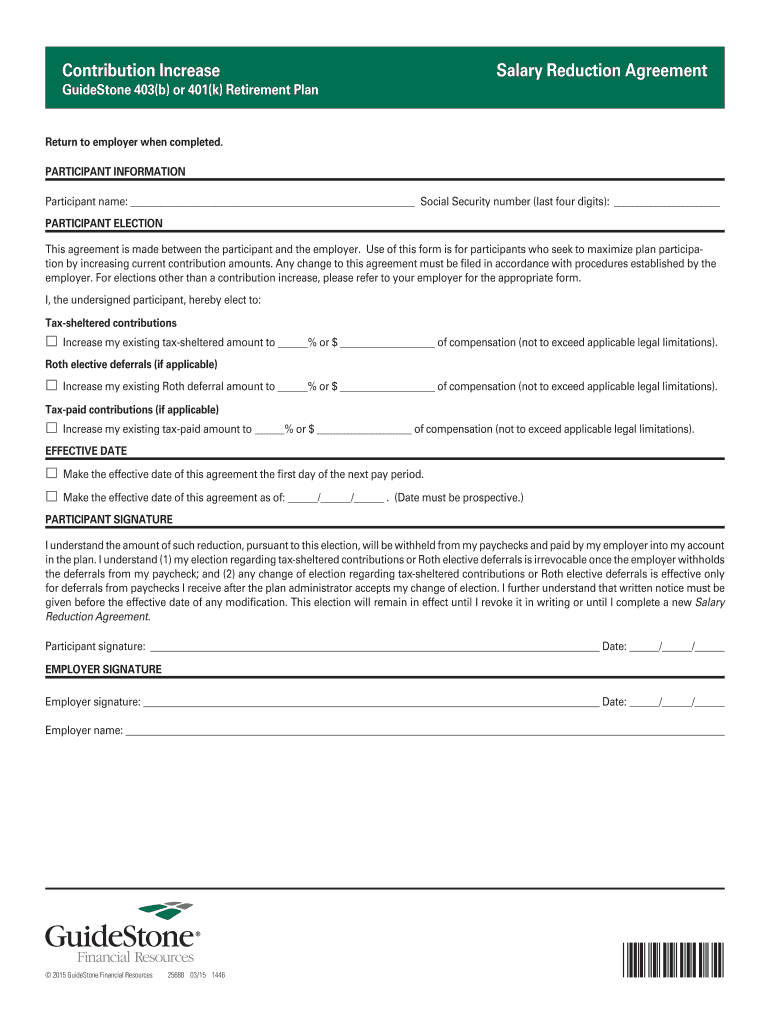

Contribution Increase Salary Reduction Agreement Guide Stone 403(b) or 401(k) Retirement Plan Return to employer when completed. PARTICIPANT INFORMATION Reset Form Participant name: Social Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contribution increase salary reduction

Edit your contribution increase salary reduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contribution increase salary reduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contribution increase salary reduction online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit contribution increase salary reduction. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contribution increase salary reduction

How to fill out contribution increase salary reduction:

01

Gather all necessary information: Start by collecting all the required information such as your employee identification number, current salary, desired contribution increase amount, and any relevant forms provided by your employer.

02

Review the forms and instructions: Carefully read through the forms and instructions provided by your employer or the retirement plan administrator. It is important to understand the specific requirements and guidelines for filling out the contribution increase salary reduction form.

03

Provide personal identification information: Begin by entering your personal identification information, such as your full name, social security number, and contact details, as requested on the form.

04

Enter current salary details: Include accurate information about your current salary, including the total dollar amount or percentage of your salary that is currently being contributed towards your retirement plan. Make sure to double-check these details for accuracy.

05

Specify desired contribution increase: Indicate the amount or percentage by which you wish to increase your salary reduction contribution. This could be a fixed dollar amount or a percentage of your salary.

06

Review and sign: Before submitting the form, carefully review all the information you have provided to ensure accuracy. Make any necessary corrections or adjustments. Sign and date the form as required.

07

Submit the form: Follow the instructions provided by your employer or the retirement plan administrator regarding the submission of the form. This could include mailing the form, submitting it online, or handing it directly to the designated personnel.

Who needs contribution increase salary reduction?

01

Employees who want to save more for retirement: Contribution increase salary reduction is beneficial for employees who desire to save a larger portion of their salary towards their retirement funds. By increasing their contributions, individuals can potentially increase their retirement savings and be better prepared for their future financial needs.

02

Individuals seeking to maximize employer matching contributions: Some employers offer matching contributions to their employees' retirement plans. By increasing their salary reduction contributions, employees can take advantage of this matching opportunity and receive additional funds from their employers, effectively boosting their retirement savings.

03

Employees looking to take advantage of tax benefits: Contributions made towards retirement accounts, such as 401(k) plans, may offer tax advantages. By increasing their contributions, individuals may be able to reduce their taxable income, potentially lowering their overall tax liability.

Overall, anyone interested in saving more for retirement, taking advantage of employer matching contributions, or maximizing tax benefits should consider a contribution increase salary reduction. It is always advisable to consult the specific guidelines and requirements provided by your employer or retirement plan administrator when considering such a change.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contribution increase salary reduction to be eSigned by others?

When you're ready to share your contribution increase salary reduction, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find contribution increase salary reduction?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific contribution increase salary reduction and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit contribution increase salary reduction on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing contribution increase salary reduction, you can start right away.

What is contribution increase salary reduction?

Contribution increase salary reduction refers to the process of reducing the amount of salary that is contributed towards certain benefits or retirement plans.

Who is required to file contribution increase salary reduction?

Employers are typically required to file contribution increase salary reduction forms on behalf of their employees.

How to fill out contribution increase salary reduction?

To fill out contribution increase salary reduction forms, you will need to provide information about the employee's salary, the amount of the contribution increase, and any other relevant details.

What is the purpose of contribution increase salary reduction?

The purpose of contribution increase salary reduction is to adjust the amount of salary that is contributed towards benefits or retirement plans in order to meet changing financial needs.

What information must be reported on contribution increase salary reduction?

Information that must be reported on contribution increase salary reduction forms typically includes the employee's name, social security number, salary amount, and the amount of the contribution increase.

Fill out your contribution increase salary reduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contribution Increase Salary Reduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.